Initial public offerings (IPOs) in 2024 reported unprecedented anchor investments from institutional investors — foreign institutional investors (FIIs) and mutual funds (MFs)— marking a significant milestone. Their combined investment surpassed Rs 45,650 crore, exceeding the previous record of Rs 42,558 crore set in 2021.

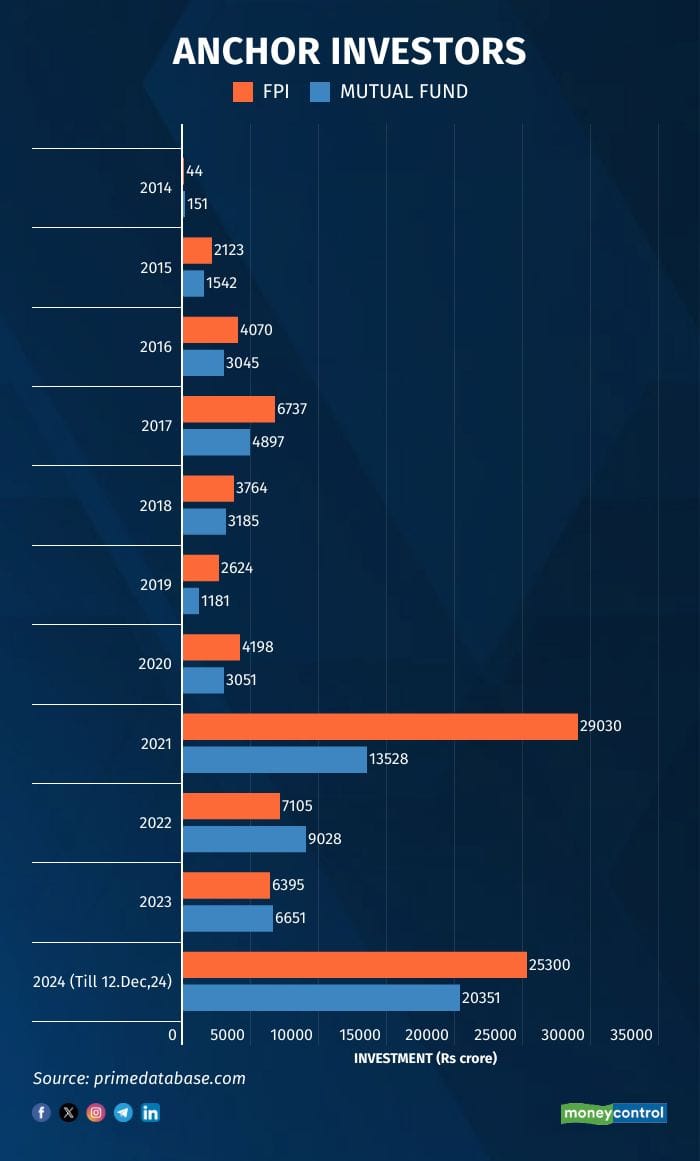

FII investment in anchors stood at Rs 25,300 crore in the current year, the highest since 2021 when their investment crossed Rs 29,000 crore, as per data from Prime Database. Similarly, MFs have contributed Rs 20,351 crore, a historic high. The MFs investment was more than three times, as compared to last year. The previous record for MFs was Rs 13,528 crore in 2021, driven by robust inflows into equity schemes.

Together, FPIs and MFs have invested over three times the amount recorded in the previous year. However, MF contributions fell short of FPI investments for the first time in two years. The MF investments were nearly 20 per cent lower than FPIs. On the contrary, in 2022 and 2023 MFs outpaced FPIs in anchor investments.

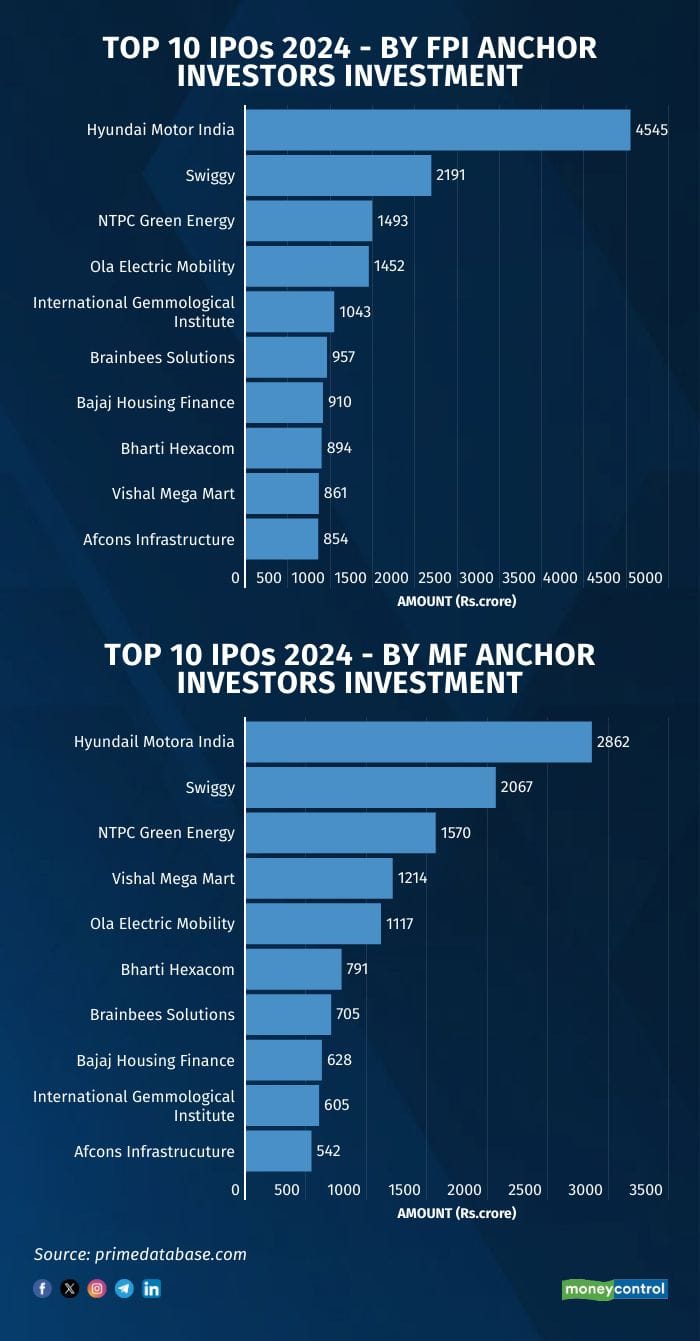

Notable IPOs that drew significant anchor investments include Hyundai Motors India, Swiggy, NTPC Green Energy, and Ola Electric Mobility. FPIs invested Rs 4,545 crore in Hyundai Motors India's anchor book, nearly 50 per cent more than MFs. In Swiggy, FPIs contributed Rs 2,100 crore, marginally surpassing MF investments. For NTPC Green Energy, FPIs invested Rs 1,493 crore, while MFs contributed a higher amount of Rs 1,570 crore.

The top five FII anchor investors this year were Government Pension Fund Global (Rs 1,273 crore), Government of Singapore (Rs 1,262 crore), New World Fund Inc (Rs 1,256 crore), Nomura Funds Ireland PLC (Rs 783 crore), and Abu Dhabi Investment Authority (Rs 730 crore).

Leading MF anchors included ICICI Prudential MF (Rs 2,261 crore), Nippon India MF (Rs 2,064 crore), HDFC MF (Rs 2,025 crore), SBI MF (Rs 1,870 crore), and Kotak Mahindra MF (Rs 1,485 crore).

This year, Indian companies have raised over Rs 1.5 lakh crore through 75 mainboard IPOs, a record high, as compared to Rs 49,435 crore from 57 IPOs in 2023 and Rs 59,301 crore from 40 public floats in 2022.

Over the past four years, there has been an appreciable increase in domestic institutional investors' (DIIs) participation, fuelled by MFs benefiting from steady monthly inflows into equity schemes. Inflows into open-ended equity funds have remained positive for 45 consecutive months. This year, inflows have reached a total of Rs 3.53 lakh crore since January. In comparison, inflows in 2023 and 2022 were Rs 1.61 lakh crore each.

SEBI introduced anchor investors in 2009 to stabilise the IPO market, enhance investors' confidence, and bridge the gap between companies and retail investors. These institutional investors invest large amounts early to lend credibility, boost demand and foster trust in the IPO process.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.