Though Indian stock exchanges saw a rise in new debutants in September, data showed a moderation in average premiums of mainboard initial public offerings (IPOs) to 18 percent this month from 28 percent in August. Analysts linked these diminishing returns to the aggressive valuations of public issues and said that the near-term trajectory of new listings would depend on overall market sentiment.

In the past week, benchmark indices Sensex and Nifty 50 have declined 1 percent each, while the BSE Midcap index was down 0.2 percent, and the BSE Smallcap index up 0.8 percent.

READ MORE: Best IPOs of 2023: Here are the stocks that have gained the most after listing

Market fatigue, policy fears hit IPO premiumsExplaining the easing gains of newly listed companies, Deepak Jasani, head of retail research at HDFC Securities, said that the market, in general, is showing signs of fatigue. “Moderating returns in September are due to the heavy selling pressure seen in the mid-and smallcap pockets. As a result, expensive public issues are bearing the brunt,” he added.

Sonam Srivastava, smallcase manager and founder of Wright Research, on the other hand, attributed this cool-off to an erosion in investor confidence amid fears of policy tightening conditions overseas. She, too, opined that there was growing scepticism about market valuations, wherein certain IPOs were perceived as overpriced.

Over 10 companies have debuted on the bourses in September, with Jupiter Life Hospitals and Vishnu Prakash R Punglia seeing 46 percent gains on their respective listing dates versus their issue price, data showed. (See chart)

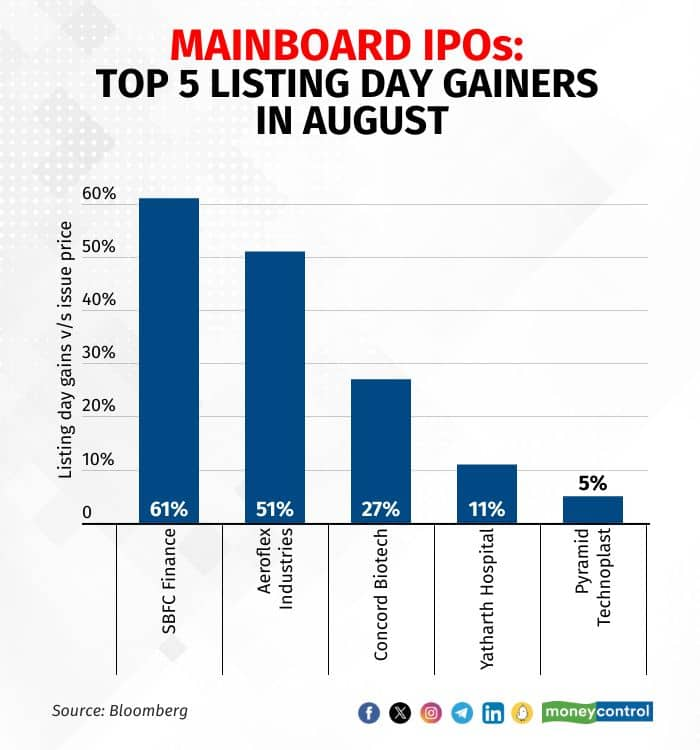

Meanwhile, in August, around six mainboard companies were listed on the exchanges. SBFC Finance surged the most on its listing date (refer chart), rising 61 percent from its issue price. This was followed by Aeroflex Industries (up 51 percent) and Concord Biotech (up 27 percent).

Over the near term, analysts said that the success of new listings hinges on market sentiment, quality of IPOs, and pricing dynamics.

“If the broader market remains uncertain, it could impact listing gains. However, high-quality IPOs with robust business models and attractive pricing might fare better,” said Wright Research’s Srivastava.

In October, four mainboard IPOs will tentatively be listed. They are: JSW Infrastructure, Updater Service, Valiant Laboratories, and Plaza Wires. Additionally, over 10 small and medium enterprise (SME) IPOs are also in the queue to be listed.

According to ipowatch.in, JSW Infra and Plaza Wires enjoyed 19 percent premiums in the grey markets on September 29, whereas Valiant Lab traded at a 11 percent premium. No demand, however, has been seen for Updater Service in the unlisted markets so far.

READ MORE: This year’s hottest tech IPO may be a transportation company

SME IPO listings fare better in September v/s mainboardIn the case of SME IPOs, the average listing day gains rose to 63 percent in September from 52 percent in August, data showed.

VFX-solutions company Basilic Fly Studio saw the maximum gains on its listing date in September, whereas renewable energy company Sungarner Energies led the charge in August. Both counters surged over 200 percent on their listing day. (Refer table for top 5 listing day gainers in August, September)

Ambareesh Baliga, independent market analyst, underpinned SME IPO listings faring better than the mainboard in September to investors’ greed for a quick buck. “Investors have flocked to these SME IPOs to mint the easy-and-quick money opportunity—the common mindset to apply and book profits on listing,” he said.

Recently, market regulator Sebi launched new investor protection measures covering SMEs, catering to this ‘dus ka bees’ (turn 10 into 20) herd, who want to double their money in no time. Moreover, it extended the applicability of Additional Surveillance Measure (ASM) and Trade for Trade (T2T) regulations to the SME segment, which was earlier only limited to mainboard stocks.

While this regulation ensures more stringent checks and balances on the SME segment, analysts said that the move might make some investors cautious due to fear of trading restrictions.

On the other hand, Srivastava of Wright Research asserted that selective investors would appreciate this move over the longer-term as an added layer of surveillance would be a step towards a more transparent and secure market.

READ MORE: Little giants growing an ugly head? Mapping the exuberance in the SME segment

Investment rationale for new listingsFrom an investment standpoint, Jasani of HDFC Securities recommended studying each public issue independently, without giving too much importance to the grey market premium or the buzz around recently listed IPOs.

Srivastava, meanwhile, advised diversifying investments across multiple IPOs in order to spread risk.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.