Exchanges along with SEBI, late evening on September 25, informed that the extant Short Term ASM and TFT Framework will be extended to Small and Medium Enterprises (SME) stocks subject to certain changes. It was somewhat expected given the rising concern over incessant uptick in prices of SME stocks and the suspected stock manipulation and frenzy among investors. The regulations focusses on identifying those stocks where very few traders are trading among themselves to manipulate prices.

Additional surveillance measure (ASM) is an initiative by the Securities Exchange Board of India (SEBI) and exchanges to safeguard the interests of the investors. Stocks under ASM are further monitored and moved in the trade-for-trade (TFT) segment if the criteria are met. Only delivery trades are allowed in stocks under the TFT segment.

The market regulator has devised such safeguards to curb heavy speculation in securities.

Also Read: Sebi extends additional surveillance measure, trade-for-trade settlement to SME segment

‘Rampant speculation’

A merchant banker who has managed some of the recent SME IPOs accepted, on the conditon of anonymity, that there is "rampant speculation" in the SME segment.

The SEBI, apparently, has also recognised this thorny issue. Besides, the ingredients in the SME segments – low float, even lesser liquidity, fear of missing out (FOMO), and ubiquitous social media presence among the market community – are adequate for price manipulators to cook their broth.

Though not everyone agrees that stock price manipulation happens at a grand level. Ghanisht Nagpal, Convenor of Delhi Investors Association and an avid SME investor, accepted that there are some unscrupulous elements in the market, but painting rise in every stock by the same brush is unwarranted.

He advocated that retail investors, who are more prone to fall to the frenzy and usually more gullible, should be restricted from investing in SME stocks while QIBs, who are usually more savvy investors, be allowed to trade without any additional measures.

“QIBs are experienced investors who are taking high risks. Thus, they are reaping rewards. They know what they are doing,” said Nagpal. That may be a hard ask as it is difficult to define who qualifies as a 'gullible' investor. Other experts believe restricting the playfield to QIBs will kill the retail market for small companies wishing to list, as well as deny the opportunity to participate in some of the small but fast growing companies the SME segment offers.

Stupendous rise

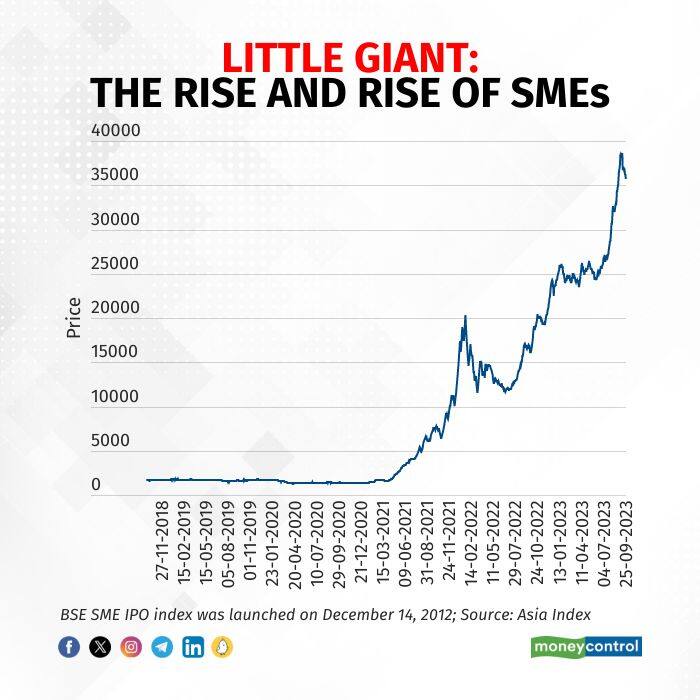

The BSE SME IPO index – a representative index of SME stocks having over 60 constituents stocks as of now – has delivered a whopping 10,350 percent returns in the last 10 years, rising at a compound annual growth rate of 59 percent. This means just Rs 1,000 invested in September 2013 could have been worth Rs 1.03 lakh today, in 2023.

In the last five years, the index has compounded at an even better rate of 82.63 percent a year and in the last three years, 193 percent every year – signaling that SMEs have come into their own in recent years. What is remarkable is that the rally shows no sign of slowing down.

The index, launched in 2012 to track the performance of companies landing on the BSE SME platform, has a unique structure. Its constituents are those that debut on the platform. After completing a year, they are excluded from the index, unlike in Nifty or Sensex where constituent stocks can be part of the index for years.

Nifty SME EMERGE, a similar index that captures the initial stock price gain in SME stocks listed on the platform, has also moved in tandem. In the last five years, the stock has risen at a compounded rate of 42.70 percent. However, it has a different criteria of choosing stocks as constituents.

The popularity or frenzy around SME stocks have reached to such an extent in 2023 that they have seen an average 67 times subscription. Some of them saw 713 times subscription, led by retail investors who applied for over 1,000 times their allocated quota in some cases, data collated by Prime Database shows.

The data shows 107-odd SME stocks listed in 2023 so far have returned an average 77 percent. Some stocks have delivered four times gains in just 4-5 months. Only 19 of these names are sitting on losses.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.