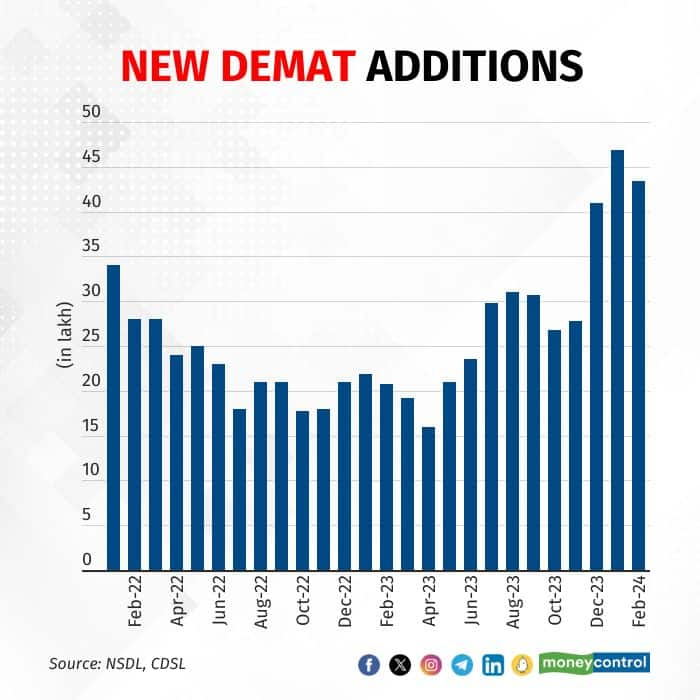

Bulls of D-Street seem to be driving people in droves to the market with fresh demat accounts surpassing 40 lakh in count for the third month in a row in February.

The number of new demat accounts opened last month reached 43.5 lakh, taking the pan-India total to 14.83 crore. February marks the third consecutive month when new demat accounts consistently exceeded the 40-lakh threshold. In December and January, the count stood at at 40.90 lakh and 46.80 lakh.

What intrigues a market observer is the fact that the rush to enter the market stays unhindered despite brokerage warnings on high valuations and sustained caution on PSU stocks, midcaps and smallcaps. Global concerns, including China's economic downturn and the likelihood of no immediate rate by the US Fed add to the complexities in a market that's grappling with mixed global cues from the macroeconomic front and geopolitical uncertainties. Investors world over are eyeing at the March 19-20 US Fed meeting for a direction on the key policy rates.

Kotak Institutional Equities in its recent note warned about over-exuberance, stressing on the market's tendency to overpay for weak business models. The report noted investor indifference to risks, fundamentals, and valuations, highlighting overvaluation in low-quality companies. Largecaps are more stable, and the financial sector displays reasonable valuations, it said. "Market richness doesn't fully reflect the widespread overvaluation, especially in consumption, investment, and outsourcing compared to the pre-pandemic levels."

AMFI, an industry body for asset managers, recently urged its member fund houses to temper inflows into smallcap and midcap funds to safeguard investors from a potential crash. The request, made in an undisclosed letter on February 27, followed communication from the market regulator Securities and Exchange Board of India (Sebi). Concerns have arisen from substantial funds flow into smallcap and midcap funds, raising questions about their resilience in the face of a sharp market downturn. Sebi has also directed fund houses to provide additional information about the risks associated with these funds.

Some broking firms like Kotak Institutional Equities expressed caution on PSU stocks due to their expensive valuations. Elara Capital advised caution but notes potential short-term momentum ahead of the elections.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!