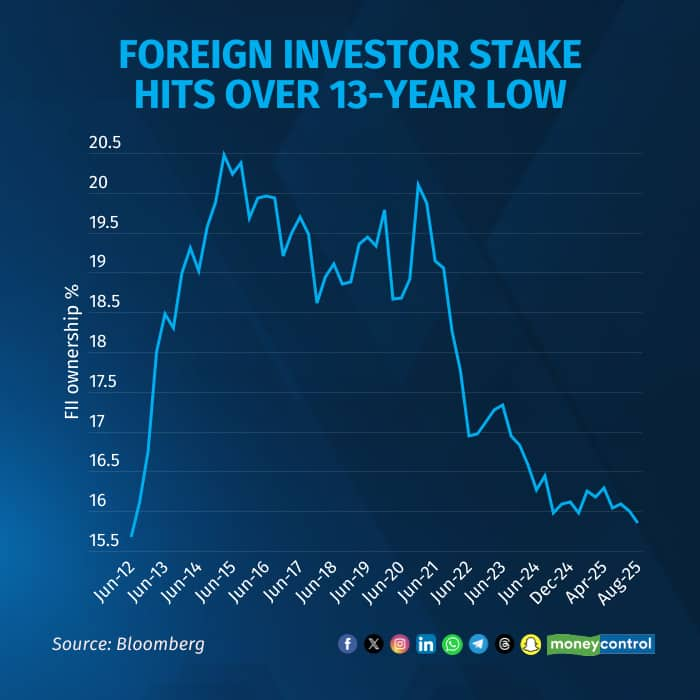

Foreign investors’ presence in Indian equities slumped to a thirteen-year low in August, with their share in NSE-listed companies slipping to 15.85 percent. Data from the NSDL show foreign portfolio assets in equities narrowing to Rs 70.33 lakh crore from Rs 71.97 lakh crore a month earlier, a decline of 2.3 percent.

Since January, overseas funds have pared nearly Rs 1.7 lakh crore from Indian markets even as benchmark indices held firm: the Sensex and Nifty have each advanced almost 4 percent in 2025.

Interestingly, domestic institutional investors have poured over Rs 5.2 lakh crore into equities this year, pushing their ownership to a record 17.82 percent in the June quarter. According to Prime Database, DIIs first surpassed foreign investors in March 2025, and the widening gap highlights how local money now anchors Indian markets.

Analysts attribute the persistent foreign sell-off to expensive valuations, moderating corporate earnings, tariff worries, and a pivot toward cheaper, better-performing markets such as the United States, China and Europe. India remains the fastest-growing major economy, but global funds have moved from a buy-and-hold stance to tactical allocation market experts observe.

Sectoral flows in August reveal heavy exits from financial services, with sales exceeding Rs 23,300 crore, followed by IT (Rs 11,285 crore) and oil & gas (Rs 6,100 crore). Power (Rs 4,000 crore), consumer durables (Rs 1,970 crore), healthcare (Rs 1,400 crore), realty (Rs 1,245 crore) and FMCG (Rs 1,100 crore) also faced sustained selling.

Buying interest was concentrated in telecom, where foreign investors deployed Rs 5,766 crore, alongside construction materials (Rs 2,475 crore), services (Rs 2,350 crore), capital goods and autos (about Rs 1,800 crore each), as well as chemicals (Rs 1,570 crore) and construction (Rs 1,350 crore).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.