The government is evaluating the financial health of state-run oil marketing companies (OMCs) before finalising the compensation for the under-recovery incurred by the refiners on sale of LPG cylinders, government officials aware of the matter told Moneycontrol.

The government may partially compensate the OMCs for the losses incurred or might even entirely decline the request, based on the evaluation, sources said.

“Oil ministry had sent their (compensation) proposal. It is up to the finance ministry now. They are looking at everything; the health of companies, current prices, etc. They will take a call on how much should the companies be compensated. It has also happened, in the past, that the companies have been asked to fully bear the losses,” said one of the sources.

The companies and the oil ministry have been eyeing the said compensation from the centre since the Union Budget 2025. Prior to the Union Budget 2025, the Ministry of Petroleum and Natural Gas (MoPNG) had requested the finance ministry for full compensation of LPG losses incurred by the OMCs.

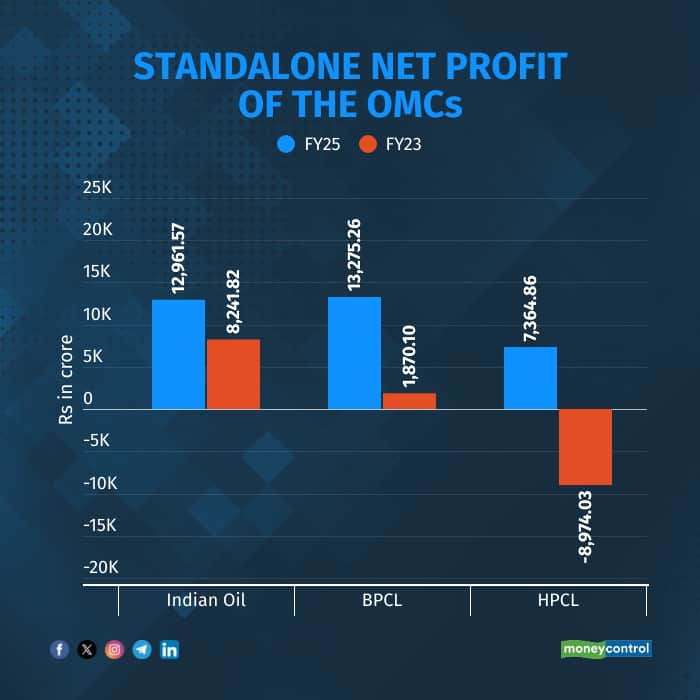

In the financial year 2024-25 (FY25), the three state-run refiners have incurred combined losses of over Rs 41,000 crore on LPG cylinders’ sale, owing to high international prices. Indian Oil Corporation Limited (IOC), Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limited (HPCL) are the three state-owned OMCs.

“These (compensation) requests have been received earlier as well, but it’s unlikely that finance ministry will provide any (financial) support,” said another source, adding that the amount is “substantial”.

Queries sent to IOC, BPCL, HPCL remain unanswered at the time of publishing.

As retail LPG cylinder prices remain regulated in the country, the OMCs have been absorbing the price difference between domestic LPG retail prices and international costs, depleting their margins. India is reliant on imports for around 50 percent of its total LPG (liquefied petroleum gas) requirements.

Earlier, the Union cabinet had compensated the OMCs in October 2022 for the LPG losses incurred by them. The centre had announced a payment of Rs 22,000 crore for state-run OMCs, for a cumulative loss of Rs 28,000 crore they had incurred.

However, at the time, the OMCs were incurring huge losses on sale of not only LPG cylinders but also other refined products such as petrol and diesel. This was on account of crude oil prices skyrocketing to as high as $120 per barrel in 2022 amid the Russia-Ukraine war.

Contrary to 2022, the state-run OMCs have largely maintained healthy bottomline in FY25 as crude oil prices have plummeted to around $65-$70 a barrel, prior to the current Iran-Israel conflict.

Revenue collection for OMCs

To shore up revenue for the OMCs going forward, the central government in April 2025 increased the excise duty on both petrol and diesel by Rs 2 per litre. Minister of Petroleum and Natural Gas Hardeep Singh Puri said that the fund would be used to compensate the OMCs for the losses they incur on the sale of LPG cylinders.

The pump prices of petrol and diesel for consumers, however, were not hiked.

To be sure, the fund collected by the government through the excise duty hike is unrelated to the losses made by the OMCs in FY25, and would only be used for the current fiscal (FY26).

Currently, the retail selling price of a 14.2 kg LPG cylinder in the national capital is Rs 853.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.