After the airline battle in India’s skies, a battle for airports is brewing down on the ground. From having a private airport at Mundra to winning bids for six airports and then check-mating GVK to bag Mumbai and Navi Mumbai, Adani airports has started making a mark. While the Ahmedabad, Lucknow and Mangaluru airports have been handed over by state-owned Airports Authority of India (AAI) to the Adani group, the others remain in the pipeline.

Privatisation of airports has not been a popular concept in India in the past, with the lone private airport at Kochi. Then came the first wave: privatisation of the Mumbai and Delhi airports, along with construction of greenfield airports at Bengaluru and Hyderabad. The first round was a draw between the GMR group and the GVK group, with GMR bagging Delhi and Hyderabad, while GVK got Mumbai and Bengaluru.

A decade later, GVK is out of the game, having sold its stake in Bengaluru International Airport Limited to Fairfax and cashed out of the Mumbai airport and the Navi Mumbai one to Adani Airports.

Adani and GMR: how do they stack up?

The Adani group seems to have entered the business with a bang, wanting to create a flutter as India aims to become the third-biggest aviation market in the world over the next couple of years.

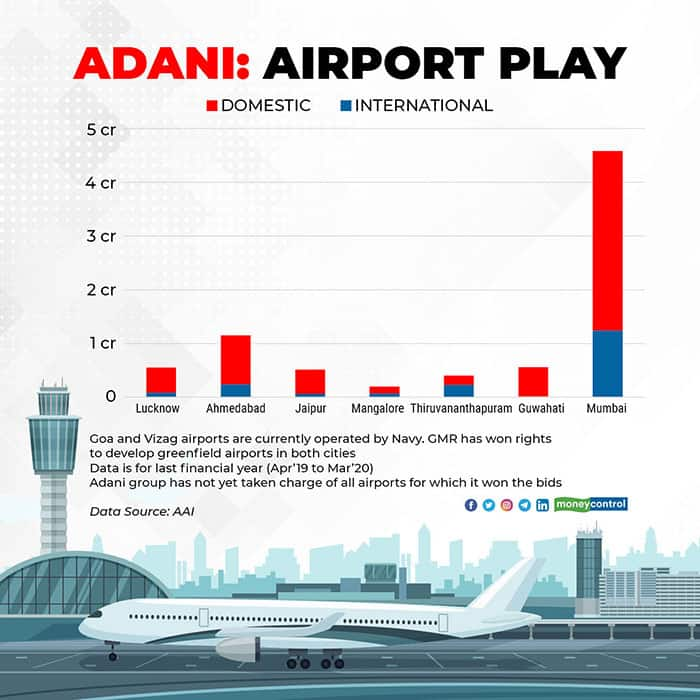

The Adani group has won rights to operate Lucknow, Ahmedabad, Jaipur, Mangaluru, Thiruvananthapuram and Guwahati. These airports accounted for 9.62 percent of India’s International passengers in the last financial year and 9.74 percent of India’s domestic traffic. Add Mumbai to the mix and the Adani group would suddenly be staring at 28.19 percent of International traffic and 21.95 percent of domestic traffic.

The GMR group, on the other hand, is operating the Delhi International Airport, which is India’s largest by area, passenger footfall, runways and connectivity. Along with Delhi, the group also operates Hyderabad and Nagpur and has won the rights to build and operate airports at Mopa in Goa and Bhogapuram, which will serve Visakhapatnam.

There has also been a special arrangement for operations at Bidar in Karnataka since it comes within a 150 km radius of Hyderabad, where the current contract does not allow another airport. Bidar, however, has limited potential as well as connectivity.

A comparison of traffic in the last financial year shows that GMR’s airports or cities handle 34.13 percent of international traffic and 29.27 percent of domestic traffic. Removing the numbers for Goa and Visakhapatnam, which are currently not operated by the GMR group, the numbers are neck and neck with airports won by the Adani group, which have 32.86 percent of international traffic and 25.55 percent of domestic traffic.

The catch?

While the numbers clearly show GMR group in the lead, there is a catch for both. The GMR group is seeing headwinds for its project at Mopa, with earlier deadlines not being met due to litigation. Besides, the existing airport at Goa will continue to operate, which will lead to a division of traffic between the two. The current Dabolim airport is located centrally, while Mopa is located in North Goa. Likewise, Bhogapuram airport is a few years away and as of now the passenger numbers cannot be stacked in favour of GMR.

Adani group, on the other hand, has faced headwinds at the Thiruvananthapuram airport, with the State government not willing to privatise the airport and litigation delaying the process. The group is yet to take charge of all the airports it has won.

From a spending perspective, there is money to be made at international terminals due to higher footfalls at food, retail and duty-free stores as compared to domestic ones. While Mumbai and Delhi have traditionally attracted international traffic, smaller airports such as Ahmedabad, Lucknow, Jaipur and others have restrictions in terms of bilaterals, which makes it difficult to attract airlines. India’s latest private airport Kannur, for example, has not been able to allow any foreign carriers since requests by foreign carriers to operate to Kannur have been on hold.

Who really takes the crown?

The government will be putting out the next set of airports for privatisation. These include Amritsar, Varanasi, Bhubaneswar, Tiruchirappalli and Raipur. While Raipur is not an international airport, all the others are and Tiruchirappalli is one of the few in the country that sees more international than domestic traffic.

These airports account for 4 percent of international traffic and 5 percent of domestic traffic. If the Adani group ends up bidding and winning all of these, the group’s airports would see more passengers being handled than the GMR group and if it swings the GMR way, that group would extend its lead further.

Will there be a twist in the tale? The bidding for Jewar airport (Noida, near Delhi) saw Zurich Airports win the bid. While both Mumbai and Navi Mumbai will be operated by the Adani-led consortium, the same would not be true at Delhi and GMR will have to fend off challenges from a rival trying to attract traffic when the airport is ready.

Would Fairfax be interested in expanding after investing in Bengaluru or will it be somebody else? While the answer will emerge with time, hopefully the airports will turn out to be a profitable business unlike the airline business, which has seen a bloodbath in India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.