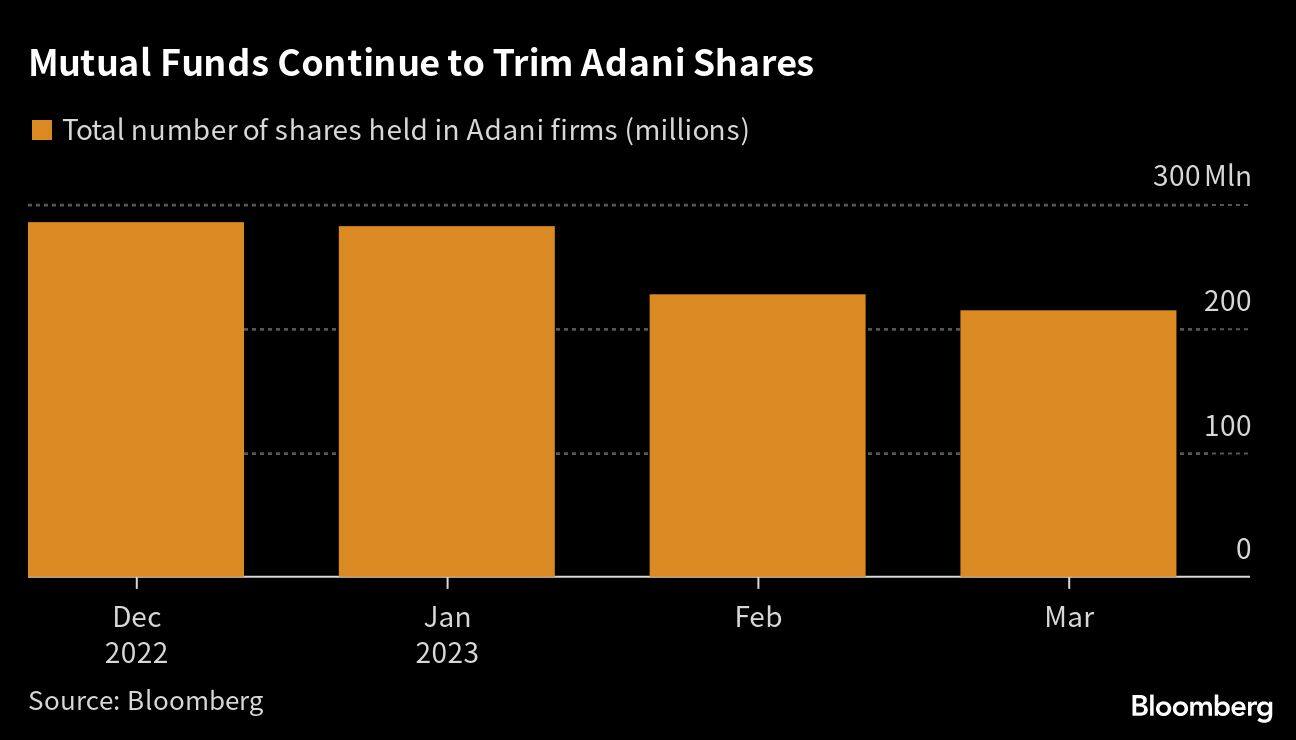

Money managers in India have continued to trim holdings of Adani Group’s stocks, suggesting concerns about governance remain even as the worst of the rout seems to have passed.

Investments by local equity mutual funds in the group accounted for only 0.9 percent of the industry’s $182 billion in assets at the end of March, according to data compiled by Bloomberg. That’s down from nearly 2 percent as of December 31.

Mutual Funds Continue to Trim Adani Shares (Source: Bloomberg)

Mutual Funds Continue to Trim Adani Shares (Source: Bloomberg)

The embattled conglomerate at one point saw $153 billion erased from its market value in the selloff following the release of Hindenburg Research’s scathing report on January 24. The group has vehemently denied allegations made by the short-seller, and has since trimmed down capital spending for growth and said that its founders have paid back share-backed loans.

Adani Shares Are Trading at Steep Losses (Source: Bloomberg)

Adani Shares Are Trading at Steep Losses (Source: Bloomberg)

Local managers’ continued caution is at odds with the optimism shown by GQG Partners’ star investor Rajiv Jain, who spent nearly $2 billion to scoop up stakes in four Adani stocks in early March. The move acted as a catalyst for a rebound of more than $30 billion in the group’s market value.

While Indian funds’ overall exposure has dropped, some players such as Mirae Asset Investment Managers and HSBC Asset Management India were buyers in March. However, shares purchased by them in two group entities totalled less than 700,000, according to data from Nuvama Wealth Management.

A historical analysis by Bloomberg Intelligence in 2021 showed that local fund managers have had smaller holdings in companies that reported governance issues than overseas and individual investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.