Foreign Institutional Investors became net sellers of financial services shares, offloading stocks worth Rs 7,536 crore in the first two weeks of February, after pulling out Rs 30,000 crore last month.

Market watchers say moderating credit demand and the struggle to raise deposits have led to investors going cautious on the banking sector. And because NBFCs are dependent on banks for fund, the problems of the banking sector will affect them as well.

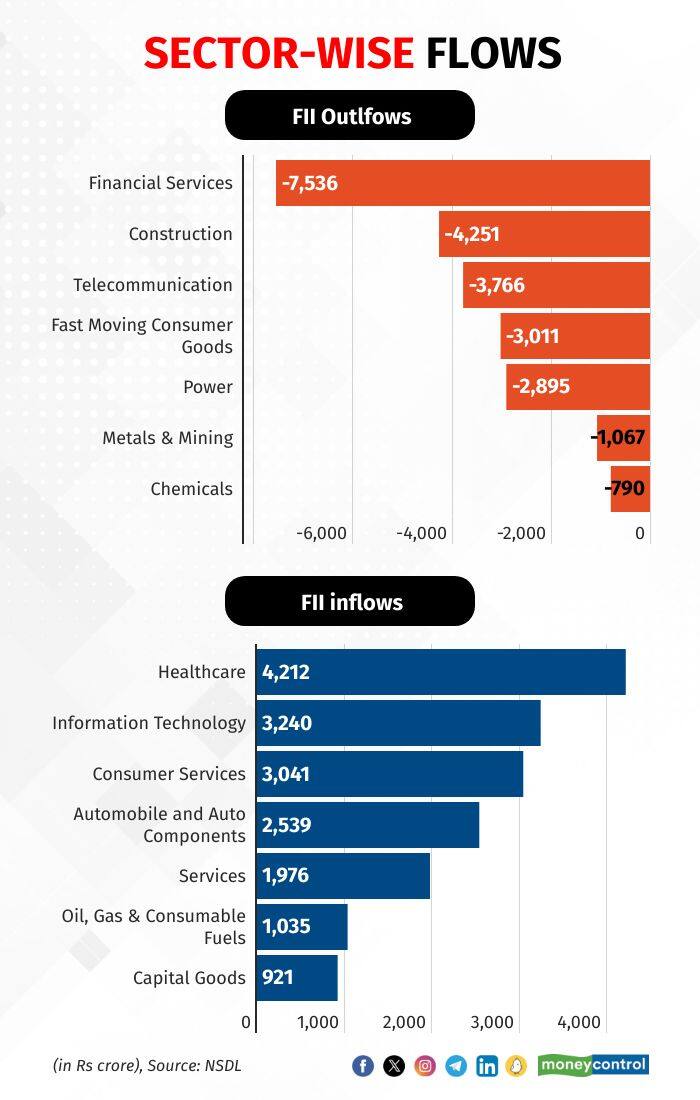

Construction and telecom were the other two sectors on the sell list of FIIs. They net sold Rs 4,251 crore of construction shares and Rs 3,766 crore of telecom shares. Significant selling was also observed in fast-moving consumer goods (Rs 3,011 crore), power (Rs 2,895 crore), metal (Rs 1,067 crore), and chemicals (Rs 790 crore), based on the fortnightly sector-wise data from the National Securities Depository.

Healthcare, information technology, consumer services, and automobile/auto components saw net FII inflows during this period.. Healthcare attracted around Rs 4,212 crore in buying from FIIs, followed by IT and consumer services, with Rs 3,240 crore and Rs 3,041 crore.

Other sectors such as automobile and auto components, services, oil gas and consumable fuels, capital goods and realty saw buying worth Rs 2,539 crore, Rs 1,976 crore, Rs 1,035 crore, Rs 921 crore and Rs 574 crore, respectively. The assets under custody (AUC) for FIIs stood at Rs 68.04 lakh crore as of February 15, of which Rs 62.84 lakh crore were in equities.

Foreign portfolio investors have sold $3.5 billion in Indian equities so far 2024, but much of that has been offset by strong domestic inflows—high net-worth individuals, retail investors directly investing in stocks and mutual funds. In January, a record Rs 18,838 crore was invested in mutual funds through SIPs, mostly in mid and smallcap stocks.

A section of the market feels FIIs may turn to Indian equities as global investors are cautious about Chinese equities, despite attractive valuations. The Chinese government's reluctance for a substantial stimulus adds to the appeal of Indian markets.

Christopher Wood, global head of equity strategy, predicts that strong earnings and global under-ownership of Indian equities will draw foreign investors. Despite being the fifth largest stock market by capitalisation, India ranks eighth in the Bloomberg World Index with a mere 2 percent weight, providing room for increased investment.

Wood notes that India's equities are the most under-owned by global emerging market active funds since 2014 and anticipates a shift in foreign investment towards India. He highlights India's increased weightage in the MSCI EM index since 2020, suggesting that Indian stocks will become essential for a broader range of equity investors. The note also mentions that despite $20-billion equity flows in 2023, there is still potential for more inflows.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.