Investors in US exchange-traded funds are once again starting to favor emerging-market stocks — as long as they don’t include China.

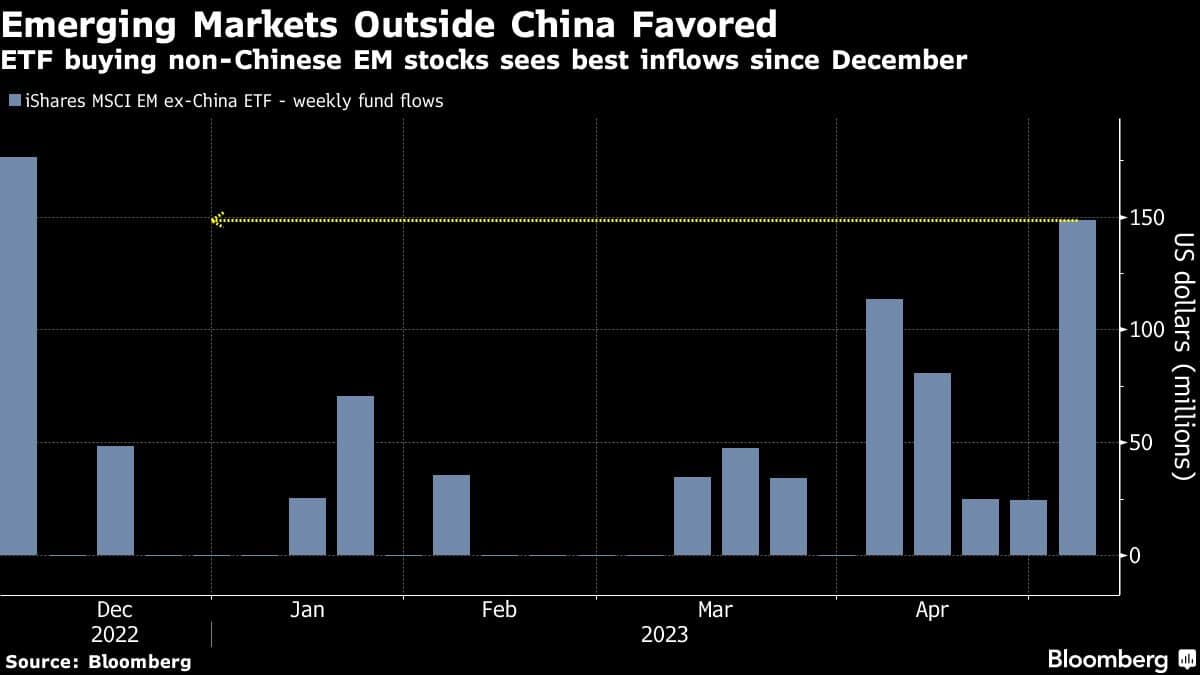

The iShares MSCI Emerging Markets ex China ETF, which invests in stocks across the developing world, but not those in the world’s second-biggest economy, received inflows of $148 million last week. That was its fifth successive week of net deposits and the biggest in five months for the fund whose largest holdings include Taiwan Semiconductor Manufacturing Co., Reliance Industries Ltd. and Vale SA.

Meanwhile, ETFs that exclusively buy Chinese shares continued to fail to get new inflows last week. China’s patchy economic recovery as well as rising geopolitical tensions and regulatory risks have tempered investor enthusiasm for Chinese equities, even as cheaper valuations and improved growth prospects are luring some investors back to emerging markets. The MSCI China Index has trailed its counterpart for the rest of emerging markets since late January, with the ratio between the two gauges at its lowest level since early December.

“The challenges overshadowing the Chinese economy are immense and have serious implications for international capital flows as well as the domestic allocation of capital, where we see a growing risk of Japan-style economic stagnation,” Ashish Chugh, a money manager at Loomis Sayles & Co. in Boston, said in an email interview Friday. “The excessive property sector and local-government debt are a major overhang on long-term growth and solvency.”

The ex-China fund has rallied in six of the past seven weeks and has not witnessed a week of outflows since Oct. 7. Investors have poured $639 million into the $3.8 billion fund, buying it even during the emerging-market selloffs in February and April. The all-equity fund has allocated 21% of its resources to Taiwan, 20% to India, 17% to South Korea and 7.4% to Brazil.

In contrast, the iShares MSCI China ETF has gone without a single day of inflows since Jan. 30, as the optimism from the start of the year around the country’s economic reopening from Covid curbs evaporates.

Other funds, such as the Xtrackers Harvest CSI 300 China A-Shares ETF and the iShares China Large-Cap ETF, have also gone without fresh deposits over several weeks.

Broader data on ETF flows backed the idea that emerging-market investors are avoiding China. According to Bloomberg’s calculations, developing-nation stock funds received new deposits of $223 million in the week through May 5, with the biggest flows going to Mexico, Taiwan, India and South Korea. China witnessed outflows across stocks and bonds.

Emerging-Market ETFs End Winning Streak, Fall $28.3 Million

The MSCI Emerging Markets Index fell 0.8% Tuesday, dragged lower by declines in mainly Chinese communication and consumer-discretionary companies. The Hang Seng China Enteprises Index and the Hang Seng Tech Index both slid more than 2%.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!