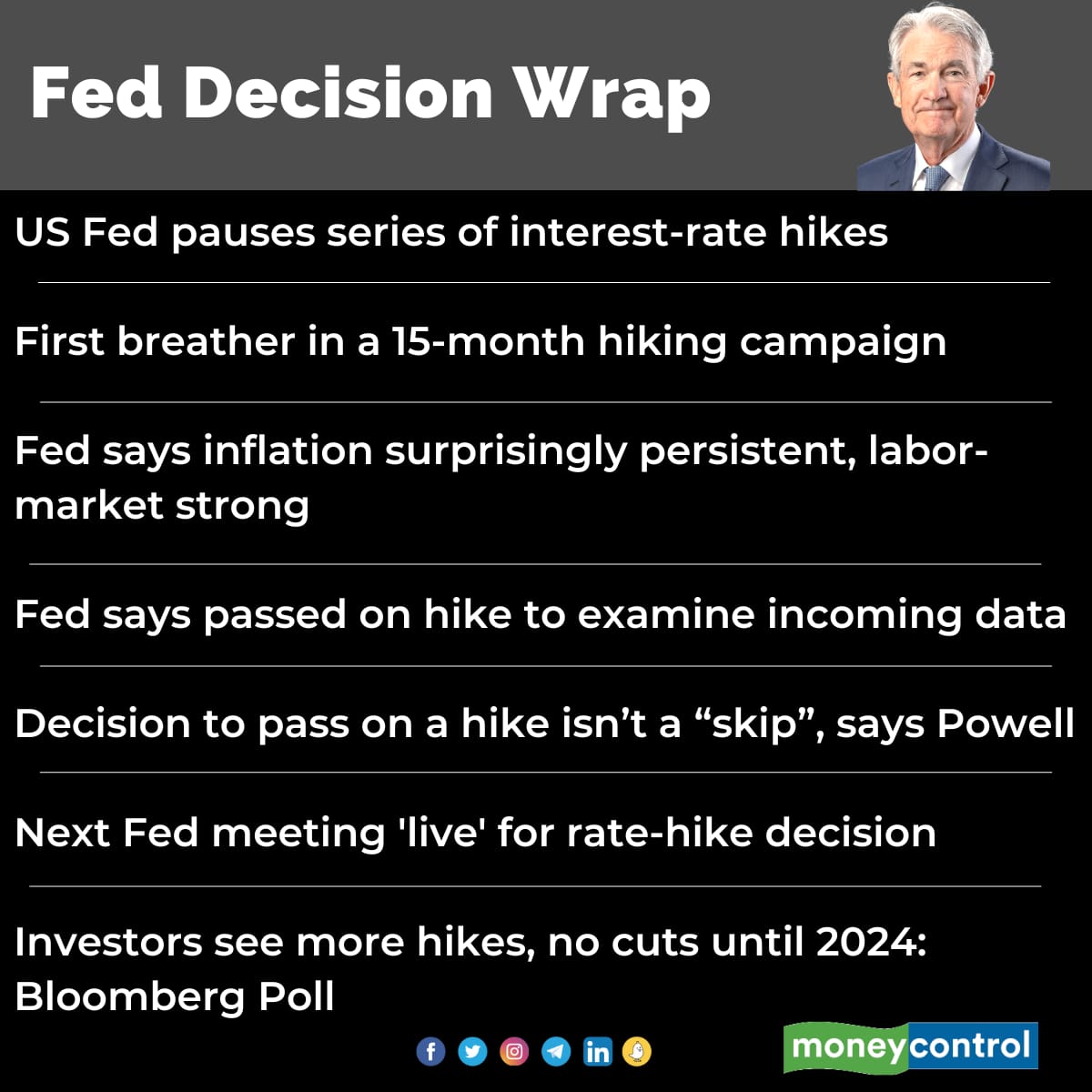

The Federal Reserve kept its key interest rate unchanged Wednesday after having raised it 10 straight times to combat high inflation. But in a surprise move, the Fed signalled that it may raise rates twice more this year, beginning as soon as next month.

The Fed’s move to leave its benchmark rate at about 5.1 percent, its highest level in 16 years, suggests that it believes the much higher borrowing rates it’s engineered to have made some progress in taming inflation. But top Fed officials want to take time to more fully assess how their rate hikes have affected inflation and the economy.

“Holding the target rate steady at this meeting allows the committee to assess additional information and its implications” for the Fed's policies, the central bank said in a statement.

US Federal Reserve Decision Wrap

US Federal Reserve Decision Wrap

The central bank’s 18 policymakers envision raising its key rate by an additional half-point this year, to about 5.6 percent, according to economic forecasts they issued Wednesday.

The economic projections revealed a more hawkish Fed than many analysts had expected. Twelve of the 18 policymakers forecast at least two more quarter-point increases in the Fed's rate. Four supported a quarter-point increase. Only two officials envisioned keeping rates unchanged.

The Fed’s aggressive streak of rate hikes, which have made mortgages, auto loans, credit cards and business borrowing costlier, have been intended to slow spending and defeat the worst bout of inflation in four decades. Mortgage rates have surged, and average credit card rates have surpassed 20 percent to a record high.

The central bank’s rate hikes have coincided with a steady drop in consumer inflation, from a peak of 9.1 percent last June to 4 percent as of May. But excluding volatile food and energy costs, so-called core inflation remains chronically high. Core inflation was 5.3 percent in May compared with 12 months earlier, well above the Fed’s 2 percent target.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!