The Reserve Bank of India (RBI) is closely monitoring the developments in the crisis-hit non-banking finance companies (NBFCs) and the housing finance companies (HFCs).

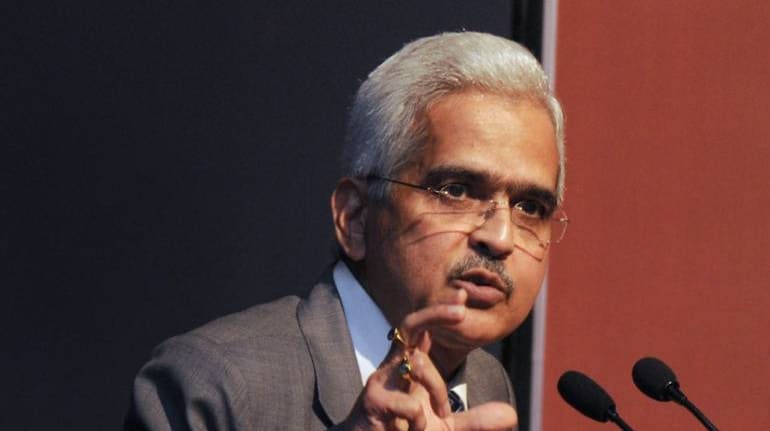

"RBI does not regulate HFCs. Nonetheless, banks have significant exposure to HFCs and RBI in any case is mandated to look after the financial stability of the entire economy. In that background, we have been very closely monitoring the activity, the performance and the development in the NBFC sector, including HFCs. We are also monitoring major entities in this universe of NBFCs and HFCs," RBI Governor Shaktikanta Das said.

Das said that the central bank is ready to take regulatory action, without delay, to safeguard financial stability of the economy, if required.

"The RBI remains committed to ensure we have a robust, well functioning NBFC sector and the RBI will not hesitate to take whatever steps are required to ensure that financial stability is not adversely impacted in any manner by any development," he added.

Das also pointed out that the central bank has reduced the periodicity of NBFC supervision from 18 months to 12 months and is well aware of the position of top entities operating in the sector.

"Individual entities themselves are resorting to various measures using market mechanisms to mobilise additional liquidity and additional resources to meet their liabilities and commitments," he said.

Last month, the RBI said it will merge its banking and non-banking supervision departments and undertake lateral recruitment of consultants as part of a functional revamp aimed at improving efficiency in the area.

"With a view to strengthening the supervision and regulation of commercial banks, urban co-operative banks and NBFCs, the Board has decided to create a specialised supervisory and regulatory cadre within the RBI," the central bank said in a statement on May 21, after its central board meeting held in Chennai.

However, with the recent default by Dewan Housing Finance Corporation (DHFL) has raised concerns of a contagion risk. CLSA said in a note that the intervention of RBI may be required as DHFL default can expose Rs 1 lakh crore in borrowing to the risk of default/haircuts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.