Inflation for certain 'lifestyle' products is cooling faster than it is for essentials, suggesting that the upwardly mobile income classes may not be feeling the pinch as much as those who spend more of their incomes on food items.

According to a Lifestyle Inflation Index (LII) constructed by Bank of Baroda Research using data from the statistics ministry's Consumer Price Index (CPI), lifestyle inflation was at 6.4 percent in 2022-23 compared to the headline CPI inflation rate of 6.7 percent. However, so far in 2023-24, the lifestyle inflation rate is down at 4.5 percent, while headline inflation has averaged 5.4 percent in the first 10 months of the year.

Also Read: FM Sitharaman rejects K-shaped recovery theory for India, asks doubters to explain

The LII has been made using 69 of the 299 items present in the statistics ministry's CPI basket and includes lifestyle food products such as millets, chocolates, canned beverages, and foreign liquor to non-food items such as suits, leather boots, air fare, laptops, and club fees, among others.

"This index is a reflection of different preferential choices of consumers within the food, clothing and miscellaneous category, particularly reflecting lifestyle choices as one moves up the consumption ladder," Dipanwita Mazumdar, an economist at Bank of Baroda, said in a note on February 16.

"One thing which clearly gets reflected in the analysis is that lifestyle inflation has picked pace partly due to (the) demand factor reflecting rising aspirations. However, when the lifestyle basket is compared with essential commodities there happens to be (a) bit of a disparity, as for the latter volatility in food prices has led to a higher inflationary burden compared to the former," Mazumdar added.

Elevated food prices

That food prices are high is no secret, with the central government announcing a raft of measures over the last couple of years to keep prices in check, including a five-year extension for the free foodgrain scheme.

Mazumdar's Essential Commodities Index—a measure of change in prices of the 22 food items for which the Department of Consumer Affairs collates data—shows that inflation for these essential items, at 6 percent, has been significantly higher than for lifestyle products in 2023-24. This is of particular concern for a developing country like India, as people in lower income brackets spend more of their income on essentials like food.

Food makes up 47 percent of the rural CPI basket and just under 30 percent of the urban CPI. As per the latest data, retail food inflation stood at 8.3 percent in January.

"As long as food inflation is elevated, the poor will continue to face the highest burden," economists from CRISIL said in a note on February 13.

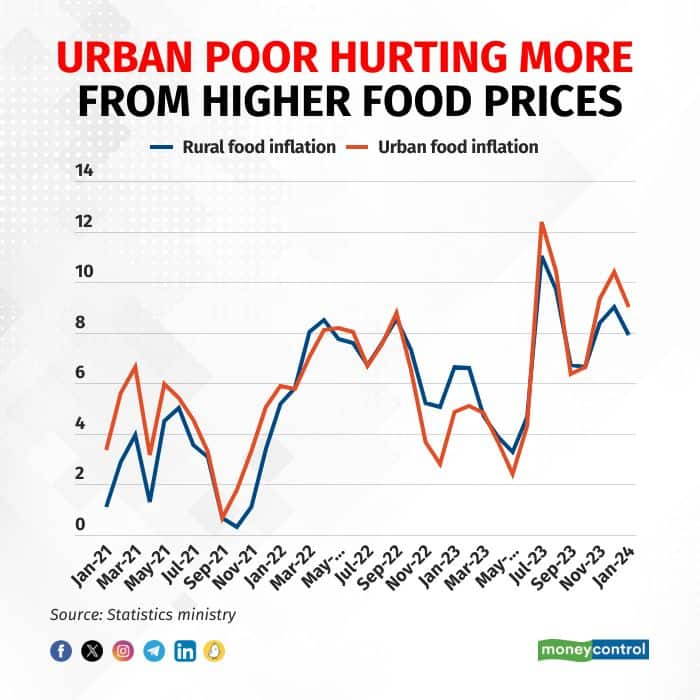

So far in 2023-24, CRISIL economists estimate that the urban poor have faced the highest inflation burden, with food prices up 7.5 percent in urban areas compared to 7.1 percent in rural areas.

In January, rural food inflation stood at 7.91 percent while urban food inflation was 9.02 percent, as per CPI data.

"On the other hand, the richest segment in urban areas faced the lowest burden since a large part of their consumption basket consists of non-food items," CRISIL added.

Core inflation—or inflation excluding food and fuel—fell to 3.6 percent in January, with CRISIL estimating it was 3.5 percent in urban areas and 3.7 percent in rural areas.

Changing consumer behaviour

To be sure, one must take conclusions about the Indian consumer from CPI data with a pinch of salt considering the current inflation series is heavily outdated.

The existing CPI inflation series is based on the 2011-12 (July-June) Consumer Expenditure Survey (CES). With the government having controversially junked the 2017-18 CES, the statistics ministry started work on a new survey in August 2022. Until that is finalised, policymakers are stuck with the current version, which includes items such as DVD players and audio cassettes, that are now as good as obsolete.

The CES is a survey of consumer spending patterns across the country. The government scrapped the CES for 2017-18 citing issues with the quality of data after it was reported in November 2019 that the draft report of the survey found consumer spending had fallen. The junking of the survey made it impossible to update India's CPI inflation data, which remains rooted in the 2011-12 survey.

Also Read: Statistics ministry mulling back-up plan to update CPI if consumer survey junked again

The current inflation data also does not consider prices on e-commerce platforms, which may also be leading to "perplexing" results within the item-wise CPI data, according to Soumya Kanti Ghosh, State Bank of India's group chief economic adviser.

Comparing item-wise data from January 2024 with April 2022, Ghosh found that the decline in the contribution to core inflation from the clothing and footwear and household goods and services categories of the CPI basket was due to weaker prices of items such as sarees, shirts, trousers, and soap, among others. However, since these goods are used on a daily basis, it would be misleading to infer that the decline in core inflation on account of lower prices of these items is due to weakening demand.

"The only reason for this phenomena could be the changing purchasing behaviour of customers. We believe that people are actively using e-commerce websites to buy these essentials, preferably at a discounted price, and hence demand is migrating from the offline to online mode," Ghosh said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.