Indian businesses with a presence in Russia, traders exporting to or importing from that country, and entities with investments in Russia are currently in wait-and-watch mode as they assess the impact of the deluge of sanctions imposed on Russian banks and businesses in the wake of the Russia-Ukraine war.

According to government estimates from 2019, there are around 300 registered Indian companies in Russia. Almost all these Indian businessmen or companies are involved in trading.

“These companies are mostly small in scale and mostly operate by importing items like tea, coffee, tobacco, pharmaceuticals, rice, spices, leather footwear and granite from India. These are then sold to local players. Only a handful engage in direct retailing, in partnership with local entities,” a senior official said. He added that the government has received requests for guidance on the issue and is in touch with all corporate stakeholders.

Sanctions on Russia involve two key components. First, the country has been cut off from a key global interbank system that facilitates transactions between banks from 200 countries. Two, the US has announced a long list of economic and trade sanctions against the country that include freezing the assets of Russia’s central bank in the US and prohibiting American citizens and business entities from doing any business with the bank.

Russia is India's 25th largest trade partner

Russia is India's 25th largest trade partner

SWIFT move affects trade

The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is the world’s leading provider of services related to the execution of financial transactions and payments between banks worldwide. Excluding Russia from the SWIFT network means banks cannot initiate transactions involving lenders or entities on the list.

“Most international trade transactions are done in US dollars and involve US banks. After the US and its allies cut off Russia from the network, most Indian banks can’t process transactions involving them. As a result, subsidiaries of Indian companies based out of Russia have been financially severed from their parent entities,” a senior functionary of the Confederation of Indian Industry said.

However, he added that seven major Russian banks have been barred from SWIFT while other banks have been spared for the time being.

“The biggest challenge seems to be payment for shipments as several banks have been placed under sanctions by the US, UK and European Union. Whether they would be able to make payments in US dollars, pounds or euros is not clear. Unless this is sorted out, shipments cannot be processed as they might get stuck in between,” said Ajay Sahai, director general and CEO of the Federation of Indian Export Organisations (FIEO).

However, the US has specified eight general licences that authorise certain transactions as well as trade in agricultural commodities, pharma, and petroleum. FIEO has told its member export promotion councils that India’s exports to Russia in these sectors would not be subjected to sanctions.

Wait and watch

Indian businesses are also still keeping an eye on American banking sanctions being implemented by the Office of Foreign Assets Control (OFAC), a financial intelligence and enforcement agency of the US treasury department. On February 24, it asked all US financial institutions to close within 30 days correspondent or payable-through accounts and to reject any future transactions with two of Russia’s largest banks, Sberbank and VTB Bank, and their subsidiaries.

VTB Bank is Russia’s second-largest bank and the total sanctions are expected to hit about 80 percent of the banking sector in Russia. On a daily basis, Russian financial institutions conduct about $46 billion worth of foreign exchange transactions globally, 80 percent of which are in US dollars. The vast majority of those transactions will now be disrupted. The US has also put sanctions against a long list of Russian oligarchs and their businesses.

“The catch is that non-US persons also stand the risk of being hit with secondary sanctions as well. The situation is fluid and we are still studying the new regulations but the US has made it clearly known that it will penalise non-US individuals and businesses through property-blocking sanctions in certain cases,” said the manager of a trading house with a presence in Russia.

According to OFAC, activities subject to secondary sanctions risk include trading through the sanctioned Russian banks, and trading with or providing support in the form of finances, material, or technology to sanctioned Russian businesses and sanctioned individuals.

Trade & investments

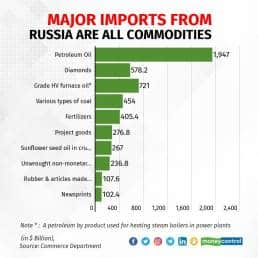

Despite being a geopolitical ally and a close economic partner for long, India’s trade with Russia has fallen much behind that of other major powers such as the US and China. As a result, Russia is only the 25th largest trading partner for India as of 2022.

However, the gamut of trade and business remains relatively large and extremely diverse. Bilateral trade is spread across hundreds of products. In the April-December period of the current financial year, bilateral trade with Russia stood at $9.4 billion. Trade had fallen to $8.5 billion in the previous year (2020-21) as a result of the pandemic, down from $10.1 billion in 2019-20. Merchandise trade had hovered around the $10-billion mark for the past five years.

The largest segment of investment by India in Russia is the multibillion-dollar investments by oil majors like Oil and Natural Gas Corporation, Oil India, Indian Oil and Bharat Petroleum Corporation, which have investments in multiple Russian oil and gas fields. Many of these companies have already started facing difficulty in repatriating income from these fields, sources said.

Most Russian companies in India operate in the heavy engineering, energy and gas, and chemical sectors. Among the most prominent Russian investments in India is Nayara Energy, formerly Essar Oil, which is 49 percent owned by Russian oil major Rosneft Oil.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.