The task of reviving growth is never a straightforward one, particularly when certain forces are not playing ball. Domestic consumption has taken a hit, private investment remains subdued, and monetary and financial conditions have begun their normalisation journey.

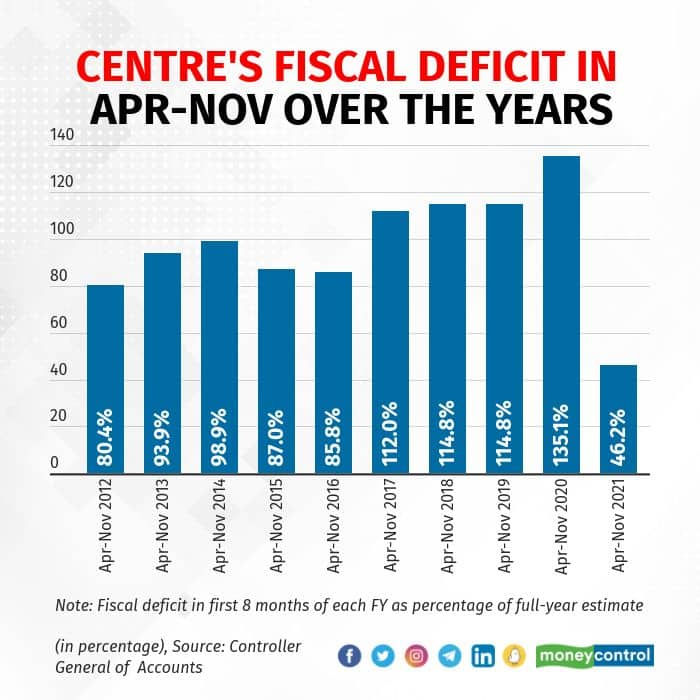

The government's challenge is further complicated by the small matter of its finances, which must be set right. After ballooning to a massive 9.2 percent of the Gross Domestic Product (GDP) in FY21, a sharp reduction was envisaged for the current year. And the central government is likely to meet its fiscal deficit target of 6.8 percent of GDP for FY22, with the first eight months of the financial year seeing the deficit at just 46.2 percent of the full-year target.

However, the fiscal deficit tells only a part of the story. India's general government debt – the combined liabilities of the Centre and state governments – steadily edged upwards over the last decade. The coronavirus pandemic proved to be a kick in the teeth, resulting in a rapid increase in general government debt.

The rising government debt is not only problematic for the government's financial situation in the long run, but also hampers its ability to boost growth in the present. The Centre's interest payments have rapidly risen over the years to Rs 8.10 lakh crores in FY22. The share of interest payments in the Centre's total expenditure has risen from 20.9 percent in FY12 to 23.2 percent in the current financial year, with growth in interest payments exceeding growth in total expenditure in seven of the last ten years.

While the Centre's fiscal concerns have been piling up, the pandemic has allowed it to shift its focus, albeit temporarily. The Budget for 2022, however, will have to start planning for a post-pandemic India. On the revenue front, the government's tax collections have improved impressively so far in FY22. An encore, at least to the same extent, cannot be assumed for FY23.

On the expenditure side, the FY22 Budget estimate already brought in some stability, with total expenditure seen declining marginally. However, an additional net cash outgo of around Rs 3 lakh crores has been approved by Parliament. As such, FY23 may only see a minor year-on-year increase in spending.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!