The government is likely to approve 100 percent foreign direct investments (FDI) in insurance broking. Sources told Moneycontrol that the approval will, however, come with caveats such as having a certain percentage of Indian members on the board as well as curbing outsourcing of activities.

Insurance intermediaries like brokers, corporate agents as well as insurance companies so far were allowed a maximum permissible limit of 49 percent FDI, while the remaining 51 percent was to be held by Indian entities.

“We have been making representations to the government to allow up to 100 percent FDI in insurance broking. The government has agreed to consider our request, although with certain restrictions,” a senior executive of a large broking firm said.

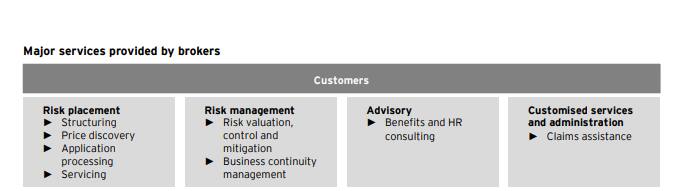

An insurance broker is an intermediary who acts as a middle man between the insurance company and the client to get them the most adequate cover at the best rate. In return, they earn commissions for the product sold.

Sources said that the approval will be issued by the authorities in the next couple of months.

In non-life insurance, the gross direct premium by brokers grew from around Rs 19,274 crore in FY15 to almost Rs 30,000 crore in FY18, according to reports.

Meanwhile, the government has made it clear to stakeholders that the increase in FDI will be subject to certain terms and conditions, like core activities such as underwriting and claims management cannot be outsourced.

Data collected from the Indian market will have to be stored in the country and global offshore centres of companies within India can also be used for the purpose.

Minimum capital requirements could be raised, as currently, direct brokers have to maintain minimum capital of Rs 50 lakh while a composite broker has to maintain minimum capital of Rs 2.5 crore.

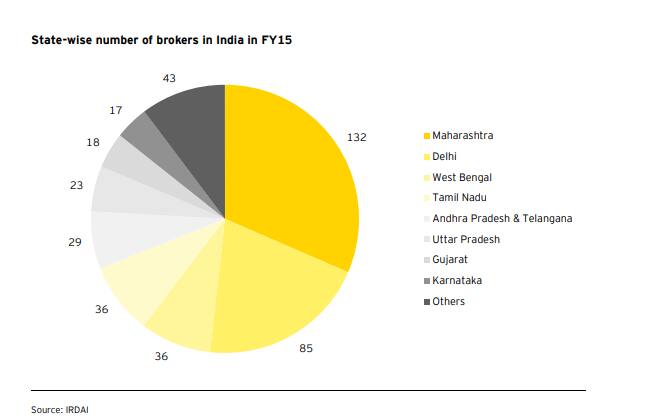

Insurance brokers are most active in the general insurance sector. About 65 percent of the corporate business including segments like group health, fire insurance, project insurance and marine insurance is sourced through these brokers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.