Headlines that describe the just-announced first quarter GDP as the slowest in five quarters don't do justice to what is a reasonably robust quarter of growth. As will be explained shortly, the GVA or gross value added number is more relevant this quarter, and this number at 6.8 percent is stronger in the April-June quarter than it was in the previous Jan-March quarter. Likewise private final consumption and capital formation at 7.5 percent each are both indicating that the economy's growth is getting broad-based.

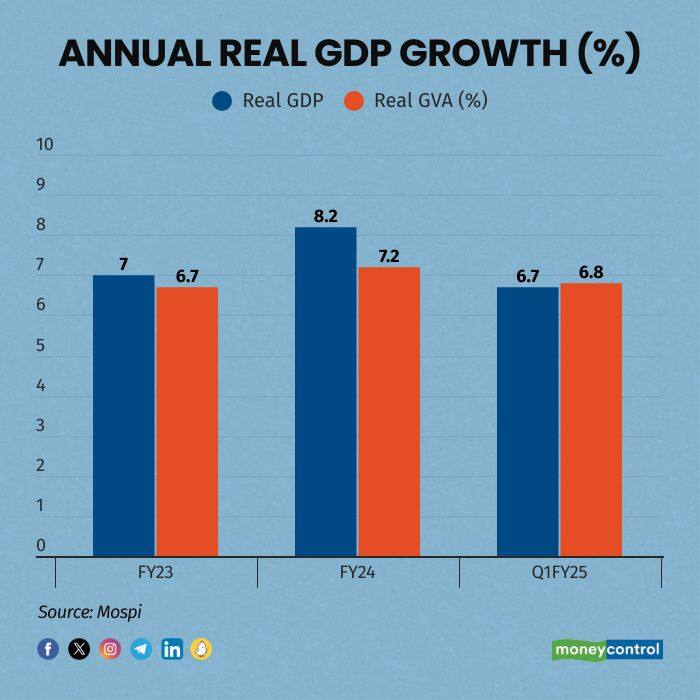

But let us address the headline GDP number of 6.7 percent which, on the face of it, is lowest in five quarters. The NSO or the National Statistical Organization doesn't measure GDP, but GVA or gross value added, which is the amount of value added output generated by each sector. To this it adds indirect taxes and subtracts subsidies to get the GDP. Now the government retained large subsidy payouts in FY23 to address the last remaining impact of Covid pandemic but withdrew them in Fy24. Hence the GDP in FY23 at 7 percent is actually understated (as the large component of subsidy got subtracted from the GVA) while the GDP in FY24 got overstated to 8.2 percent because subsidies were withdrawn and hence a much smaller subsidy component was subtracted from GVA. The FY24 GDP got overstated because of base effect created by the subsidies. Because of these distortions to the GDP, its better to look at the GVA to get a sense of the economy's trajectory. Here are the annual and quarterly numbers

One can see a huge wedge between GDP and GVA in Q2, Q3 and Q4 last year due to the subsidy impact. Hence a look at the GDP numbers gives the mistaken impact that the economy has slowed by one percentage point from Q4 of last year to Q1 this year. However, the GVA gives the correct picture that despite the El Nino heat and a government busy with election, the GVA, i.e. the value added by the economy, rose from 6.3 percent in Q4 last year to 6.8 percent in Q1 this year.

There is another internal of the economy that is heartening which is the recovery of private final consumption expenditure. Here's the data

Let's ignore the FY23 consumption figures as they are affected by the covid impact in the base year, but in FY24, private consumption was clearly a disappointment growing by just 4 percent through the year, although GDP grew by 8.2 percent and GVA by 7.2 percent. But this long lean phase of consumption has clearly reversed and recovered in Q1 of the current year. FMCG companies have already been speaking of better rural consumption and the GDP numbers confirm the recovery. Another sign of improved consumption is the last entry in the GDP. ie Public administration, defence and other services ( or PADS)

This last entry PADS comprises government services and other services like health and education. Now we know that government expenditure was low in April-June quarter. The GDP data shows that government final consumption expenditure fell by 0.25 percent in Q1. Despite that, if the PADS segment grew by 9.5 percent, it appears that the non-governmental services in health and education must have done well.

Finally, the gross fixed capital formation has also grown by a strong 7.5 percent in Q1. This is despite the fact that government capex fell during the April-June quarter due to elections. Indeed the fiscal data shows that for April-June, government capital expenditure was a full 35 percent lower than the same quarter year-ago. If despite that, the GDP data shows a 7.5 percent growth in capital formation, the inference can only be that private capex must have picked up. Signs were already visible in real estate. Core sector data has also been showing good growth in steel and power output.

The disappointment in the GDP data is that the two sectors that have shown sub-par growth - agriculture and trade, hotels, transport and communication - are both employment heavy and largely informal sectors. This increases the concern that economic growth remains K-shaped, with fewer Indians participating in the post-Covid recovery. Indeed the trade-hotels-transport segment has simply not been able to regain its pre-Covid mojo.

There is also the disappointment that growth is slipping from the 7 percent-plus mark forecast by the RBI. Of course, there are still 3 quarters to go. As government capex picks up, the incipient recovery in private capex and in private consumption may gather pace and the economy may yet post a 7 percent-plus growth. But for the moment, bulk of the economists, including the country's chief economic advisor are sticking with a sub 7 percent GDP growth forecast for this year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.