GDP data, along with headline retail inflation, is the most keenly-watched economic indicator of the Indian economy's performance. And with inflation declining and growth robust, many economists say India is in a 'goldilocks' phase.

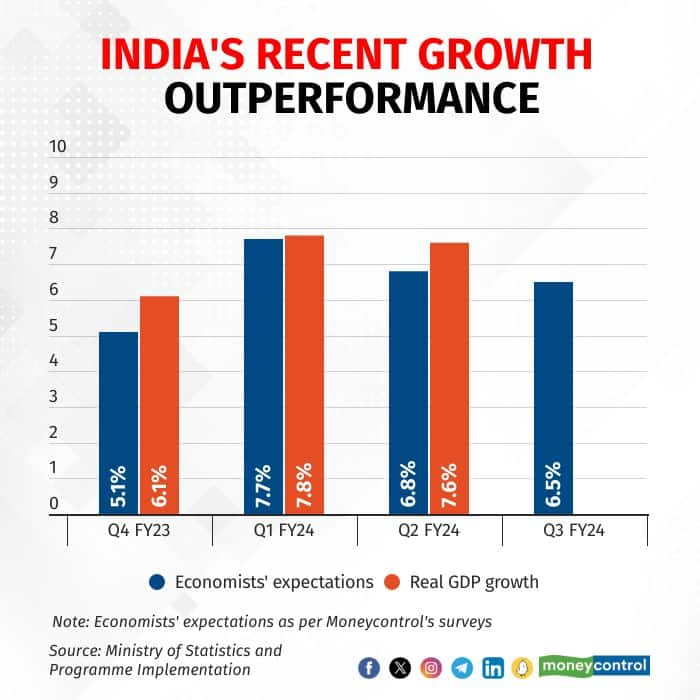

However, GDP growth is likely to have moderated sharply in the final quarter of 2023, with a Moneycontrol survey of economists suggesting it may ease to a three-quarter low of 6.5 percent from 7.6 percent in July-September 2023.

The Statistics Ministry will release GDP data for October-December 2023 at 5:30pm on February 29.

What will be the key monitorables?As usual, the agriculture and manufacturing sectors will have to be eyed closely.

After posting a growth rate of just 1.2 percent in July-September – the lowest in four-and-a-half years – the growth in the farm sector's Gross Value Added (GVA) may have risen to 2-3 percent. However, there is uncertainty as the kharif output in 2023-24 has been nearly 5 percent lower compared to last year. On the other hand, acreage under rabi has been higher. This uncertainty could weigh on GDP growth numbers for the quarter ending December.

"The inland fish production has shown rapid growth from 2014-15 to 2022-23. and reached 131.13 lakh tonnes in 2022-23. The share of the Fisheries sector constitutes about 1.07 percent of the total national GVA and 6.86 percent of agricultural GVA. So, this might support the agri and allied sector growth in 2023-24," added Soumya Kanti Ghosh, State Bank of India's Group Chief Economic Adviser.

On the industrial side, the picture is mixed, with Index of Industrial Production (IIP) data showing that industrial output – that is, the volume of production – grew by 5.9 percent in October-December, down from 7.8 percent in July-September, with the manufacturing sector's output growth slowing to 5.1 percent from 6.8 percent.

At the same time, companies' profit margins remain "buoyant".

"In October-December, as per corporate sector data available, gross profit momentum seems to have remained buoyant; consequently, we expect the industrial sector's real GVA to record about 7-8 percent growth," Kaushik Das, Deutsche Bank's Chief Economist for India and South Asia, said.

In July-September, industrial GVA growth was 13.2 percent, with the manufacturing sector’s GVA going up 13.9 percent.

On the investment front, while the Centre's capital expenditure growth edged down marginally to 24.4 percent year-on-year in October-December from 26.4 percent in July-September, "the capital outlay and net lending of 25 state governments shrank 3.9 percent, after having surged 42.4 percent in Q2 2023-24," Aditi Nayar, ICRA's Chief Economist, noted.

Aiding growth in the third quarter will be service, especially the 'trade, hotels and transportation' category, which benefited from India hosting the 2023 cricket ICC World Cup from October 5 to November 19.

Meanwhile, the erosion in India's GDP due to the country being a net importer may be lower in October-December as the sum of the merchandise trade deficit and the services trade surplus amounted to -$25.4 billion in the quarter, an improvement from the year-ago figure of -$32.8 billion.

On the whole, the segments that could pull down growth – industry and possibly agriculture – are seen outweighing those that are supporting the headline GDP number.

Can growth exceed expectations?Undoubtedly. Even economists' estimates for the third quarter growth figure is in a wide range of as low as 6.0 percent to as high as 7.0 percent.

As such, the median estimate of 6.5 percent could be exceeded. And if the recent growth prints are anything to go by, expectations could again be beaten.

What will the Q3 number mean for Q4?After posting growth rates of 7.8 percent and 7.6 percent in the first two quarters of 2023-24, the first half of the year has seen growth of 7.7 percent. As such, any slowdown in growth in October-December "should be seen in the context of elevated growth" in the first half of the year, according to Rahul Bajoria, Managing Director and Head of EM Asia (ex-China) Economics at Barclays.

But if growth does indeed ease to 6.5 percent, then it might rebound sharply again in the first quarter of 2024. In fact, if full-year growth must meet the Statistics Ministry's first advance estimate of 7.3 percent, a decline in growth to 6.5 percent in October-December must be followed by an increase to 7.4 percent in January-March 2024.

But if growth is as high as 7.0 percent in October-December, it can edge down slightly to 6.9 percent in January-March and still the first advance estimate of 7.3 percent would be achieved, calculations show.

What else will be released on February 29?As it turns out, there will be several numbers to parse through on February 29.

In addition to the GDP data for October-December, the Statistics Ministry will also release its second advance estimate for growth for 2023-24 as a whole. Its first estimate, released on January 5, pegged the full-year growth rate at an unexpectedly high 7.3 percent. Economists see this being lowered to around 6.9 percent.

But there is more.

| GDP DATA REVISIONS | ||||||

| YEAR | 1st AE | 2nd AE | PE | 1st RE | 2nd RE | 3rd RE |

| FY20 | 5.0% | 5.0% | 4.2% | 4.0% | 3.7% | 3.9% |

| FY21 | -7.7% | -8.0% | -7.3% | -6.6% | -5.8% | |

| FY22 | 9.2% | 8.9% | 8.7% | 9.1% | ||

| FY23 | 7.0% | 7.0% | 7.2% | |||

| FY24 | 7.3% | |||||

The Statistics Ministry will also publish its first, second, and third revised estimates of growth for 2022-23, 2021-22, and 2020-21, respectively on February 29. And going by past experience, the revisions can be rather drastic. These revisions can also influence subsequent years' growth estimates due to the change in the base year's number.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.