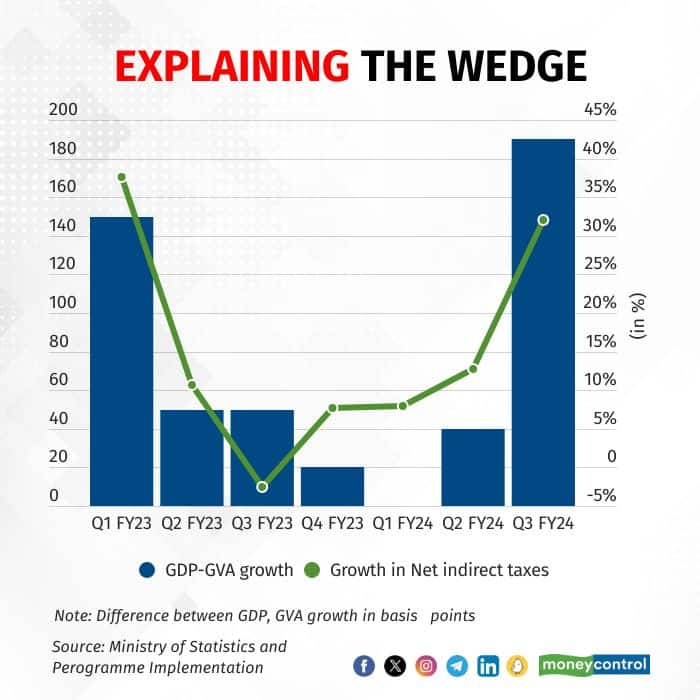

Economists are seemingly focusing on the growth in Gross Value Added (GVA) — and not the GDP growth figure — in the third quarter of 2023-24 to better understand the fundamentals of the Indian economy, with massive volatility in the government's net tax collections adding "noise" to the overall picture.

Data released on February 29 showed India's GDP growth surged to a six-quarter high of 8.4 percent in October-December, way higher than any economist's estimates. The GVA growth was nearly 2 percentage points lower at 6.5 percent and broadly in line with expectations.

GVA is the value generated by a producer of goods and services and is a measure of the contribution to GDP made by an individual producer or sector. It is computed by subtracting net indirect tax collections — or tax collections after adjusting for subsidy payouts — from the GDP. As such, when net indirect taxes figure is positive — or indirect tax collections are more than subsidy paid out — the GDP is greater than the GVA.

In the October-December period, the growth in net indirect taxes nearly trebled from the previous quarter to 32 percent year-on-year (YoY), the most since posting an increase of 37.6 percent in the first quarter of 2022-23.

"The fluctuation in net tax collections has added a lot of volatility in the GDP print in Q3," said Gaura Sen Gupta, India economist at IDFC First Bank.

"Instead, GVA would be a better metric to look at while assessing growth as it's not impacted by fluctuation in net tax collections," she added.

Also Read: Barclays hikes India GDP growth forecast for FY24 to 7.8% after blowout Q3 dataGupta is not alone in thinking that there is merit in focusing on the GVA growth rate as opposed to that of GDP, with economists at QuantEco Research saying the GVA growth of 6.5 percent is a "more believable assessment of the state of the economy".

Aditi Nayar, chief economist at ICRA, too, said, "It may be more appropriate to look at the trend in the GVA growth to understand the underlying momentum of economic activity."

So how exactly did net indirect taxes rise so sharply in the final quarter of 2023? While Goods and Services Tax (GST) collections were up 12.9 percent YoY compared to 10.6 percent in July-September 2023, the Centre's major subsidies were less than half of those in October-December 2022.

Taking GST and major subsidies — food, petroleum and fertiliser — as proxies for indirect taxes and total subsidies, net taxes in the third quarter were 47 percent higher YoY compared to 18.8 percent in the second quarter.

This is not the first time that GDP and GVA growth rates have been so wildly different. In January-March 2021, it was GVA growth that had exceeded GDP growth by a whopping 290 basis points after the Centre paid out lakhs of crores of rupees in food subsidy as it cleaned its books.

Also Read: CEA says case for global agencies to raise view on India's potential growth to 7%, if not moreThis is not to say that the impressive GDP growth rate of 8.4 percent is to be ignored.

"Another stellar quarter of healthy growth prints has been underpinned by healthy manufacturing and steady services," Madhavi Arora, lead economist at Emkay Global Financial Services, said.

According to Radhika Rao, senior economist at DBS Bank, investment growth is showing the sort of hot "streak last witnessed in 2004-2008", with the government's capex focus expected to keep the order books of infrastructure and capital goods firm buoyant, "rekindling expectations of a private capex recovery and improving capital flows".

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.