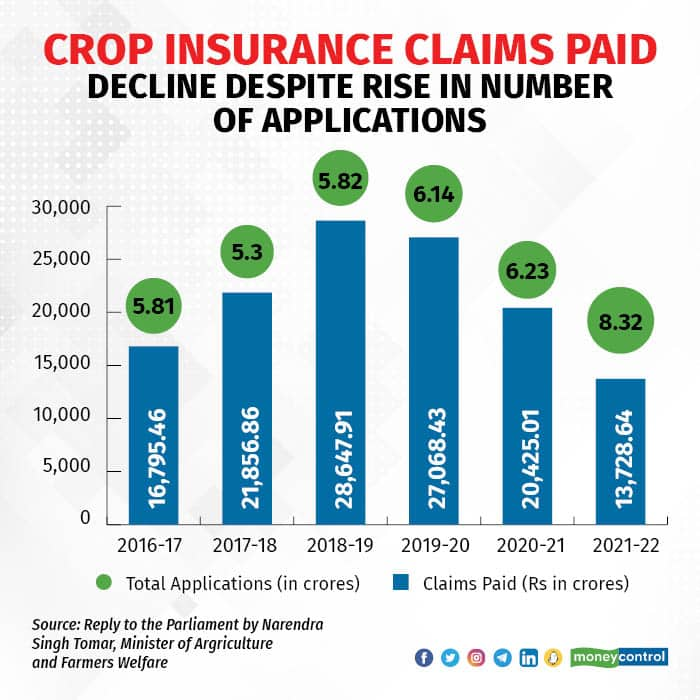

Despite a rise in the number of applications, the overall claims paid through the central government’s crop insurance scheme, the Pradhan Mantri Fasal Bima Yojana (PMFBY), went down by 48.77 percent in 2021-22, government data shows.

In 2021-22, Rs 13,728.64 crore was paid against 8.32 crore insurance claims. The amount is lower than the Rs 20,425.01 crore paid in 2020-21 for 6.23 crore applications.

Flaws within the scheme are the main reason for the low payout, say experts. “Enrolment to the scheme is done through banks and that may have gone up. But the claims are either rejected or they take so long to be processed that many farmers lose hope in the scheme,” said Devinder Sharma, a food and trade policy analyst.

PMFBY has been implemented through a multi-agency framework by empanelled insurance companies under the guidance of the union agricultural ministry and the state governments. The executing company for a state is selected by its government through a bidding process.

‘PFMBY being used for profit’

Despite being a scheme to help farmers, PMFBY has been used by insurance companies to earn profits, critics say. “Farmers and the government have been paying a large amount as premium to insurance companies. But the claims paid is lower and the difference is being pocketed as profit by private insurance companies,” said Awanish Kumar, an agricultural economist.

According to the PMFBY website, the gross premiums for 2021, for both rabi and kharif crops, stood at Rs 28,288.31 crore.

“The insurance companies will always focus on maximising profit. Given the nature of this scheme, it means that farmers are at the receiving end. Most of the designated insurance companies don’t even have enough surveyors to determine whether a claim ought to be paid or not,” said Himanshu, an assistant professor at the Centre for Economic Studies and Planning, Jawaharlal Nehru University (JNU).

‘Delay in receiving crop loss data, premiums’

However, insurance companies say that the delay in payment of claims is not because of them. “It can’t be said that the delay is because we don’t have resources. We have them in every taluka as per the guidelines. Delays are often because we didn’t get crop loss data on time from the government,” said Ashish Agrawal, Head–Agribusiness, Bajaj Allianz General Insurance, one of the empanelled companies.

“Another reason is that the premiums often come in late. The premiums are shared between the farmer, the state government, and the central government. But states often take their own time to release their share of the premium. This delays the payment of claims at times,” he added.

The government has admitted to some of the issues with the implementation of the policy. “During the implementation of the PMFBY, complaints have been received about non-payment, delayed payment, and under-payment of claims on account of incorrect/delayed submission of insurance proposals by banks; discrepancy in yield data and consequent disputes between state governments and insurance companies; delay in providing the state government’s share of funds; non-deployment of sufficient personnel by insurance companies, etc.,” Union Minister of Agriculture and Farmer Welfare Narendra Singh Tomar said in a reply to Parliament.

“Most of the complaints were suitably addressed by the concerned state government, insurer and the union ministry.”

The calculus of loss

“One of the major flaws with the scheme is the way average loss is computed at the village level and not on a per-unit basis. This means that regardless of the loss of an individual farmer, his compensation will be based on the average loss in the village. This can lead to small farmers getting much lower claims than they deserve. When my car has an accident, the insurance company sends people to inspect it. Crop insurance should also be managed the same way,” said Sharma.

In the absence of a survey of individual farms, fixed yield values that determine the coverage often lead to underpayment of claims.

“I have seen cases where the yield value for coverage is two tonnes per hectare, but the normal production of the farm is 3.5 tonnes per hectare. In case of crop failure, the farmer won’t get a proper cover for his loss because the sum paid is based on the average loss in the area, the farmer will only get a fraction of his loss,” said Sharma.

It is not possible to calculate the loss per unit because of the nature of policy, say insurers. “Calculating agricultural loss is complex and considering that the duration of the policy is very short, it is not possible to go to each farm and assess losses. The area-wise approach was adopted to address this issue and this is done most scientifically. While it is true that in some cases the loss of an individual farmer might be higher, the opposite can also be true and a farmer may get more money than he’s lost,” said Agrawal.

Investing in infrastructure to gather real-time data could reduce the delay in the payment of claims. “More investment should be made in setting up weather stations, satellites, etc., to gather real-time data on weather patterns, yield, and things like that. This can help in understanding what is happening in each region and tweak the payouts accordingly. Moreover, it will also help estimate yield loss better than the method currently being used and reduce delays as well,” said Kumar.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.