The Union Budget is barely a few days away, and expectations are that it will have measures to get the economy back on track.

The biggest tax cut the government can offer is reduction of import duties for critical sectors like solar panels, newsprint and gold.

It also need to remove taxes on Indian flag ships and their staff. Current policies favour foreign flag ships than Indian flag ships. This is inconsistent with the publicly cherished nationalistic stand of the government.

Perhaps the most unfortunate levy of duties is on solar panels. It must be recalled that there are three reasons why solar panels should be made duty free.

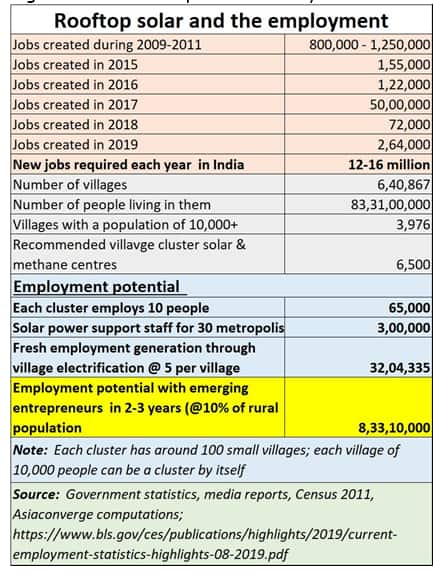

First, it is a major employment generator. Rooftop solar has the potential for creating around 80 million jobs in a few years’ time. Yet, despite the huge demand and employment potential, China continues to remain the biggest producer of solar panels (see chart).

Second, solar power has the potential to drastically reduce India’s import bills. At a time when the government has been talking about even limiting the number of duty free import of personal effects global passengers can bring in (including reducing liquor bottles permitted per person from two to one), does it make sense to continue allowing import of expensive oil and fuel? Solar and waste to energy are two natural advantages India enjoys which can even make the country forex positive. Can the finance ministry pundits get their priorities right?

Third, as the Tripura rooftop solar experiment has shown, there is an urgent need for the power ministry to be told that funds should be allocated for rooftop solar, and not solar farms or grid connectivity in rural areas. Tripura discovered that providing rooftop solar connections would cost the state just around Rs.50,000 per household, against a grid connectivity cost of over Rs.2,00,000. Plus, there will be little need for annual subsidies. Shouldn’t the government then promote rooftop solar more aggressively? In fact, the government should offer subsidies for rooftop solar in view of the three benefits outlined above.

Yet, in defiance of logic, the government slapped a safeguard duty of 25 percent. At a time when the government needs to reduce its import bills for petroleum and gas, and at a time when Tripura has shown that solar connectivity for rural areas offers the best solution, it is surprising that the government continues with the import duty levy of 25 percent. The justification: India needs to promote domestic production of solar panels. The reality is different. The rule benefits a chosen few companies.

In fact, according to Frank Haugwitz, Director of the Asia Europe Clean Energy (Solar) Advisory Co (AECEA), he was not expecting that 12 GW will be installed in December 2019 due to several reasons and also given the fairly low installations numbers in October (1 GW) and November (nearly 0.5 GW). “A year-end rally is nothing unusual, however up to 12 GW in one single month, still beats all estimates.” Mercom, an energy consultant, reported that AECAE expects India to install around 23-31 GW capacity during 2020.

A similar situation confronts the newspaper industry. Last year the government slapped a 10 percent duty on newsprint import. Now it proposed to increase this further (some say to around 22 percent by levying an anti-dumping duty on newsprint imports from “Australia, Canada, European Union, Hong Kong, Russia, Singapore and United Arab Emirates.”

This, in effect, means imports from all major producing and trans-shipment centres. Some will interpret this move as another attempt to muzzle the print media. Irrespective of the interpretation, it will push up costs of information dissemination further. This comes at a time, when education and information are the biggest stumbling blocks that hobble India.

What the budget should do is to - Make sure that Indian flag ships and their crew get better (or at least the same benefits) than foreign flag ships. It is absurd to promote Indian producers but damn Indian shipping.

- Immediately revoke the duty on solar panels, because it has a cascading increase in capital costs for India, reduced deployment of solar panels in India, and swelling import bills for oil and gas.

- Offer incentives for the rooftop solar industry, as it brings the biggest bang for the buck for India.

- Abolish duties on newsprint, because what India needs today is more internet and more information.

- Reduce import duties and cesses on gold imports to under 5 percent.

All this would be synergistic with the oft espoused policy of the government. It would benefit the environment, restore the dignity of Indian shipping, promote stability of the Indian currency, reduce smuggling, and create jobs.

The author is consulting editor with MoneycontrolDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.