The Tata group’s consumer staples firm is set to report its earnings for the third quarter of the current fiscal year on January 30, 2025. Tata Consumer Products Ltd. is likely to outperform its FMCG peers in terms of revenue growth, despite surging raw material inflation.

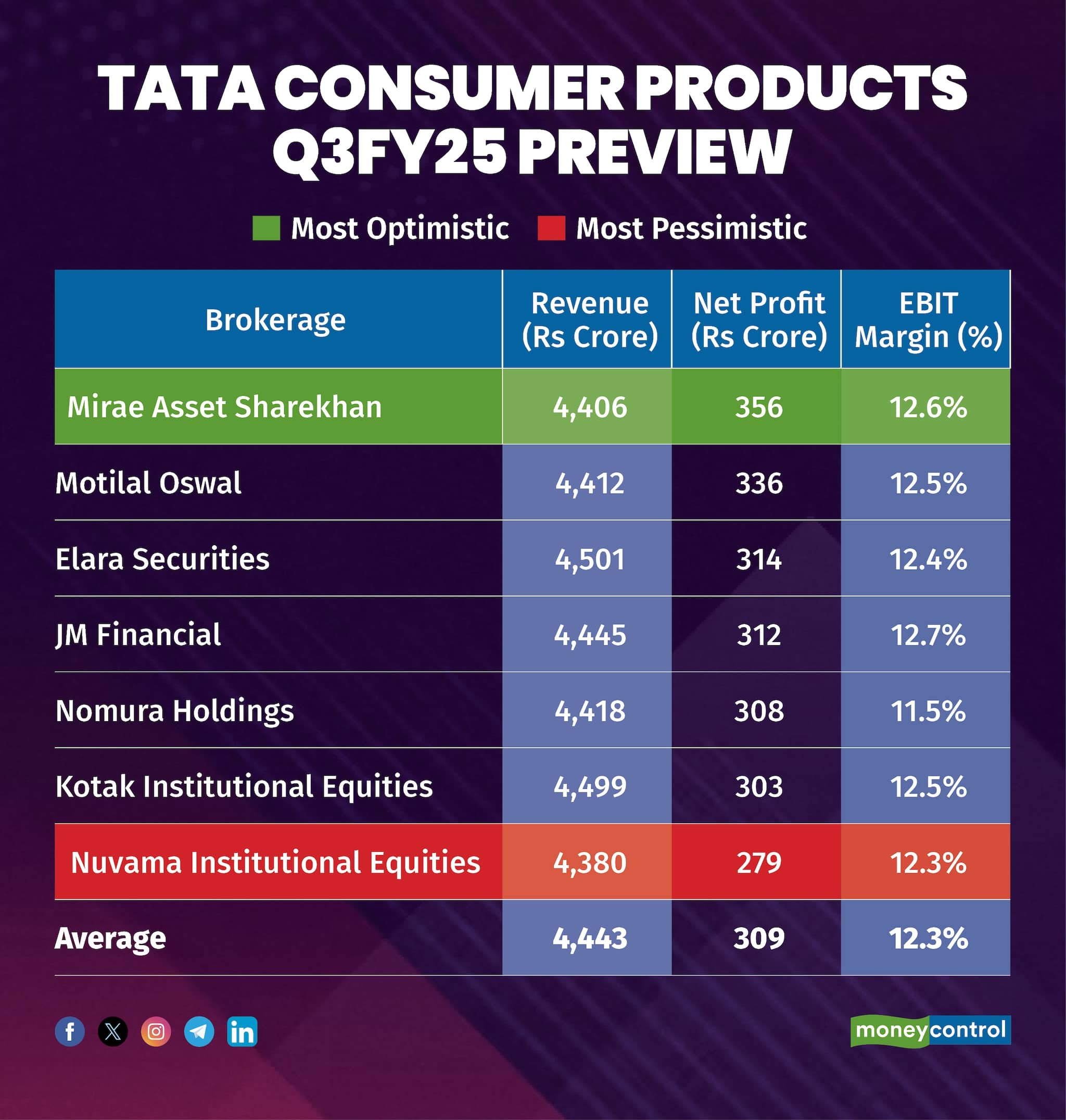

According to a Moneycontrol poll of seven brokerages, Tata Consumer is likely to report revenue at Rs 4,443 crore, surging 17 percent on-year compared to Rs 3,804 in the December quarter of FY24.

Net profit is likely to come in at Rs 309 crore, down from Rs 370 crore from the corresponding quarter last year, falling 16.6 percent on-year.

There is a serious divergence in the earnings estimates of different analysts polled by Moneycontrol. Even the most optimistic estimate sees TCPL’s net profit falling four percent on-year, however the most pessimistic projection suggests that net profit might sink 25 percent.

What factors are impacting the earnings?

Tea Inflation Impacts Margins: Brokerages expect sharp contraction in margins given the high inflation seen in tea prices. Raw tea costs have increased 25–30 percent, but Tata Consumer has started to hike prices gradually, raising the MRP by five percent so far.

Acquisitions: The profit is likely to decline sharply on-year due to amortization charge pertaining to acquisitions. Nuvama Institutional Equities expects that the recently acquired Capital Foods' revenue shall improve 5 percent QoQ while Organic India revenue shall remain flat. Together, both these acquisitions shall report revenue of Rs 3,200 crore.

India Foods Business: The arm's revenue is likely to increase 9 percent YoY."In foods, we estimate Sampann (likely to grow 27 percent) and Soulfull to do well given strong growth. We anticipate salt to grow 8 percent YoY due to price hikes (we forecast 6–7 percent price increase) with volume growth of 2 percent. Within salt, value-added salt shall post stronger growth," noted Nuvama.

International Business: The brokerage added that the International business has done well and is likely to grow 6 percent YoY. Margins are likely to improve for the segment led by price hikes and lower input costs.

What to look out for in the quarterly show?

Analysts will closely monitor demand in metro areas and tier-3 towns. Tea and coffee prices are also key monitorables, as tea prices surge to record highs. The impact of the raw material pricing on margins will be closely watched, as well as the growing competitive pressure from unorganized players.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.