Shares of State Bank of India on Wednesday became the third lender and seventh Indian company to cross the Rs 5-trillion market cap for the first time after its shares rallied over 22 percent so far this year.

The stock hit a record high of Rs 564.85 on the BSE, up 1.3 percent from its previous close. The stock stayed in the green through five straight sessions and gained 6 percent in this period.

HDFC Bank Ltd and ICICI Bank Ltd achieved this milestone earlier. Among other Indian companies, Reliance Industries, Tata Consultancy Services, Infosys, Hindustan Unilever, Life Insurance Corp of India and HDFC are in the league.

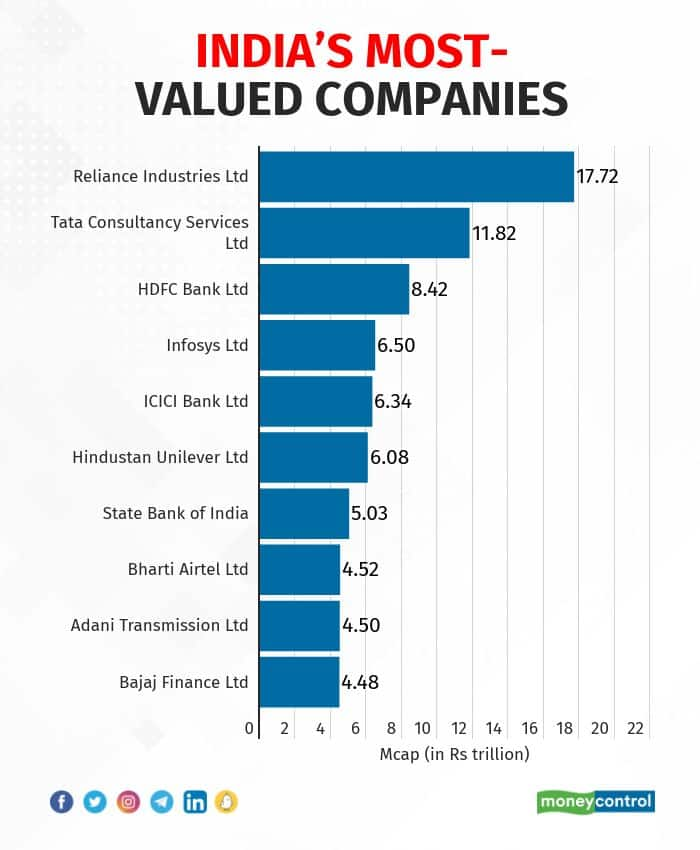

SBI now ranks seventh most valued Indian company. Reliance Industries remains India's most-valued company, followed by Tata Consultancy Services, HDFC Bank, Infosys, ICICI Bank and Hindustan Unilever.

Since the last few sessions, banking stocks traded higher amid RBI data showing demand for credit in good growth. Bank Nifty rose for the fifth session, gaining 2 percent in this period. Since the start of September, ICICI Bank gained 5 percent, HDFC Bank 3 percent and Axis Bank 7.5 percent.

The RBI data for the week ended August 26 showed the credit growth of Indian banks was at a nine-year high of 15.5 percent on-year. Outstanding credit in the banking system stood at Rs 124.30 trillion at the end of August 26 with banks having lent close to Rs 6 trillion between April and August.

Analysts expect that SBI is a key beneficiary of the systemic uptick in credit demand, especially led by corporate credit growth witnessed so far this year.

"With increasing signs of momentum continuing in corporate demand and a potential capex upturn in FY24, we believe that SBI is one of the best-placed participants in the sector. Though the share of retail loans has gone up over the last few years (36 percent of loans in 1Q23 as against 31 percent in FY20), we see a gradual increase in the corporate credit share incrementally," said JM Financial in a recent note to investors.

The lender reported unimpressive earnings in the June quarter with many brokerages have either maintained or cut their earnings forecast for FY23 and FY24, citing a miss on the net interest margin (NIM), lowest net interest income (NII) growth in Q1 among top five banks, and likely capital requirement in the medium term.

"(Margins) in our view should normalise going ahead with the bank’s liability franchise being among the best in the sector. While the bank may need to raise equity capital over the next 12-24 months (CET1), stake sale in subsidiaries (SBI Funds, SBI General Insurance) remains another option to augment capital and may delay the eventual dilution," the JM Financial report said.

According to Bloomberg, SBI has 48 'buy' and two 'hold' ratings. No analysts have a 'sell' rating on the stock.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.