Analysts expect Larsen & Toubro to report a healthy Q3 on the back of robust order inflows and lowering of debt. The multinational EPC (engineering, procurement, and construction) and manufacturing company will announce its results on January 30. Over the last one and five years, shares of L&T have gained 74.83 and 179 percent, respectively. At mid-day on January 29, the stock was trading at Rs 3,694.05, around 3 percent higher than yesterday.

Analyst estimate a healthy Q3FY24

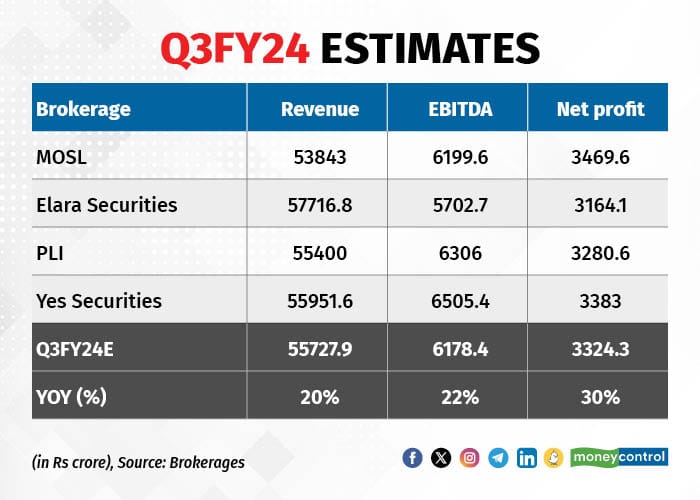

According to an estimate of four brokerages, the net profit of the diversified conglomerate is expected to jump over 30 percent year-on-year (YoY) to Rs 3,324.3 crore. Revenue is expected to grow 20 percent YoY to Rs 55,720 crore in October-December 2023 on the strength of a strong order book. Earnings before interest, taxes, depreciation, and amortisation (EBITDA) is expected to grow 22 percent from a year ago, to around Rs 6,178 crore for the reporting period. According to analysts at Prabhudas Lilladher, the EBITDA margin is expected to grow due to continued profitability improvement in development projects, and better margins in the energy, IT, and financial services segments.

Also read: L&T bags 'significant' orders in India, overseas

In Q2FY23-24, L&T reported a 45 percent YoY increase in net profit, at Rs 3,224 crore, while revenues grew 19 percent YoY, to Rs 51,024 crore.

What the brokerages say

Analysts at Yes Securities say that with the proportion of low-margin legacy projects declining, sequential margin expansion is expected. Additionally, improved profitability in Hyderabad Metro and lower debt are expected to further drive PAT (profit after tax) growth.

Analysts at Prabhudas Lilladher expect revenue growth to be led by growth in infrastructure, manufacturing, and development projects.

"During the quarter, L&T announced robust order intake in the range of Rs 53,500-82,000 crore, driven by a couple of large hydrocarbon projects in the Middle East," the report added.

Earlier in January, the infrastructure major had reported a “significant” order from HITES (HLL Infratech Services), a mini-ratna PSE (public sector enterprise) under the Ministry of Health and Family Welfare, to build a new All India Institute of Medical Sciences in Rewari. According to reports, while the order value was not disclosed, the term significant is usually used to describe orders in the range of Rs 1,000 to Rs 2,500 crore.

Also read: L&T Q2 results: Profit jumps 45% to Rs 3,223 crore, revenue up 19% at Rs 51,024 crore

Geopolitical tension

Most analysts see minimal impact of geopolitical conflict on the company’s earnings. According to analysts at BNP Paribas, the company’s exposure is largely in non-conflict zones.

"L&T delivered a sharp rise in order wins from Saudi Arabia after its improved focus on compliance with IKV (in-kingdom value added tax programme) guidelines. We expect similar gains in the UAE and Qatar as compliance with ICV (in-country value added tax programme) rises with more localisation," the report says.

Valuation and outlook

Most brokerages have been positive about the stock. In a November 2023 report, analysts at Geojit had said that they remain optimistic about the company's outlook and reiterated their Buy call on the stock with a revised target price of Rs 3,348. Motilal Oswal named L&T among their top picks for 2024 with a buy call and a target price of Rs 3,660, as of December 22, 2023.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.