More than 85 percent of the Nifty50 constituents and about 60 percent of the companies from the BSE500 universe have declared their earnings for the quarter ended September 2022 so far. It's been a bag of mixed fortunes for India Inc as companies with strong domestic plays have outperformed those that were impacted by adverse global macros.

At the same time, a rising interest rate scenario augurs well for banks, which posted handsome growth while pent-up demand coupled with strong festival season demand propelled the performance of auto companies.

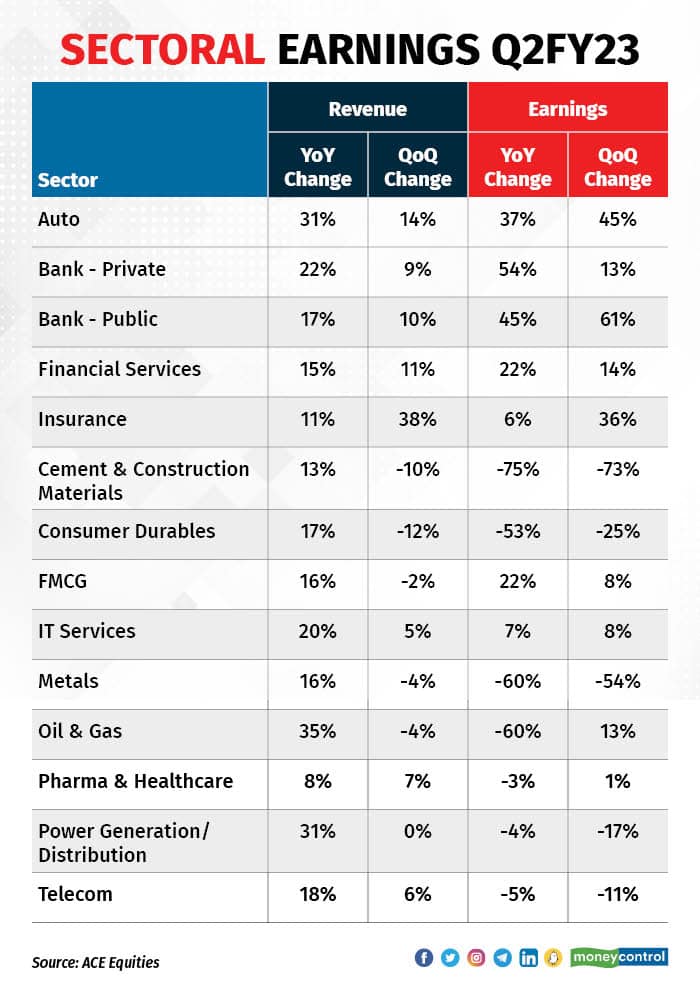

In fact, the earnings growth for the current quarter was led by banks and autos while the traditional growth engine, IT services sector, delivered mid-single-digit growth. However, global factors dented sentiments for sectors like metals and oil and gas which, along with cement and consumer durables, were the biggest drags on the earnings on the BSE500.

According to a report from brokerage Motilal Oswal Financial Services, as on November 1, 32 of the Nifty50 companies had reported their earnings and their profits have dipped 2 percent year-on-year (YoY), led by global cyclicals. “Excluding the global cyclicals, profits would have grown 25 percent YoY while, excluding the banking, finance services and insurance (BFSI) companies, Nifty profits would have decreased 14 percent YoY,” the report said.

Sectoral performance (BSE500)

Banks and financial services companies posted the best earnings of the season. The net profit of this sector is up between 20 and 50 percent over last year. Net interest income has moved up and the credit in the economy has also increased fivefold compared to the previous year. More importantly, asset quality has remained stable.

“Banks have passed on the 190bps (basis points) rate hikes through floating rate loans while simultaneously delaying the rate hikes for deposits, thus benefiting from spreads and expanding their margins,” said Anil Rego, founder and funds manager, Right Horizons PMS, a Bengaluru-based portfolio management services firm. Adequate buffers have ensured slippages are in line as well, he added.

Disbursements remained strong across vehicle, home and personal loans while the microfinance segment saw modest trends. Margins exhibited mixed trends with large banks witnessing a healthy improvement while small and mid-sized banks reported a contraction due to an increase in funding cost.

“In the high-interest rates scenario, banks will stand to earn good interest incomes, and we expect H2FY23 to stand out for the BFSI sector,” said Sonam Srivastava, founder, Wright Research, a Mumbai-based investment advisory firm. As the Indian economy picks up pace, banks will stand out with an increase in credit uptake.

“General insurance players saw a decent growth in premiums underpinned by revival in auto sales, sustained high demand for health insurance and commercial lines growing in line with the economic growth,” said the Motilal Oswal Financial Services report. Claims, however, remained elevated, especially in the health segment.

The brokerage segment saw a revival in revenue as trading volumes on the stock exchanges improved remarkably owing to improved market sentiments. Incremental account openings, however, remained modest.

AutomobilesThe autos and auto ancillaries sector posted good numbers this quarter and saw revenue grow by 31 percent on an annualised basis, which is quite commendable. OEMs increased prices of almost their entire portfolio and softening commodity prices enabled earnings to grow 37 percent on year.

Demand has been robust for the auto sector. The commercial vehicle (CV) segment witnessed domestic sales grow by 40 percent in Q2FY23, led by increasing sales in both the mid and heavy commercial vehicles (MHCV) and light commercial vehicle (LCV) sub-segment. The passenger vehicle (PV) segment registered a growth of 40 percent in H1FY23 against the same period last year. The demand for PVs was driven by demand momentum, especially for premium vehicles, new model launches and the easing of the shortage of semiconductors.

“OEMs’ performance was largely in line or above estimates, driven by strong volume growth, favourable commodity and currency movements, while operating leverage aided margin expansion,” said the analysts at Motilal Oswal Financial Services.

Based on the current spot commodity prices, all the companies have indicated that the full benefit of softening commodity costs could be seen in H2FY23.

CementThe sector was one of the biggest drags on earnings during the quarter and saw its earnings tumble by around 75 percent over the previous year due to rising input cost pressures. Revenue was slightly higher by 10 percent on year and was in line with expectations.

Aggregate EBITDA (earnings before interest, taxes, depreciation and amortisation) of the four major cement players (UltraTech, Shree Cements, ACC and Ambuja Cement) was down 46 percent YoY as well as on quarterly basis, and operating margins contracted 12 percent YoY to 10.7 percent.

Average EBITDA per tonne was down 51 percent YoY and 42 percent on quarter to Rs 610 while the aggregate profit was down 63 percent YoY.

Consumer durablesConsumer durables players were hit by soaring raw material prices and higher operating costs as the sector witnessed a 53 percent YoY and a 25 percent sequential decline in earnings for the quarter.

“While the consumer durables segment is expected to have witnessed growth across the board, demand for the consumer electrical segment was muted on account of destocking by distributors,” said Rego of Right Horizon PMS. The cost pressures are expected to stabilise soon while the trend in the festive season demand has been moderate, with urban holding up better than rural.

FMCGThe FMCG sector posted moderately good numbers. Earnings growth in the industry was 22 percent on year and 8 percent on quarter while revenue improved by 16 percent on year and remained flat sequentially.

According to industry experts, what is evident from the results so far is that urban and discretionary demand is holding up well but rural demand remains weak with no clear recovery in sight over the next few months. High rural CPI inflation continues to have an adverse effect on rural demand. On the margins front, commodity cost pressures sustained or even intensified in the September quarter for most companies, as a result of which gross margins witnessed pressure.

The gross margin pressure was more severe than expected and companies tried to offset it by lower ad spends during the quarter. Commodity prices didn’t witness any sharp reduction and softness was seen only in palm oil and crude-related costs. On the other hand, raw material prices for food and beverage products continued to be at elevated levels.

“With high-cost raw material inventory of companies, overall margin recovery will be slower than earlier expectations with Q4FY23 now likely to be the quarter when significant margin improvement is likely instead of Q3FY23,” said a note from Motilal Oswal Financial Services.

IT servicesThe numbers for the IT sector were in line with/slightly better than expectations as the trailing twelve month (TTM) deal and total contract value (TCV) growth improved for select companies on a YoY basis.

The sector witnessed a 7 percent YoY growth in its earnings for the quarter while revenues were up 20 percent on year. On a sequential basis, revenues were up 5 percent and earnings improved by 8 percent.

Tier II companies posted better growth than Tier I companies.

Companies slowed down on hiring in Q2FY23 due to looming macro uncertainties after a very strong headcount addition in the last six quarters. Margin headwinds included wage hikes, backfilling costs, and increased travel and visa costs. Operating leverage, freshers turning billable and favourable currency movements were margin tailwinds during the quarter.

“Despite the demand, macro-related uncertainties continue to impact retail, consumer packaged goods and banking (mortgage) segments,” said Rego.

At the same time, Vikas Gupta, founder of OmniScience Capital, a Mumbai-based investment advisory firm, is of the opinion that “most companies are being conservative on the second half given the macro environment, but the deal wins continue to signify that they are likely to surprise on the upside”.

Metals“Metals had the worst quarter and dragged the whole market's averages down,” said Srivastava of Wright Research. The sector faced a challenging environment during the quarter as the meltdown in global commodity prices and slowdown in the global economy hit demand. The sector saw earnings tank by 60 percent on year and 54 percent compared to the previous quarter.

“The quarter was marred by several issues such as strong correction in the realisations post-imposition of export duty, higher input costs, higher finance costs, continued domestic weakness, seasonally weak quarter and weak international sentiments especially in the EU,” said the analysts at Motilal Oswal Financial Services.

Oil and gasThe performance of the sector was impacted due to commodity price correction and government regulations for capping profits. Even though revenues were up 35 percent on year, earnings were down 60 percent YoY due to significant decline in gross refining margins (GRMs) of refiners.

According to the analysts at Motilal Oswal Financial Services, “Singapore GRMs saw a sharp decline to $7.1 per barrel in Q2FY23 (from $21.4 per barrel in Q1FY23) led by a decline in all the product cracks including gasoline, gasoil and aviation turbine fuel (ATF), highlighting that a sustained good performance in refining segment remains a concern given the highly volatile macro environment at present.” Even the marketing margins of oil marketing companies were impacted due to the volatility in crude prices and the price control exercised by the Indian government.

Pharma & healthcareThe pharmaceuticals sector was a mixed bag with companies focussed on the domestic market reporting better numbers compared to those that cater more to the US market.

“Stocks like Sun Pharma and Cipla, which have domestic market exposure, have done well and are at highs, while other pharma stocks, which have a lot of US market exposure, have been in trouble,” said Srivastava.

The domestic formulations segment exhibited healthy growth fuelled by the revival of the non-COVID portfolio, inflation-linked price hikes in medicines under the National List of Essential Medicines and favourable seasonality. The price erosion, however, remained intense in the US generics segment. However, favourable currency movements negated the impact of price erosion and aided profitability.

TelecomThe sector delivered results that were in line with analyst’s expectations. EBITDA growth was mainly led by improvement in spectrum usage charges while the higher data traffic aided the improvement in average revenue per user.

As the players roll out 5G services, the intensified capex may impact the generation of free cash flow for the time being but an increase in tariffs driven by premium services could help partially negate that impact.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.