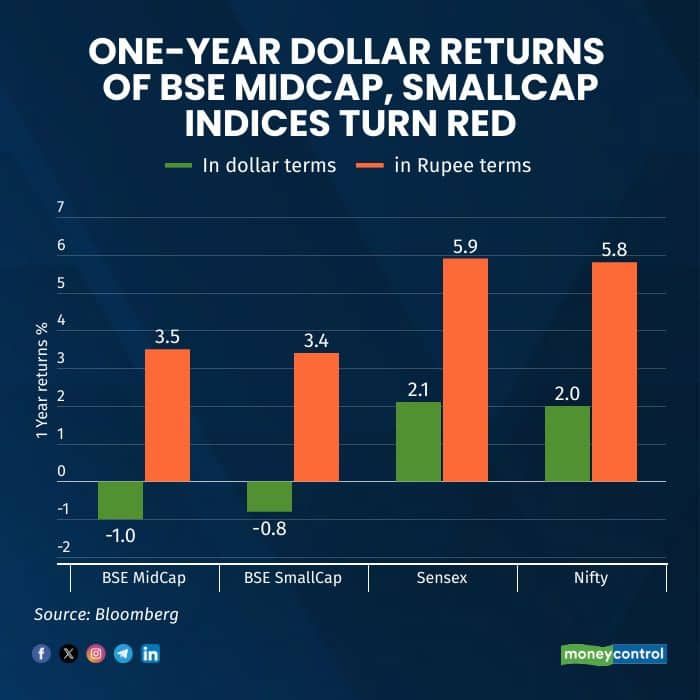

Over the last year, the BSE MidCap and SmallCap indices have declined nearly 1 percent in dollar terms, while gaining around 3.5 percent each in rupee terms. The broader Indian markets had been on an upward trajectory since early 2023, but have come under significant pressure during the recent correction.

However, the benchmark indices, Sensex and Nifty, are still trading higher, around 6 percent each in the last one year, in rupee terms. In dollar terms, they are up around 2 percent each.

So far in 2025, the rupee has weakened 1.2 percent against the US dollar, becoming the second- worst currency in Asia, after the Indonesian rupiah. The rupee has hit a lifetime low of 87.95 a dollar on February 10 from 85.50 a dollar at the start of the year.

Year-to-date, in rupee terms, the BSE MidCap and SmallCap indices have lost around 11 percent and 13 percent, respectively, while in dollar terms, both declined 15 percent and 18 percent, respectively.

Further, from their September 2024 peak, both indices have fallen over 19 percent and 20 percent in local currency while in dollar terms they lost over 22 percent, entering bear market territory.

Hardik Matalia, derivatives analyst at Choice Broking, said that this sharp correction has confirmed a bearish trend, as both indices are forming lower highs and lower lows on the charts, indicating continued weakness.

No signs of reversalCurrently, there are no clear signs of a reversal or a strong bounceback. Any minor pullback could be a dead-cat bounce and might present a selling opportunity rather than a sustainable recovery. Moreover, both indices are trading below all key moving averages, including short-term, medium-term, and long-term EMAs (exponential moving averages), reinforcing the ongoing bearish sentiment.

The recent selloff in mid- and small-cap stocks follows cautious remarks by ICICI Pru AMC's CIO S Naren at a distributor conference.

He warned investors against SIPs in mid and small-cap funds due to market volatility, sparking a debate in the industry. Speaking at an IFA Galaxy event, he urged investors to exit these segments, questioning their long-term potential.

Sustained selling by FIIsSustained selling by foreign investors, driven by slowing growth, weak earnings, and looming tariff wars, further dampened market sentiment.

As of now, the one-year forward P/E ratio of the BSE MidCap index stands at 26.34x, compared to its 10-year average of 24.07x. Meanwhile, the BSE SmallCap index's one-year forward P/E ratio is 22.54x, against its 10-year average of 19.03x.

Nearly 100 stocks in the BSE MidCap index and 760 in the BSE SmallCap index are trading below their 200-day moving average. Within the MidCap index, 63 stocks have turned negative over the past year, while 510 stocks in the SmallCap index have declined during the same period.

Experts said that, for fresh buying, it is advisable to wait for a confirmed trend reversal, which would require a strong and sustained move above the key resistance levels. Until then, the downside risk remains significant.

The potential triggers for a renewed bull run in the midcap and smallcap segments could include a favourable macroeconomic environment, strong corporate earnings, or a shift in market sentiment toward high-beta stocks. However, as per the current technical setup, fresh buying is not recommended until a clear trend reversal is established, they added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.