Madhuchanda Dey

Moneycontrol Research

Mindtree continues to surprise with better-than-expected execution and deal wins, leveraging its key strength of a head start in digital technologies. Q1 FY19 witnessed strong traction in revenue and healthy order booking. The management exuded confidence for the future and expects FY19 to be a very strong year. Recent initiatives to collaborate with top class global universities to stay ahead in areas of new technology and competition is a well thought out strategy.

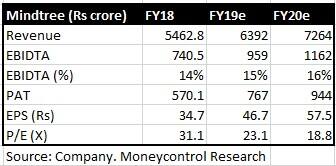

The stock had a stellar run in the past and might consolidate as the headline valuation at 18.8 times FY20e earnings appears to have factored in most positives. As a winner in the IT pack, Mindtree deserves a place in the long term portfolio of investors and should be accumulated on every weakness.

Source: BSE

The quarter at a glance

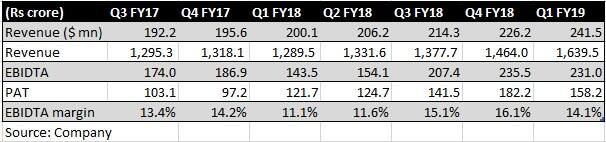

In the quarter gone by, Mindtree reported sequential (quarter-on-quarter) dollar revenue growth of 6.8 percent and constant currency growth of 8.2 percent, both of which were much higher than the preceding quarter. Sequential addition to revenue to the tune of $15 million was best in the past 11 quarters. The management maintained its stable outlook on pricing.

In line with its earlier guidance, Q1 saw the impact of wage revision impacting operating margin. Earnings before interest, depreciation, tax and amortisation (EBIDTA) margin declined 200 basis points (bps) QoQ to 14.1 percent. While wage revision negatively impacted margin to the tune of 270 bps, 20 bps was on account of visa costs and 60 bps due to company’s contribution to Stanford University’s endowment fund. These were partially offset by operational improvement that had a positive impact of 30 bps and favourable currency movement (rupee depreciation versus the dollar) impacting positively to the tune of 120 bps.

The management expects some margin improvement in Q2. The strong business outlook definitely points to a full year improvement in margin even without the probable currency opportunities.

The only challenges to near term margin is the full impact of 1,200 hires in Q1 (700 lateral and 500 fresher) and impact on salaries due to promotions that take effect from July 1.

An all-round improvement

In terms of geographies, US grew strongly while Europe’s growth in reported currency was muted due to an adverse currency movement. What was interesting about Mindtree’s performance in the quarter gone by was the strong sequential traction from all verticals: Hi-tech and media grew 9.3 percent; travel and hospitality 6 percent; banking, financial service and insurance (BFSI) 5 percent and retail consumer packaged goods (CPG) and manufacturing 4.9 percent

Digital continued to grow at a scorching pace, up 12.6 percent sequentially and 35.4 percent year-on-year. The segment contributed 47.5 percent of total revenue.

We take comfort from the management’s approach to remain ahead of competition in terms of technological innovation by forging partnership with world renowned institutions. It has committed $2 million to Stanford University which stands testimony to this approach.

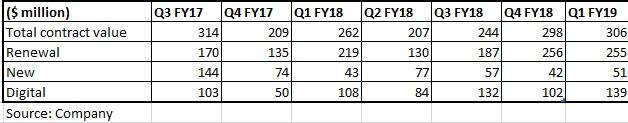

Deal momentum strong, likely to sustain

The management had guided to a strong pipeline and the result is evident from deal flows in Q1. The company has seen significant improvement in its top client but doesn’t see a worry in this concentration as its share in the client’s budget is still small and has further headroom to grow.

The management is seeing deal size in digital improving and mentioned that enterprises are selecting technology partners based on the level of competence and specialisation and not according to the size of the firm. This gives an edge to mid-sized but competent players like Mindtree.

The strong deal wins, commentary on the deal pipeline and significant jump in hiring despite stable attrition points to a strong business momentum going forward. In Q2, while the management expects the trajectory to be upwards, it has guided to lower sequential revenue growth than Q1.

Should you buy after its stellar run?

Mindtree certainly possesses the right ingredients in this transformative environment. With the demand environment looking up and the company’s win ratio improving, it is at a vantage position. As the CEO puts it on a lighter note, “The stars are aligned in our favour.”

The management has put recent speculation to rest by clarifying that promoters are not offloading their stake to a strategic investor and the resolution to increase CSR (corporate social responsibility) spend is an enabling one only.

We do not see much risk to the premium valuation of the stock. Given the recent outperformance, we advise investors to watch out for dips and gradually accumulate this business which is rightly positioned for the future.For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.