Shares of India's largest car marker Maruti Suzuki India Ltd. tumbled on open on April 28, after the New Delhi-based auto firm reported a miss on its earnings report for the fourth fiscal quarter of FY2025, with margins moderating sharply.

Maruti Suzuki's net profit for the March quarter came in at Rs 3,711 crore, lower by 4.3 percent year-on-year (YoY). The auto player's revenue from operations saw a 6.4 percent uptick to Rs 40,674 crore, as against Rs 38,235 crore in the same period last year.

At 9.50 am, shares of the auto firm were down 0.8 percent at Rs 11,604 per share, after trimming intraday losses following its 3.5 percent fall on open

The auto giant's margins clocked in at 10.5 percent, down from 12.3 percent during the corresponding quarter for FY2024, tumbling sharply below estimates, primarily due to higher expenses related to the new Kharkhoda plant, adverse commodity costs (mainly steel), an unfavorable product mix, and increased advertising spend for the e-Vitara unveil.

Further, the management's commentary was weak, as a result of low domestic demand and affordability concerns. "The local market has been soft, and growth was extremely limited," the company said, noting that FY26 is unlikely to see a significant improvement.

Follow our market blog to catch all the live updates

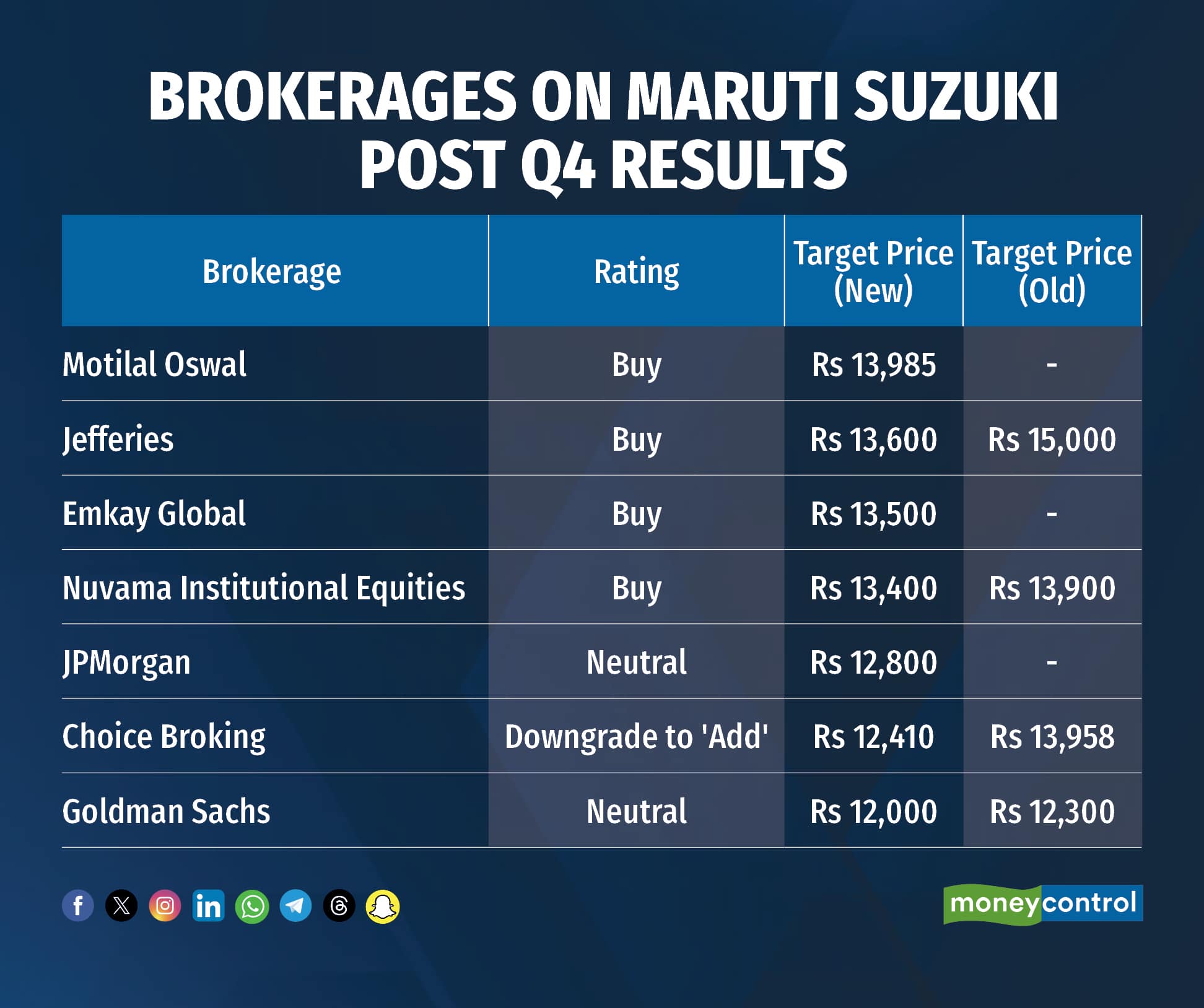

International brokerage JPMorgan believes that margin pressure could sustain in the near-term, and a strong model cycle is needed for re- rating. FY2026 could be weaker than FY2025 as the company will continue to ramp-up its new plant, in an environment where volume growth could remain soft.

Going ahead, Choice Broking expects the EBITDA margin to normalize going forward as the plant ramps up production in the coming quarters. The EV segment which is set to begin sales in H1FY26 with an expected 3-4 percent penetration by FY26 may have a slight drag on the margin due to much lower profitability compared ICE vehicles.

Brokerages cut their target prices on the auto player following its earnings show. Goldman Sachs trimmed its target price on the firm, stating that Q4 numbers remain a miss, prompting tepid fiscal 2026 expectations and margin headwinds. Growth recovery in the small car segment is still not visible.

While Jefferies maintained its buy call, the international broking firm remained cautious on domestic demand in the current financial year, but expects around 20 percent growth in exports and plans to launch a new SUV in the year. Jefferies prefers peers M&M, TVS Motor and Eicher within the auto segment.

For FY26, while domestic demand is likely to remain weak, the firm is expected to outperform peers supported by its new launches. Further, continued export momentum is likely to boost volumes. Maruti Suzuki anticipates exports to rise at least by 20 percent in FY26. "Hence, we factor in a 7.6 percent volume CAGR over FY2025-2027E," said Motilal Oswal.

"However, we also factor in a 50 bps margin pressure for the firm for FY26E given the anticipated rise in input costs. Overall, we expect MSIL to deliver a 10 percent earnings CAGR over FY25-27, driven by new launches and strong export growth," added the brokerage.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.