New Delhi-headquartered Maruti Suzuki India Limited is set to release its earnings report for the fourth fiscal quarter of FY25 on April 25. Analysts expect an uptick in revenue, driven by a strong product mix, higher average selling prices and a rise in volumes. However, margins could face pressure due to higher advertising spending and discounts.

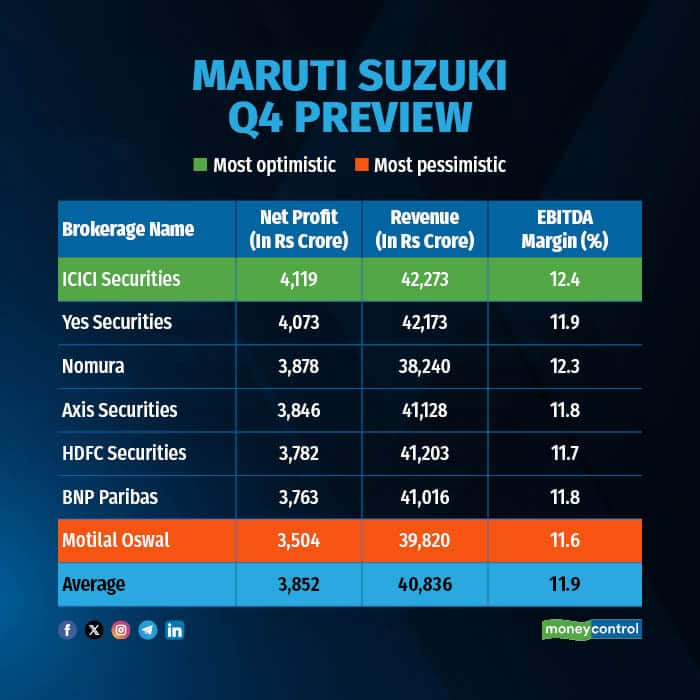

According to a Moneycontrol poll of seven brokerage firms, the Wagon-R maker is anticipated to record a 6.8 percent year-on-year increase in revenue, reaching Rs 40,836 crore. Net profit is projected to witness a slight 1 percent dip to Rs 3,852 crore from Rs 3,878 crore in the same quarter of the previous fiscal year.

Earnings estimates from analysts polled by Moneycontrol are in a diverse range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price. Most optimistic brokerage -- ICICI Securities -- has forecasted a 6.2 percent increase in net profit. On the flipside, Motilal Oswal -- the most pessimistic brokerage -- projects a 9.6 percent drop in net profit.

What factors could affect Maruti Suzuki's earnings?

EBITDA Contraction: The EBITDA margin is expected to decline by 40 bps YoY due to higher

marketing and advertisement spending, higher discounts, partly offset by operating leverage, and increased sales of CNG vehicles. Furthermore, the margin would also be impacted by Kharkhoda plant’s higher depreciation and overhead costs.

Modest volumes: Maruti Suzuki, India's largest four-wheeler manufacturer, will witness a 3 percent rise in volumes, which will positively impact revenue growth during the fourth quarter. Despite the overall slowdown in the auto sector, the company has sold 6,04,635 units in Q4, higher than the 5,84,031 units sold in the same quarter last year.

Poor Mix: Analysts say that the average selling price (ASP) could rise, but note that this will be partially offset by an unfavourable mix - specifically, a higher share of entry-level cars and a lower share of exports, both of which typically fetch lower prices.

What to look out for in the quarterly show?

Shareholders should watch out for updates on the company’s orderbook and inventory levels, along with details on the upcoming e-Vitara launch and its expected volumes. Clarity on the demand outlook for FY26, especially the trends across rural and urban markets, will be key.

Investors will also look for insights into the company’s cost-control measures, prevailing industry discounting trends, and the commodity price outlook for 2025. Commentary on the average price hikes taken during the quarter, as well as the company’s stance on hybrids and related policy developments, will be closely tracked.

Maruti Suzuki shares closed at Rs 11,900, higher by 1.42 percent from the last close on the NSE on April 23. Maruti Suzuki shares have gained nearly 10 percent since the start of the year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!