IndusInd Bank is expected to report strong growth in earnings for the quarter ended June, led by a sharp decline in loan-loss provisions coupled with healthy growth in advances.

The Mumbai-based private lender will report its June quarter earnings on July 20.

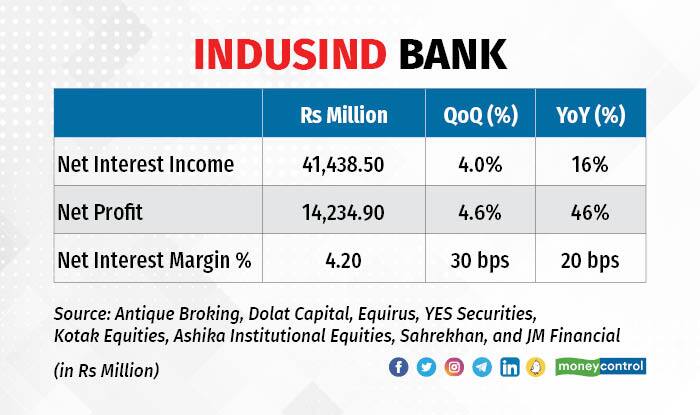

The bank is likely to expand its net profit by 46 percent year-on-year and 4.6 percent sequentially to Rs 1,423.5 crore in the reported quarter, according to an average of estimates from seven brokerage firms polled by Moneycontrol.

IndusInd Bank is likely to see a 37 percent year-on-year fall in loan-loss provisions during the quarter to Rs 993.7 crore, as asset quality continues to improve aided by lower slippages.

“We expect provisions to keep declining, led by lower slippages and better asset quality trends,” brokerage firm Kotak Institutional Equities said in a preview note. Kotak Equities’ analysts are building in slippages of around 2.5 percent of the loan book or roughly Rs 1,600 crore.

The lender’s net interest income—the difference between the interest income the bank earned from lending activities and the interest it paid to depositors—in the reported quarter is likely to grow by 16 percent year-on-year to Rs 4,143.9 crore, the Moneycontrol poll found. The growth will be led by an 18 percent on-year and 4 percent sequential rise in loans during the three-month period ended June.

Also read: RBI measures unlikely to open forex floodgates, may not stop rupee slide: Experts

The rise in IndusInd Bank’s loan book will likely be driven by an enhanced focus on consumer loans, which have done well in the quarter aided by the reopening of the economy. The first full quarter of no COVID-19-related disruption has boosted credit off-take in the overall economy.

That said, operating performance will be weak, affected by substantial losses in the treasury department due to the spurt in government bond yields during the June quarter.

Also Read: Bank results Q1 preview: High profit growth likely but watch out for treasury hit

Government bond yields jumped over 60 basis points (bps) during the previous quarter following a 90-bps interest rate hike by the Reserve Bank of India as well as continued concerns around high inflation. One basis point is one-hundredth of a percentage point.

Bond prices move in the opposite direction to bond yields.

Lower government bond prices will cause marked-to-market losses of around Rs 500 crore during the quarter to IndusInd Bank, resulting in its pre-provision operating profit remaining flat at Rs 3,153 crore. On a sequential basis, operating profit will fall 5.3 percent.

Also read: More banks look to issue AT1 bonds as investor demand comes back

Investors will also focus on management commentary around asset quality in the microfinance loan book, trends in retail loan growth and outlook on the vehicle finance business.

At 12.19 pm, IndusInd Bank was trading 0.12 percent down on the National Stock Exchange at Rs 850.05.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.