FMCG major Hindustan Unilever is expected to report a muted performance for the quarter ended June even as the year-on-year performance will be aided by the low base of the year-ago quarter damaged by the pandemic.

The Mumbai-based company will announce its June quarter earnings on July 19.

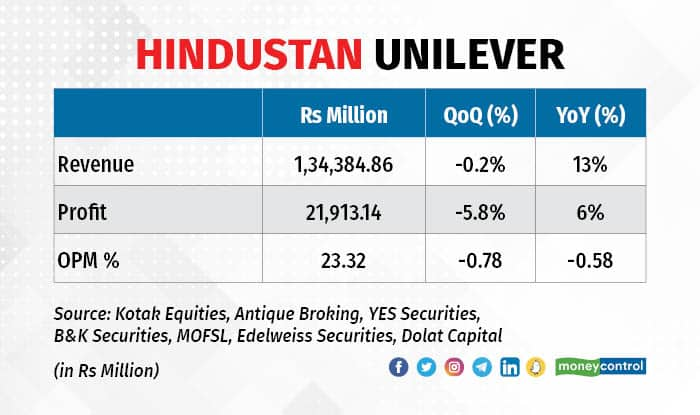

On a sequential basis, the company’s revenues are expected to remain flat at Rs 13,438.5 crore for the reported quarter, according to an average of estimates from seven brokerages polled by Moneycontrol.

The fast-moving consumer goods company may see its net profit down 6 percent on-quarter to Rs 2,191.3 crore for the reporting quarter, whereas operating profit taking a 3.5 percent knock sequentially, the Moneycontrol poll showed.

Also Read: FMCG Q1 preview | Inflation may dent volumes, margins for another quarter

The weak sequential topline performance is a result of muted demand conditions in the rural market that has been hit by high prices. “We expect consumption to have seen some dip due to price hikes with rural seeing more impact than urban,” brokerage firm Edelweiss Securities said in a preview note.

Analysts expect HUL's volumes to grow merely 2-3 percent on-year given the high base of the year-ago quarter and muted demand.

Overall, the company’s sales are expected to rise 12.8 percent on a year-on-year basis benefitting from the low base of the year-ago quarter, which was affected by state-wide lockdowns triggered by the second wave of the pandemic.

HUL’s net profit will still see only a 6.3 percent rise on-year even as operating profits rise 10 percent largely because of higher costs. On a year-on-year basis, costs pressures faced by FMCG companies has been immense even if they have been able to pass on some of the cost inflation to end consumer.

Brokerage firm Kotak Institutional Equities expects a 320 basis points (bps) on-year, and 230 bps on-quarter, contraction in gross margin due to broad-based inflationary pressures. Overall, analysts expect the company to report operating margins of 23.32 percent for the June quarter, which is lower by 58 bps from the year-ago quarter and 78 basis points from the previous quarter.

“Input costs continue to remain elevated during the quarter. Palm oil, sunflower oil and copra prices have seen some correction of late, but the benefits are expected to come in with a lag,” brokerage firm B&K Securities said in a preview note.

Besides the June quarter numbers, the investor focus will be on the company’s commentary on rural demand in the wake of acceleration in the spread of the monsoon rains across the country. Further, analysts would like clarity on possibility of further price hikes going ahead given that company has not yet passed on full extent of rise in input prices.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.