Anubhav Sahu

Moneycontrol Research

Riding on cyclical opportunities of end market - global aluminium industry -Himadri Speciality Chemical posted yet another robust set of Q1 FY19 earnings, backed by improved product realisations for carbon products. While recovery in another important end market for the chemical industry - Indian FMCG - aided higher earnings growth for Galaxy Surfactants.

Himadri Speciality Chemical: Sequential improvement in Q1 margin

Source: Company

Q1 sales were up 34 percent year-on-year (YoY), backed by pricing gains (volume growth of 5 percent). While raw material cost surged 37 percent, EBITDA per tonne moved up 34 percent YoY and 9 percent quarter-on-quarter (QoQ) on account of better pricing trends for carbon black and coal tar pitch (CTP). EBITDA stands for earnings before interest, tax, depreciation and amortisation.

EBITDA margin, excluding forex effect, expanded 103 basis points YoY and 32 bps QoQ, reflecting healthy operating leverage. Moderate increase in depreciation and higher other income aided net profit growth of 53 percent.

Capacity expansion to accelerate earnings growth in near term

The company is on course to set-up a 20,000 tonne capacity for advance carbon material (ACM) in West Bengal for lithium ion batteries in phases. Currently, company is completely able to utilize 50 tonne per month capacity of ACM and, hence, expected to deliver 600 tonnes in FY19. For FY20, ACM production and sale of 5000 tonne is expected.

Full 20,000 tons capacity would be available for production by FY20-end. In case of carbon black, 60,000 tonne of additional capacity (currently: 1.2 lakh tonne) of specialty carbon black having majorly a non-tyre application would be available by Q1 FY20. Debottlenecking initiatives for CTP would lead to an one lakh tonne capacity increase (currently: 4 lakh tonne) in Q3 FY19.”

Financial projections

In the medium term, volume growth is expected from key revenue streams: CTP and carbon black. Higher contribution from advance carbon material and higher utilisation of Sulfonated Naphthalene Formaldehyde (imposition of anti-dumping duty) is expected to aid margin. We expect EBITDA CAGR of 31 percent (FY18-20e). Seen in this context, the stock is trading at an attractive multiple of 11.3 times FY20e earnings.

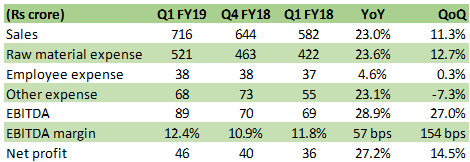

Galaxy Surfactants: Volume-led growth in Q1

Galaxy Surfactants saw a 23 percent YoY increase in sales led by double-digit (15 percent) volume growth. In the domestic market, it continues to witness ahead-of-industry growth (14 percent) and rise in market share. Among international markets, volumes in Africa, Middle East and Turkey rose 6 percent and was impacted by a macro slowdown. However, volume growth in other markets was a robust 35 percent.

Higher volume growth (20 percent) in specialty care products and operating leverage helped improve margin. Negative other income (mark-to-market losses), however, slightly moderated profit growth.

Result snapshot

Source: Company

Steady volume-led earnings growthTurkey, which accounts for about 7 percent of total volume, is one export markets that should be monitored. As of now, the management is confident of meeting the challenge as its policy of advance payment for most non-MNC customers ensures there is no impact on receivables.

In the medium term, we expect sales growth to mimic high single-digit volume growth, which in turn would be backed by capacity expansion (Jhagadia, Taloja and Egypt), the benefits of which would accrue in Q1 FY20. Improving utilisation of existing plants (73 percent for performance surfactants and 58 percent for special care products) would be guided by recovery in the FMCG sector.

In the recent market turmoil, the stock corrected about 30 percent from its listing highs and trades at a fair 21 times FY20e earnings. We remain positive on the stock, given its dominant market share, long term strategic partnership and R&D focus. Its sole focus on the personal care end market makes it a defensive bet in the chemical industry.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.