India's largest private lender HDFC Bank's shares rose in trade on April 21, after the bank posted its quarterly earnings show for the quarter ended March FY2025, showcasing strong growth amid solid loan growth.

HDFC Bank posted a 6.7 percent year-on-year rise in standalone net profit to Rs 17,616 crore for the fourth quarter of FY25. On a sequential basis, net profit rose by 5.3 percent.

Gross non-performing asset (NPA) ratio of the bank shrunk to 1.33 percent as on March 31, 2025, as compared to 1.42 percent as on December 31, 2024. However, it expanded from 1.24 percent a year ago, showed the stock exchange filings.

HDFC Bank's net interest income (NII) for the quarter grew by 10.3 percent to Rs 32,070 crore from Rs 29,080 crore from the previous quarter last year.

The bank's net interest margin was at 3.54 percent on total assets, and 3.73 percent based on interest earning assets. Excluding Rs 700 crore of interest on income tax refund, core net interest margin was at 3.46 percent on total assets, and 3.65 percent based on interest earning assets, release noted.

The lender's management believe that in the global context, India is well placed, amid two subsequent rate cuts by the RBI, and its change in stance from neutral to accommodative is a welcome relief for the bank.

At close, HDFC Bank shares were quoting Rs 1,925.2 per share, up 1 percent on the NSE.

Should you buy, sell, or hold HDFC Bank shares?

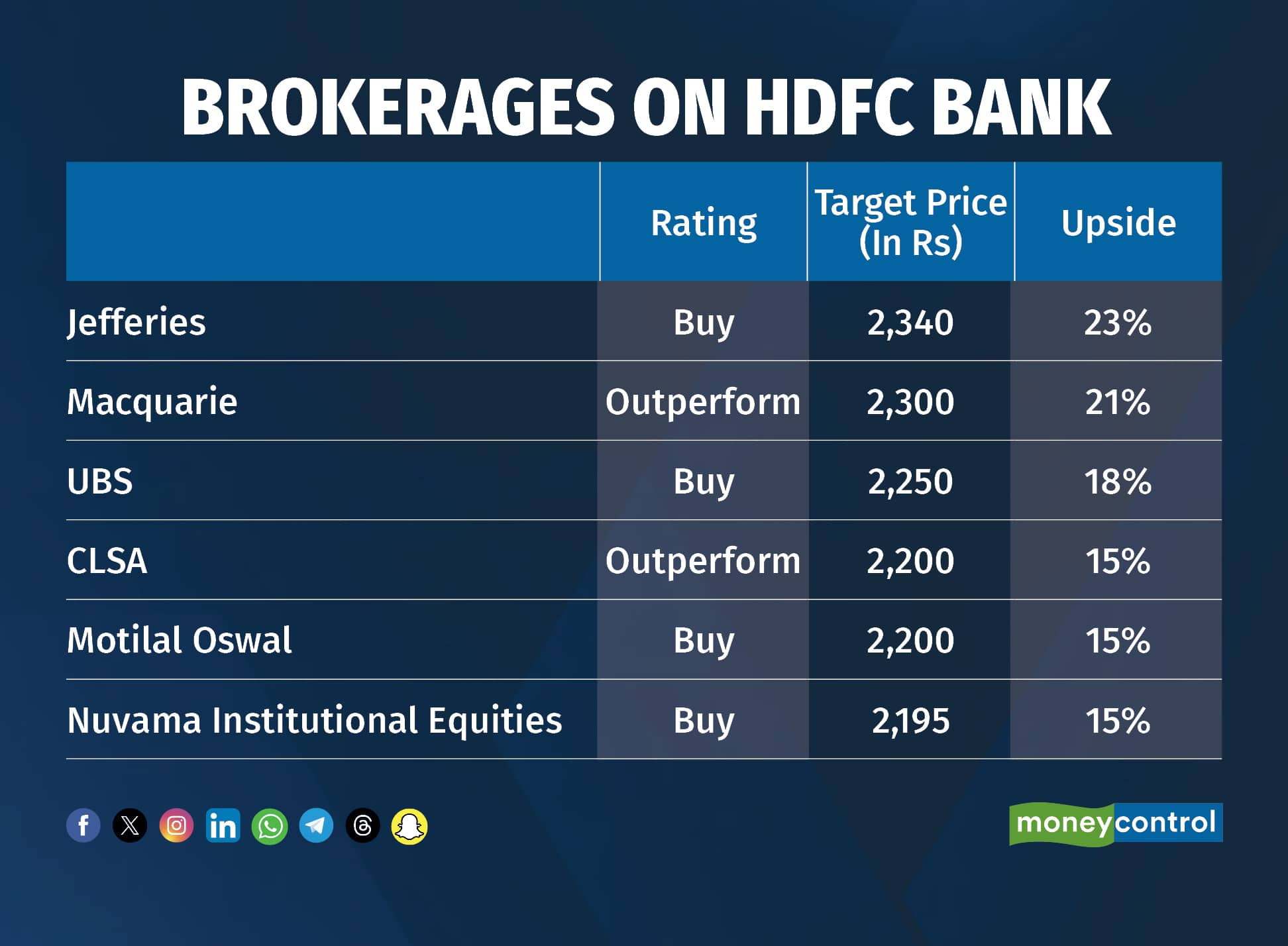

HDFC Bank posted a slight beat on the net profit front, noted brokerages. "Business growth was healthy while aligning with the bank’s strategy to reduce the C/D ratio consistently. Asset quality improved, with slippages remaining at a controlled level," said domestic brokerage Motilal Oswal. "The gradual retirement of high-cost borrowings, along with an improvement in operating leverage, will support return ratios over the coming years."

CLSA noted that HDFC Bank reported a 'decent' quarter. While the preceding four quarters for the lender were weak, HDFC Bank finally picked up loan growth (rising four percent sequentially) and reiterated its intention to growth in-line with the market in FY26.

"We believe with positive outcomes on asset quality, a substantial gain in deposit market share, consistent improvement in LDR and an uptick in core NIM, Q4FY25 was a strong quarter," said Nuvama Institutional Equities.

Macquarie said it was maintaining its 'outperform' rating given HDFC Bank's potential for ROA improvement over the next two years, driven by NIM expansion.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.