Index heavyweights TCS and Infosys Q3 results propelled the Nifty IT index by 5 percent, pulling NSE Nifty 50 to a new record high. Nifty 50 was holding near 21,850 in the afternoon trade on January 12, while the Nifty IT index was at 36,400.

Market leaders Tata Consultancy Services (TCS) and Infosys (INFY) reported weak quarterly that missed expectations on some counts, and barely met the estimates on others. However, strong deal wins and outlook alleviated concerns about the sector grappling with fears of sluggish demand. Infosys stock rose 7 percent to Rs 1,613, while TCS stock jumped 4 percent post-results, reaching Rs 3,888.

TCS may head to all-time high, Infosys may challenge resistance; watch these levels to buy on dips:

Sameet Chavan, Technical Analyst at Angel One, stated, "All IT counters have started finding their mojo back since the early part of November. Initially, midsize IT counters showed some outperformance, but now it's time for larger peers to catch up. Both Infosys and TCS were in the process of revival, and with the boost from results, the tough times seem to be behind them."

"Infosys is now confirming its multi-month breakout above Rs 1,592, and from hereon, the tide has turned to 'BUY on dips'. In 2-3 weeks, we would expect it to challenge its major intermediate resistance of Rs 1,670-1,675, with Rs 1,486 becoming a sacrosanct support. As far as TCS is concerned, it is also picking up some pace, and soon we would see it heading towards its all-time high of Rs 4,043."

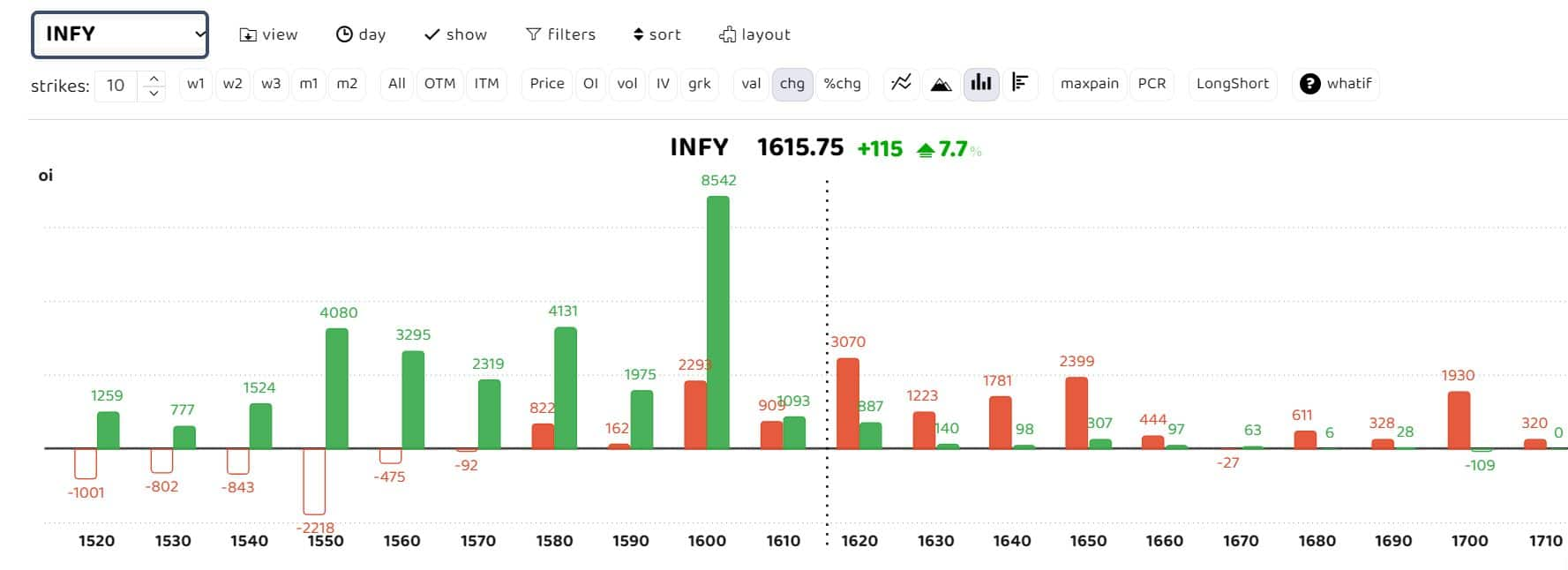

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Akshay Bhagwat, Senior Vice President-Derivatives Research at JM Financial, stated, "Infosys had seen call shorting bets placed ahead of the results. A strong gap up has surprised the call writers, resulting in the unwinding of short bets. The weekly chart structure remains positive, with the recent swing highs of Rs 1,575 being taken off. Momentum should see upside of Rs 1,625-1,660, with a support base building up at Rs 1,550."

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

On the other hand, TCS had a decent set of quarterly numbers, which provided the impetus for a gap-up open, said Bhagwat. "Post setting up a support base at Rs 3,700, the momentum regaining in this IT major can retest and attempt a breakout above the swing highs of Rs 3,925," he added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.