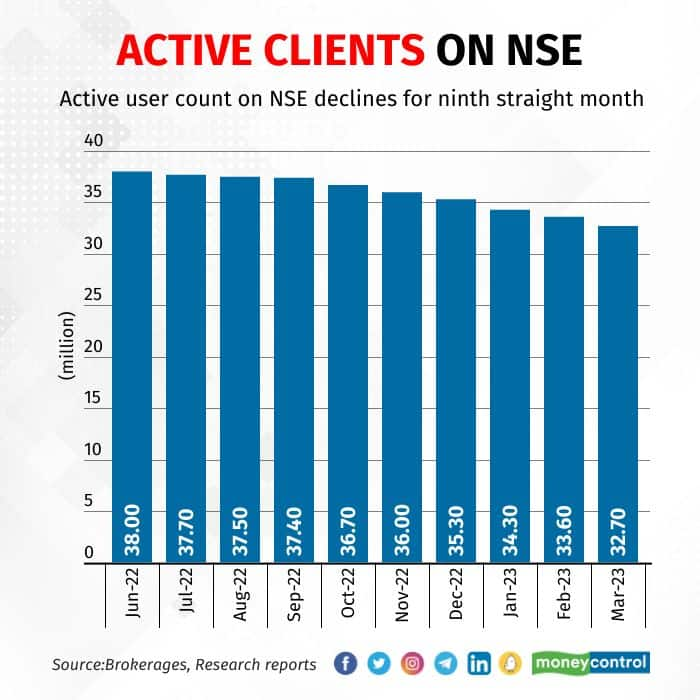

The active user count on the NSE decreased for the ninth straight month to 32.60 million in March as against 33.60 million in February.

The number of active participants has been decreasing consistently since July 2022, which experts attribute to the uncertain economic environment, lacklustre one-year returns, and declining retail enthusiasm impacting market participation.

The active user base in the financial markets has historically been influenced by market fluctuations. Whenever the Nifty experiences a rally, the number of active users tends to increase, but when the Nifty remains stagnant or goes downhill, this number typically decreases.

"Since last one year, the Nifty has been trading within a wide sideways range. However, the key point to note is the high volatility within this range. The sharp upward and downward swings have resulted in significant losses for traders, while short sellers have also faced considerable challenges in navigating this market," said Rahul Ghose, Founder and CEO of Hedged, an algorithm-powered advisory platform.

"The lack of direction has also left the investors frustrated with no real return being seen and a very small bunch of stocks giving real returns," Ghose said.

In the last one year, the Sensex and the Nifty gained 2.7 percent and 1.3 percent, while the BSE MidCap and SmallCap lost 0.5 percent and 4.5 percent. Foreign investors have sold $2.09 billion in local equities so far this year, while they sold $17.21 billion in entire 2022.

In 2023 so far, out of Nifty 50 stocks, only seven have given over 10 percent returns, while nearly 13 stocks have risen below 7 percent. The remaining 30 stocks are trading in the red. In the last one year, 22 stocks out of the Nifty 50 are trading still in the negative, while 18 gave positive returns.

Between March 2020 and October 2021, there was a remarkable surge in the total number of demat accounts, which increased from around 4 crores to 7.38 crores. A large proportion of these new accounts belonged to active traders. This surge in the number of total and active demat accounts coincided with a remarkable rally in the market, with the Nifty soaring from 7511 in March 2020 to 18604 in October 2021. However, following this period, the market became more volatile and began to deliver negative returns.

"Active traders started losing money in this declining phase and have been leaving the market. This has happened during market downturns after a period of rally. Rising fixed income returns due to rising interest rates is another factor that is pulling investors away from equity. The healthy trend in the market is the increasing number of equity mutual fund investors, particularly in the systematic segment, where monthly SIPs have crossed Rs 14000 crores" said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!