Dr Reddy’s Laboratories is yet to report its Q4 FY25 earnings as schedule for May 9. Analysts are expecting to see subtle margin improvement on a quarterly basis, with price erosion in the US business expected to be offset by steady traction in key products.

A Moneycontrol poll of five analysts project revenue to grow 15.5% YoY, from Rs 7083 million in Q4FY24 to Rs 7020 crore, and net profit by 14.95%, from Rs 1307 crore in Q4FY24 to Rs 1022 crore. EBITDA margin is expected to reach 26.35% from 29.7%.

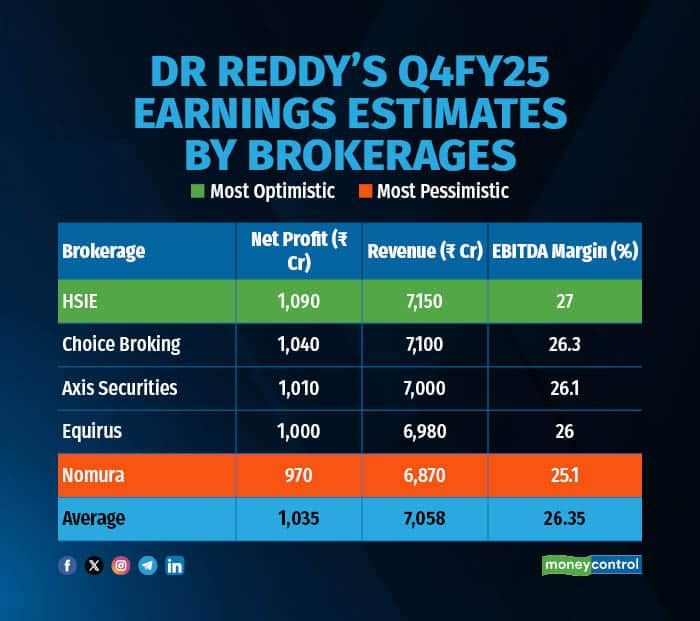

On an average, Monycontrol poll reveals that analysts expect Dr Reddy’s to report an average revenue about Rs 7,058 crore, net profit of Rs 1,035 crore, and EBITDA margin of 26.35 percent for Q4 FY25.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock.

Key factors driving Q4 earnings:Dr Reddy’s Q4 performance is expected to be regionally mixed, with strength in India and Europe offsetting continued challenges in the US. In the domestic market, revenue is likely to be driven by the full-quarter integration of the Sanofi-acquired vaccine portfolio, which has expanded the company’s footprint in preventive healthcare and strengthened its chronic therapy offerings.

In Europe, the recently acquired nicotine replacement therapy (NRT) portfolio continues to scale up steadily, contributing to revenue growth and supporting margins through a favourable shift in product mix.

Meanwhile, the US business presents a more nuanced picture — while sales of gRevlimid are stabilising at around $130 million, the base generics portfolio remains under pressure from price erosion and intensifying competition. Meanwhile, HSIE expects US revenue to rise 4% sequentially, as gRevlimid gains partly offset base erosion.

Analysts predict margin outlook aided by product mix and USD tailwinds; but lack of one-off income may weigh QoQ. Analysts viewed gross and EBITDA margins to remain steady. Herein, Axis Securities anticipates flat sequential growth in US revenue, pegging gRevlimid at ~$130 million and the base business at ~$285 million.

However, Equirus flags the absence of Q3 milestone income as a drag on sequential growth but sees some recovery in gRevlimid. It also notes continued pressure in high-value US generics and advises monitoring US margin trends and updates on the gIxempra launch.

What to watch out forAnalysts will closely track management commentary on the US generics outlook, especially with regard to the base business recovery and competitive pressures in key molecules. While gRevlimid volumes appear stable, its longer-term contribution may taper due to expected market erosion. Any update on the launch timeline and ramp-up potential for gIxempra, an important oncology asset, could shape medium-term growth visibility. Investors will also look for signals on product filings and regulatory progress in the US pipeline, especially for complex generics or specialty drugs.

On the domestic front, updates on the integration and growth momentum of the Sanofi vaccine portfolio, as well as the scaling trajectory of the NRT and nutraceuticals segments, will be important to assess the strength of Dr Reddy’s consumer health strategy.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.