India’s largest paint player Asian Paints is set to report its earnings for the first quarter of the current fiscal year on July 17. The election season, unavailability of painters and lower weddings could potentially play spoilsport in the paint major’s result show.

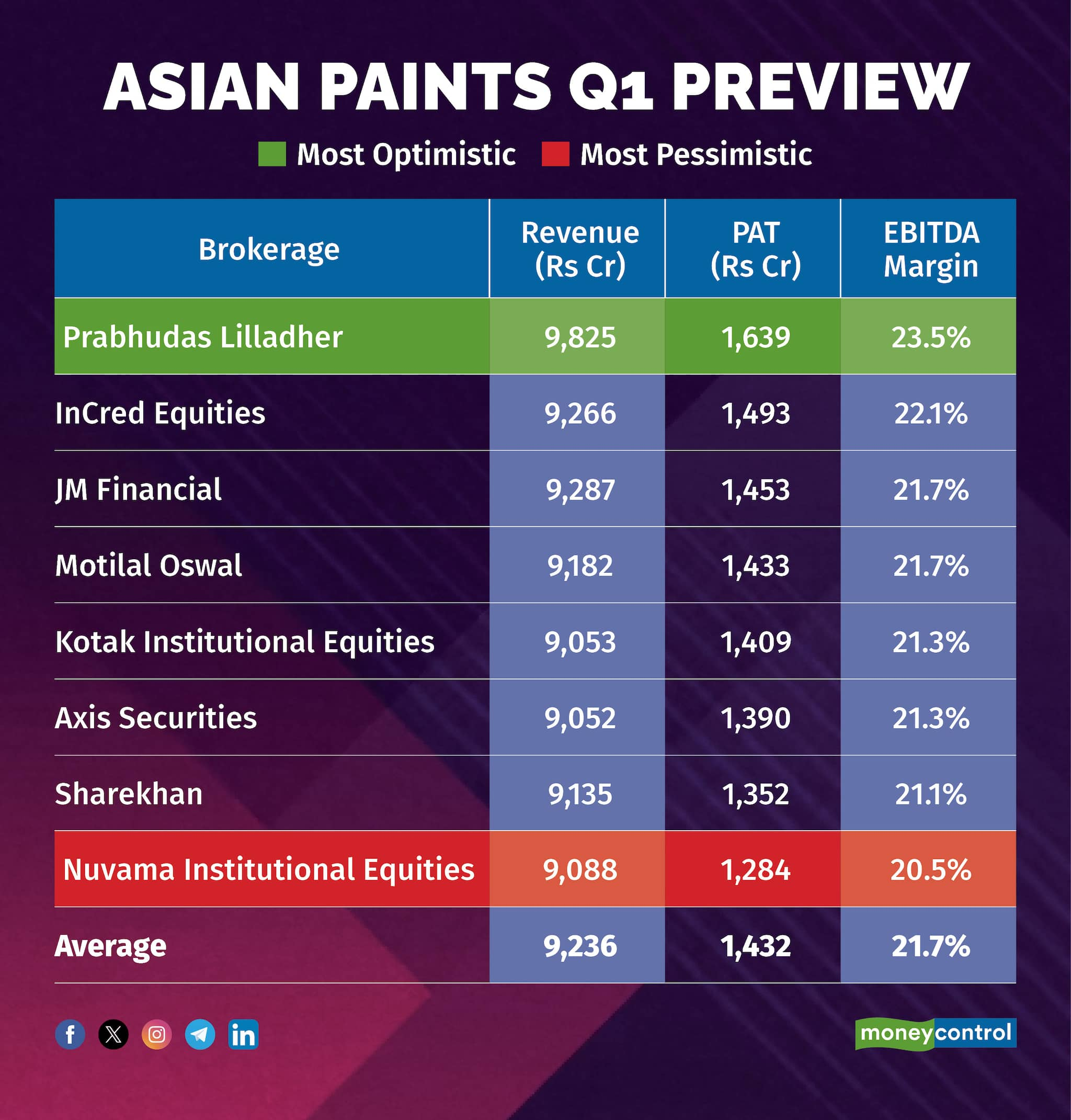

According to a Moneycontrol poll of eight brokerages, Asian Paints is likely to report a flat revenue growth at Rs 9,236 crore for the quarter. However, net profit is likely to fall 7.6 percent on-year to Rs 1,432 crore, down from Rs 1,550 crore from the corresponding quarter last year.

There is a serious divergence in the earnings estimates of different analysts polled by Moneycontrol.

The most optimistic estimate sees Asian Paints' net profit jumping five percent on-year, but the most pessimistic projection suggests that net profit might sink 17 percent.

Prabhudas Lilladher is penciling an optimistic outlook for Asian Paints on stable demand and competitive landscape, amid a benign commodity basket. On the other hand, Nuvama Institutional Equities is pessimistic due to a higher base and lack of operating leverage during the quarter.

Also Read | Nuvama bullish on Asian Paints after price hikes, sees recovery in coming quarters

What factors are driving the earnings?

Asian Paints is anticipated to deliver a subdued performance in Q1FY25, with single-digit on-year volume growth affected by reduced labor availability due to the election, causing delays in painting projects, said StoxBox.

Volume/value growth: The overall demand for Asian Paints was muted in Q1FY25 due to severe heat-waves and election impact, said Nuvama Institutional Equities. The expectations for the paint major’s volume growth are in the high single digits to low double-digits, ranging from six to 11 percent. However, the value growth will be impacted due to a weak mix and price cuts.

Election impact: The Lok Sabha elections would have an impact on the topline, as there was a shortage of painters in the quarter gone-by. Painters were not easily available, as they were participating in election rallies, said Nuvama.

RM prices: According to brokerages, the largely stable raw material prices would aid a ~ 60 bps on-year expansion in gross margin. However, this is offset by higher employee expenses and advertising spends.

What to look out for in the quarterly show?

Analysts will be keeping a close eye on the demand outlook in metros and tier-3 towns. The raw material prices and their impact on margins will also be watched, along with increasing competitive intensity.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.