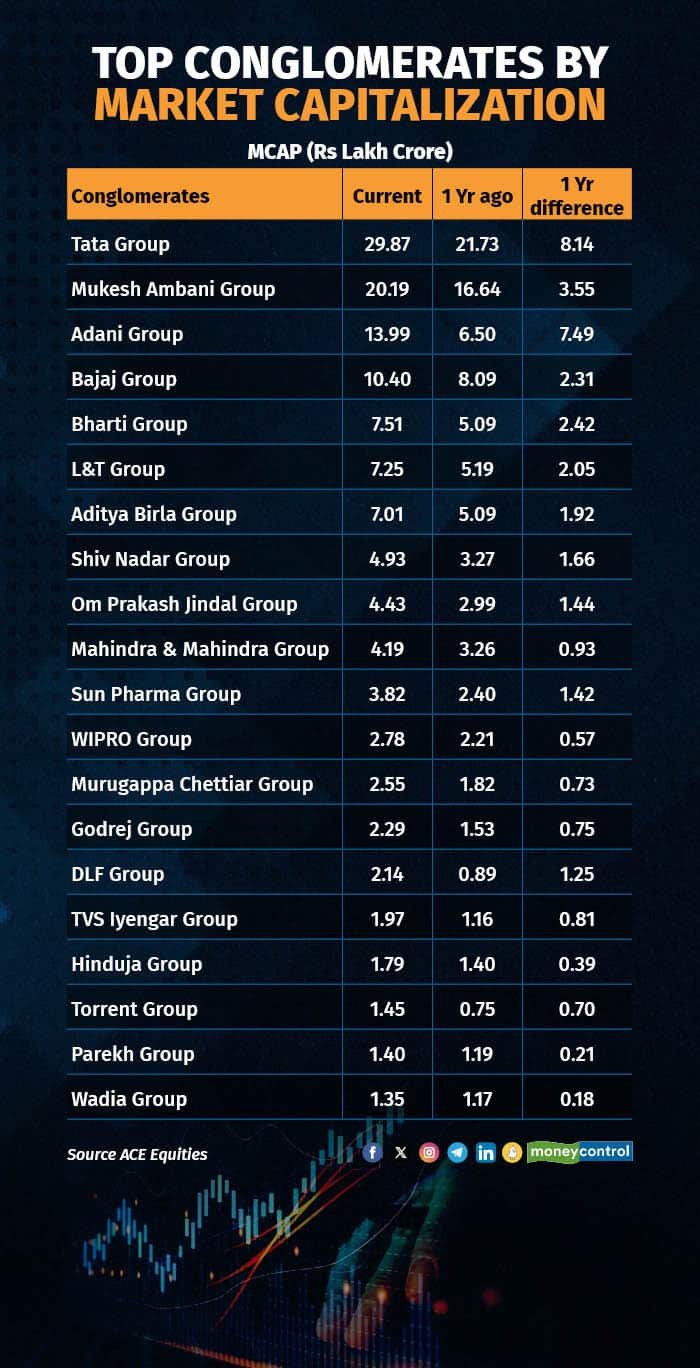

The Aditya Birla Group, with seven listed firms in its fold, added around Rs 1.91 lakh crore in market capitalisation in the last year. In terms of market capitalisation, it currently ranks as the seventh largest conglomerate in the country.

Hindalco, the second largest company in the group is the news because of its subsidiary Novelis filing for an initial public offering in the US. Hindalco, is on a path to recovery, with global growth looking up, spelling good news for its overseas subsidiary Novelis, although the latter’s capex guidance has met with resistance from the street.

The cement business has been the crown jewel of the group and continued to lead the show. Notwithstanding, the entry of a large corporate group, the stock did well thanks to buoyant demand coming from post-COVID recovery, boosted by government spending and housing revival. Operating margins also got a boost from benign input prices. While demand revival might pause due to upcoming elections, the long-term trajectory remains strong and Ultratech’s pan-India operations and efficiency should stand in good stead.

Vodafone, which has been facing business challenges with steady erosion in its customer base, got a sentiment boost with recent news reports suggesting a potential equity infusion by the promoters.

Aditya Birla Fashion hasn’t had the best of times owing to twin challenges of subdued urban sentiment and the task of improving the profitability of its numerous acquisitions. Aditya Birla Capital, in contrast, has had a strong show with the business growth accelerating under the new CEO. However, given the cautious sentiment towards unsecured lending, growth in the financing business could moderate.

Overall, the Aditya Birla Group has been a steady performer with its cement business stealing the show. Its underperformance relative to some notable conglomerates in the past year might have been due to multiple winners in other groups that made the most of a raging bull market.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.