WestBridge-backed education technology firm PhysicsWallah Ltd has propelled both its founders, Alakh Pandey and Prateek Boob, into the billionaire ranks following the announcement of its initial public offering price band at Rs 103–109 per share. At the upper end, the company is valued at Rs 31,170 crore.

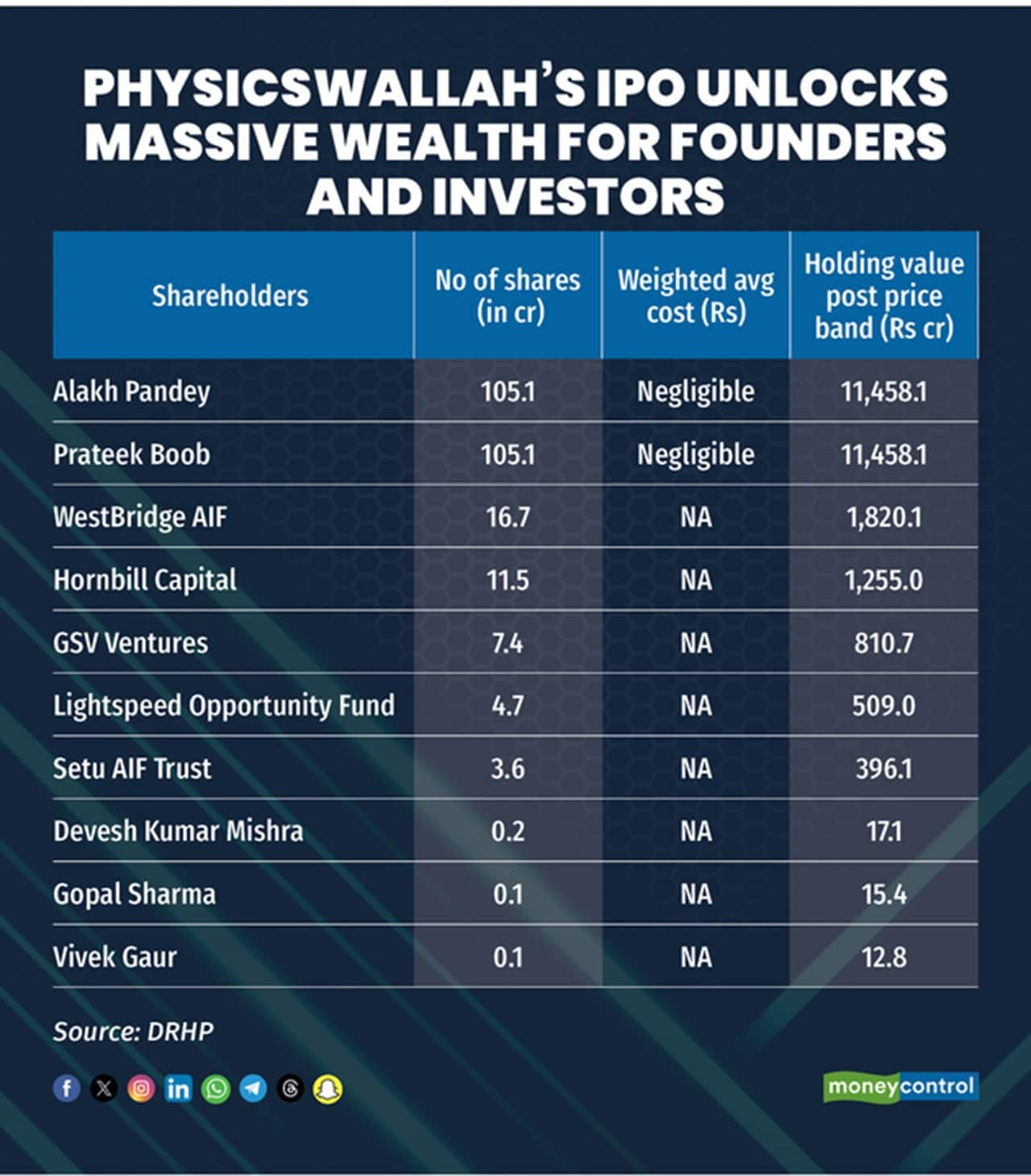

Pandey and Boob each hold 105.12 crore shares, translating to a 40.31 percent stake apiece in the company. At the top price band, their individual stakes are valued at Rs 11,458 crore, or about $1.29 billion each. According to the draft red herring prospectus (DRHP), their acquisition cost for these shares is negligible.

In March 2025, PhysicsWallah issued a 35:1 bonus share allotment to its shareholders. Prior to the bonus, as of June 2024, both founders held 3 crore shares each, representing a 50 percent stake in the company.

Pandey, the company’s chief executive officer and whole-time director, is known for his unconventional journey. Despite not holding a formal higher education degree—having completed higher secondary education from Bishop Johnson Education School and College, Prayagraj—he has amassed over five years of experience in the education technology sector.

Boob, also a whole-time director, joined PhysicsWallah on July 1, 2020, and leads its strategy and innovation initiatives. A mechanical engineering graduate from the Indian Institute of Technology (BHU), Varanasi, Boob previously worked with Caterpillar India Pvt Ltd and brings over a decade of edtech experience.

Among institutional investors, WestBridge AIF holds 16.8 crore shares or 6.4 percent stake, valued at Rs 1,820 crore. Hornbill Capital Partners owns 11.52 crore shares or 4.41 percent, valued at Rs 1,255 crore, while Lightspeed Opportunity Fund’s 4.66 crore shares are worth Rs 509 crore. Setu AIF Trust holds 3.64 crore shares, valued at Rs 396 crore. The DRHP does not disclose the weighted average acquisition cost for these investors.

The Noida-based online education platform plans to raise Rs 3,100 crore through a fresh issue and Rs 380 crore via an offer for sale. The IPO will open for subscription on November 11 and close on November 13, with the anchor book opening on November 10.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!