Ruchi Agrawal Moneycontrol Research

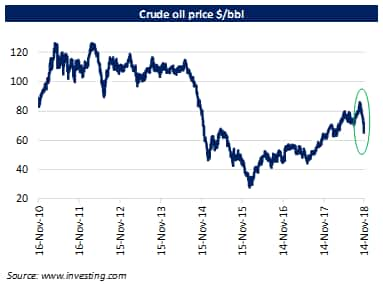

After shooting past their four-year highs, crude oil prices have seen a steep plunge in the last six weeks, wiping out the year's gains and dipping below its level in December 2017.

Though US President Donald Trump is thumping his chest and taking credit for this correction, there seems a number of global developments that have contributed to it.

Indication of a future rise, or rather a glut in crude oil supply, coupled with an outlook of a slowdown in demand, was the major factor behind prices easing.

This later intensified as banks rushed to cover their hedging exposure. While prices seem to be in a downward trajectory for now, a rebound cannot be ruled out and the turmoil is expected to continue until the market finds an equilibrium.

Slowing demand growth

A few weeks ago, there were growing concerns over shortage of supply in the crude oil market because of the sanctions imposed by US on Iran, and internal constraints in major oil producing nations holding back production.

This led to a steep rise in crude prices, with Brent crude touching a four-year high of $86 per barrel in early October.

For many developing countries, higher crude oil prices across the globe have coincided with sharp depreciation of their currencies against the US dollar. This that their cost of oil, which is dollar-denominated, shot up.

In October, the IMF lowered its forecast for global economic growth. OPEC and the International Energy Agency came out with a bearish outlook on oil demand, projecting that oil consumption would grow less than previously forecast, and pointing to signs of slowing global economic growth due to trade tensions, rising interest rates and substantial weakness in emerging market currencies.

Weak economic data from China reinforced this belief, which in turn created a ripple in the market. With expectations of a slowdown in economic growth in major oil consuming nations, the outlook for oil demand seemed bearish and led to the initial easing in the oil prices.

Rising Supply

After US' announcement of sanctions on Iran, Saudi Arabia and Russia both rapidly increased their oil output in a bid to capture the lost Iranian barrels. Although they were bound by capacity constraints, US shale producers were also producing at max capacities to capture the benefit of the high prices. Latest US oil inventory data showed a noticeable uptick in the October inventory levels.

While on the one hand production was rising, as the November 4 deadline drew nearer, US announced waivers for oil imports from Iran for India, China and six other nations who totally account for 75 percent of Iranian oil exports. This gave indications of a possible future supply glut, which further weakened prices.

Delta hedging by banks

In order to protect themselves from a fall in oil prices, major oil producers hedge their exposure and buy put options at low prices. With prices in a downward trajectory, and indications of further correction, banks that had written put options for oil producers suddenly found the delta shrinking as spot prices moved closer to strike prices.

To avoid a situation in which these option contracts are exercised, and in order to avoid the liability of large payments later, there was substantial selling in these options. This further intensified the fall, with prices plunging sharply within a few hours.

Outlook on US waiving sanctions

The 180 days waiver on the ban on importing oil from Iran granted by US seems to be a bridging mechanism. Oil prices remaining low had resulted in many oil producers in US going out of business over the past few years. The uptick in crude prices made shale production viable again and US shale oil producers have been investing in increasing production ever since.

However, there is a time lag between this investment and production capacities coming back, which seen coming only in mid-2019. That's when US' dependence on crude import would go down. Until then, waivers on sanctions seem like a bridging attempt by Trump to cool off prices.

What it means for India

Current account balance – India imports nearly 80 percent of its oil requirement and a dip in prices brings down the import bill and helps in narrowing the current account deficit.

Retail prices and margins – Reduction in crude prices directly helps bring down the prices of petrol and diesel in the domestic retail market, thereby giving some much-needed relief to consumers. With oil being an input for many industries, a fall in oil prices means lower input costs for companies, and by extension, better margins.

Inflation – Lower fuel prices mean lower transportation, packaging and other input costs which leads to lower food and commodity prices. All this together leads to easing in retail prices and lower inflation.

Oil companies - It comes as a breather for oil marketing companies that have seen their margins come under pressure of late. It also gives relief to oil producers that were expected to share the subsidy burden. However, this also means bad news for exporters of oil products.

Nifty – While fundamentally the high price of crude eats away a portion of the profitability of listed companies and should mean a negative correlation, they do not always move in tandem. A steep fall in crude prices has a negative impact on foreign investment inflows, which negates the impact.

Outlook

A plethora of factors like changing geopolitical stance, growing trade wars, bottlenecks in production capacities, piling inventories, sluggish demand and economic growth outlook are currently impacting crude prices. While OPEC and its allies are trying hard to sustain higher crude prices, with Saudi Arabia announcing a cut in production by 50,000 barrels a day from December, numerous contiguous factors will determine the future course.

We believe that very high or very low crude prices are not sustainable in the long run as they impact the number of producers on board the supply ship. However, we expect the current volatility to continue in the short term till the market finds an equilibrium.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.