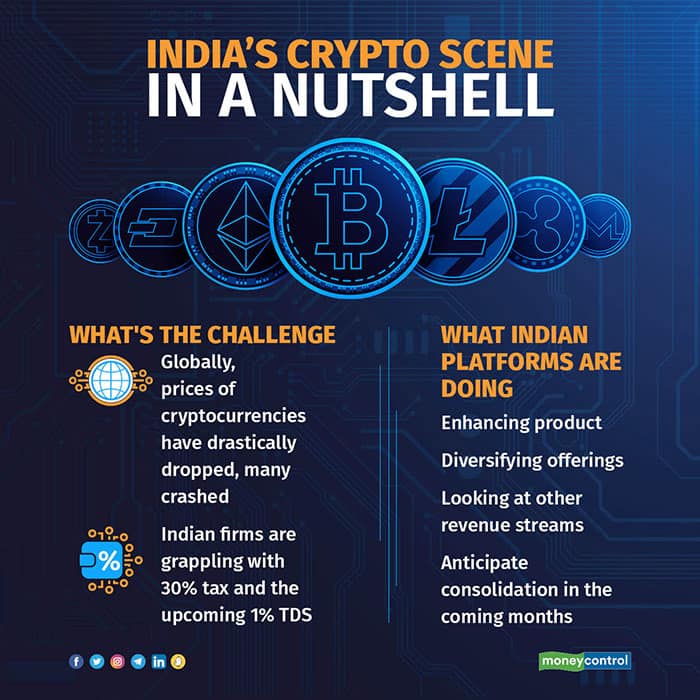

On Saturday, Bitcoin's price dropped upto $18,000 while Ethereum dropped below $1,000. Further, a 90 percent drop in volumes since March has raised questions about survival, especially for smaller players. But, Indian crypto players are not jumping the gun when it comes to making any business decisions. The market crash has given them an opportunity to rethink spends and hold on tight as the crypto winter looks to be far from over.

Meanwhile, international exchanges are feeling the pinch with volumes dropping amid falling prices of tokens, led by Bitcoin and Ethereum. Coinbase, the third-largest crypto exchange, has laid off 18 percent of its workforce. Many other exchanges have had to resort to the same move. But, Binance and Kraken have said that they will continue to hire more people despite the slowdown.

In India, while there may not be layoffs immediately, companies are likely to cut down on branding spends and cash burn. Over the past year, the acquisition spend per customer for many exchanges was in the range of Rs 500 to over Rs 1,000. While overall advertising has slowed down owing to the crash, per customer costs have not come down drastically yet.

“Currently, the best approach is to be conservative. There will be lesser spends on branding and more on performance-driven activities going forward,” said a fintech-crypto executive.

Sathvik Vishwanath, founder and CEO of crypto exchange Unocoin, said, “There may not be a significant reduction in cost per customer yet. But it is just that in a bear market you won’t get many customers even if you try.”“So platforms may not go overboard to spend on getting customers,” he added.

Meanwhile, crypto firms like CoinDCX, Coinswitch, and Giottus also said that they are working on their products to bridge the gap with international products.Speaking to Moneycontrol, Parth Chaturvedi, Crypto Ecosystem Lead of CoinSwitch said that they are doubling down on investments in education and product features. CoinSwitch will continue to build through the bear market and continue hiring.

CoinSwitch plans to expand into non-crypto products in FY2023.

“While we are building an array of crypto specific products and services including CRE8, India’s first rupee denominated index for crypto, we are in advanced stages to launch our first non-crypto product.”

On the other hand, a CoinDCX spokesperson said, “While we are not looking at cost cutting, we are definitely looking to optimise. Due to the current macro conditions, cost of capital has increased and we need to increase efficiency.”

He added that the unicorn is currently investing in new products that will help with better opportunities post TDS.

Both firms have also started investing seed amounts in crypto and Web3 ventures. While CoinDCX announced its venture arm last month, CoinSwitch is yet to launch it formally. CoinDCX has created a fund of Rs 100 crore, which has been dedicated to this initiative. It will be deployed in the next 12 months.

Further, in an interaction with Moneycontrol, CoinDCX had said that they will be expanding to international markets but did not specify a timeline.WazirX and Zebpay have already established themselves in international markers.

Experts tracking the space have reiterated that the industry will see consolidation in the coming months.

“The smaller ones unfortunately need to fold up altogether. Start-ups at the ideation stage will move to do something different. Those who had scaled up may find it difficult because they may not find investors and may not have cash to continue. That is when the panic will set in and we may see some movements on acquisitions,” added the lawyer.

“We are watching the situation with caution. The tornado is lurking on the shores but has not hit yet,” said a crypto exchange executive.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.