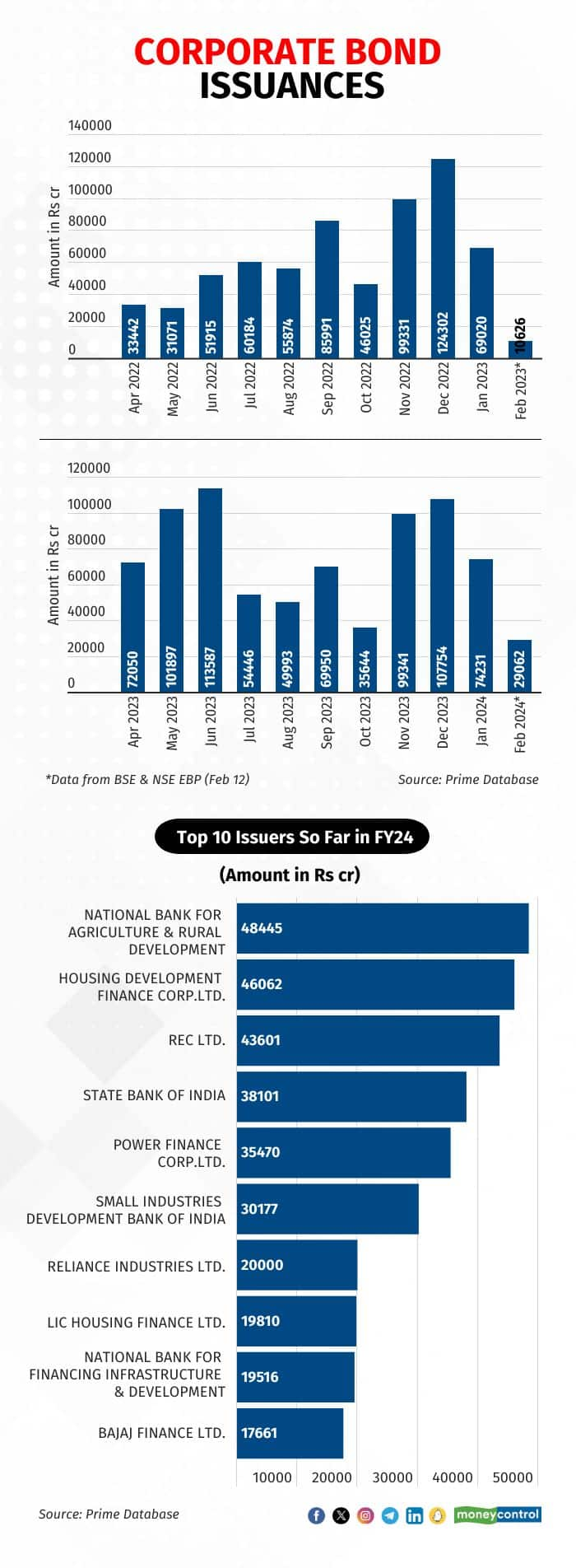

Fundraising through corporate bonds so far in the current financial year has risen 21 percent on year to Rs 8.08 lakh crore, data compiled from Prime database showed. Experts attributed this to the stability in the yield in the last few months and increased demand from domestic as well as overseas investors.

Additionally, the increased cost of funds for borrowings from banks also contributed to the surge in corporate bond issuance, experts said.

Companies and banks have raised Rs 8.08 lakh crore so far this fiscal year through corporate bonds, as compared to Rs 6.68 lakh crore in the same period of the previous fiscal year, according to data compiled from the Prime database, NSE and BSE electronic bidding platforms.

“The combination of favorable interest rates, investor demand, strategic financial planning, and market confidence has contributed to the growth in India's corporate bond issuances,” said Venkatakrishnan Srinivasan, founder and managing partner of Rockfort Fincap LLP.

Adding to this, Ajay Manglunia, managing director and head of the investment group at JM Financial, said the increased cost of bank borrowings has also contributed to a surge in issuances.

Adani Green Energy likely to tap dollar bond market in March: Sources

Numbers

So far this financial year, the National Bank for Agriculture & Rural Development (NABARD), Housing Development Finance Corp, REC, State Bank of India and Power Finance Corp are the top five issuers in the corporate bond market.

These companies and banks have together raised Rs 2.12 lakh crore through bonds so far this financial year accounting for around 25 percent of the total issuances so far.

Adding to this, the Small Industries Development Bank of India (SIDBI), Reliance Industries, LIC Housing Finance, National Bank for Financing Infrastructure and Development, and Bajaj Finance were other top issuers of corporate bonds.

Experts said that large issuances by these entities could be attributed to the overall increase in bond issuances.

Manglunia said corporates now find themselves needing to achieve their target of meeting capital market fundraising through debt instruments.

“We have seen NBFCs rushing to borrow on the back of increased demand for capital after the RBI decides to increase risk weights on unsecured lending,” said Mataprasad Pandey, Vice President, Arete Capital Service.

Most of the top 10 issuers are NBFCs. The RBI on November 16 said that it has increased the risk weight on consumer credit exposure of commercial banks and NBFCs by 25 percent.

Increased demand

In the last few months, demand from foreign investors as well as long-term domestic investors has increased after the announcement that Indian bonds would be included in the JP Morgan bond index. Demand has increased for both corporate bonds and government securities, experts said.

Last year, JP Morgan Chase & Co said it would add Indian government bonds to the JPMorgan Government Bond Index-Emerging Markets starting June 28, 2024.

Since this announcement, flows of foreign portfolio investors have increased substantially. As per NSDL data, so far this fiscal year, net investment by FPIs in debt stood at Rs 1,00,160 crore. Similarly, investment in Fully Accessible Route (FAR) securities by FPIs has also increased.

In the previous financial year, most issuers refrained from tapping the bond market due to continuous rate hikes by the Reserve Bank of India (RBI). The central bank had cumulatively hiked rates by 250 basis points (Bps) since May 2022, before hitting a pause in April 2023.

One basis point is one-hundredth of a percentage point.

Since April 2023, the central bank has kept the repo rate unchanged and remained cautious about inflation numbers.

Bloomberg advisory panel backs entry of Indian bonds in EM Index

Yield movement

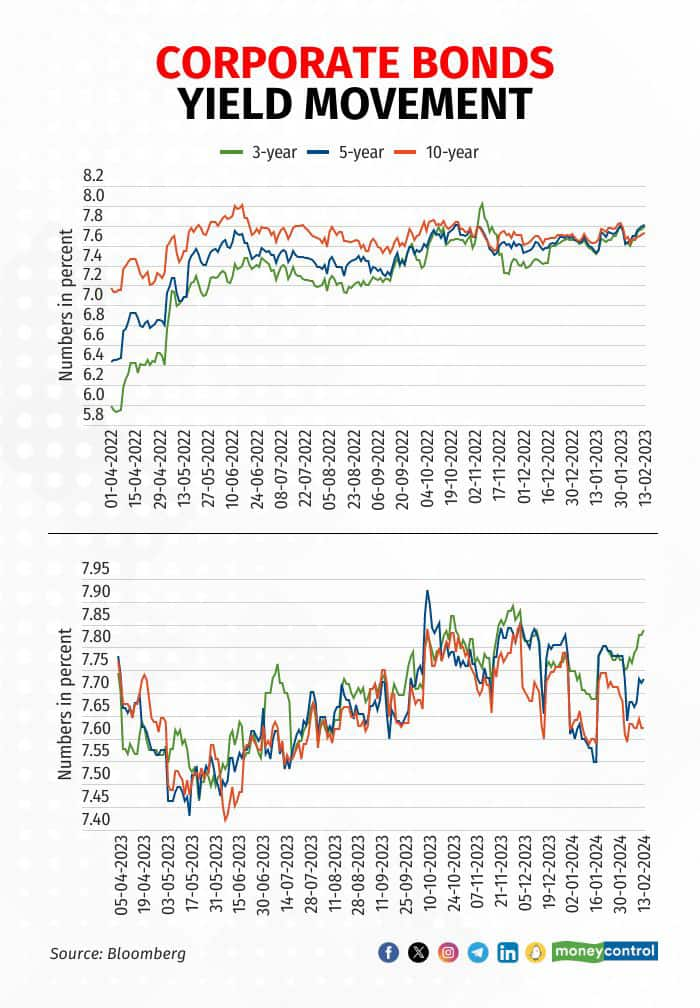

So far this financial year, yields on corporate bonds across maturities have remained stable. However, shorter-tenure securities remained on the higher side.

On this, Srinivasan said shorter-term bonds, such as three-year and five-year bonds, are more sensitive to changes in market conditions and monetary policy compared to longer-term bonds like 10-year bonds.

Further, treasury heads said this is also because of higher deficit liquidity in the banking system.

The yield on corporate bonds maturing in three years remained in the range of 7.45-790 percent, while the five-year bond yield was in the range of 7.40-7.85 percent and 10-year between 7.45 percent and 7.80 percent.

The yield on longer-tenure securities remained lower, tracking the fall in the yield on government securities after the inclusion announcement and demand from pension funds and the EPFO, experts said.

Going ahead, money market experts expect yields to be on a downward trajectory anticipating lower borrowing by the government in the next financial year, inflows after the JP Morgan bond index inclusion and sustained demand from domestic investors.

Additionally, they said issuances are also likely to pick up next financial year due to an expected rate cut by the RBI.

Srinivasan said the expected Repo rate cuts by the RBI during the year are likely to result in lower borrowing costs for corporates, making it more attractive for companies to raise funds through bond issuances.

“I see issuances in the next fiscal going up as bond yields are expected to come down in the next fiscal as we may expect rate cuts in the next fiscal as inflation will come down gradually within the RBI's comfort zone,” said Pandey from Arete Capital Service.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.