Krishna KarwaMoneycontrol Research

Within the textile sector, the trade is now shifting towards the innerwear companies as outerwear companies’ growth and margins have been facing the brunt of competition, with new domestic and international players crowding the market.

To put things in perspective, domestic fabric manufacturers like Siyaram, KPR Mill, Arvind and many others, who were pure fabric players for a long time, have moved up the value chain by manufacturing garments to improve their margin profile. In stark contrast, over the last ten years, there is literally no new entrant in the innerwear industry, which, in fact, seems to be consolidating.

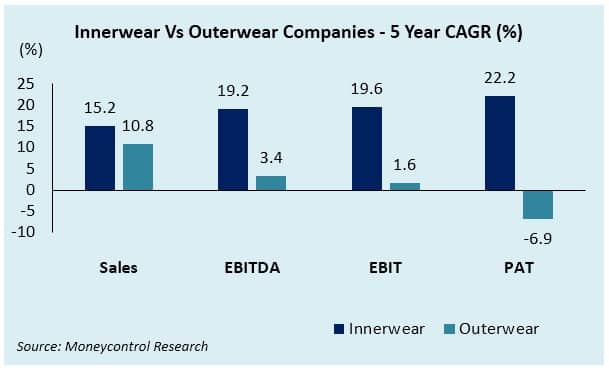

Consequently, over the past five fiscals, branded innerwear companies cumulatively reported 15.2/22 percent CAGR in sales/net profits, respectively. Apparently, this performance is far superior compared to branded outerwear companies, that, from a cumulative standpoint, delivered only 11 percent CAGR in sales, besides reporting a 7 percent decline in profits.

What is alarming is that during this period, on an aggregate basis, the return on capital reduced by 290 bps in case of outerwear companies, as opposed to a 570 bps increase witnessed in case of innerwear companies.

Can innerwear companies deliver growth sustainably?

Building durable advantage

Ideally, the innerwear industry should be a slow-growing one, considering the limited scope for penetration. However, what appears to be changing is the business strategy chosen by branded innerwear companies.

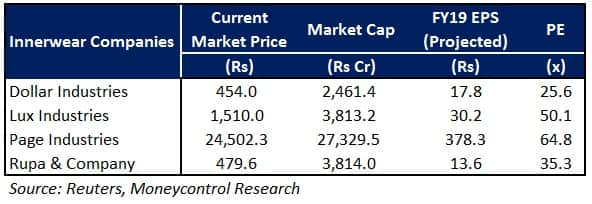

Today, the four large domestic innerwear companies (Dollar, Lux, Rupa, VIP Clothing) have a total market capitalisation of Rs 10,675.2 crore, which is about one third of the market cap of Page Industries (which stands at Rs 27,329.5 crore). The latter has successfully demonstrated the growth and profitability model in the Indian context.

Taking cues from this, domestic innerwear companies, that were pretty passive for a long time, have been cashing in on the opportunity with the right set of strategies in the past few years.

Revenue mix of innerwear companies seems to be moving in favour of product premiumisation. For instance, Page Industries’ Jockey products command an average realisation of close to Rs 145 per piece vis-à-vis the products sold by Dollar Industries, the realisation for which is in the average range of Rs 50-60 per piece.

Nevertheless, companies like Dollar have been working extensively on branding their products to fetch better realisations. For example, its premium category brands like Big Boss, with an average realisation of Rs 130 per piece, currently accounts for close to 44 percent of its turnover. Secondly, the company’s share of high-value products that stood at less than 50 percent prior to FY10, now comprises roughly 65 percent of the annual top-line.

Improving profitability

Apparently, with the increasing contribution from premium products, innerwear companies have been able to earn better margins and higher profits.

Lux has seen its EBITDA margins consistently scaling up from merely 4.3 percent in FY11 to 12.3 percent in FY17 on the back of emphasis on premiumisation. Its high-value brands like ONN (men’s innerwear) and Lyra (women category) are more margin-accretive (16-17 percent operating margin) than economy products like Lux (8 percent operating margin).

Most of the companies are achieving this objective because of aggressive spending on marketing and promotion. For instance, to create brand awareness for its premium product offerings, Dollar signed up with Akshay Kumar in 2010, whereas Lux signed Varun Dhawan earlier this year.

On similar lines, Rupa chose Ranveer Singh in 2015 to endorse its high-value fashion brands such as Frontline and Euro, the realisations for which are in the range of Rs 145-200 per piece on Amazon, versus realisations of Rs 80-90 per piece for economy products like Macroman. Furthermore, the company’s spends on advertisements increased from approximately Rs 63 crore in FY13 (7.5 percent of sales) to over Rs 105 crore in FY17 (9.6 percent of sales).

Apart from realisations, one important trend worth noting is that innerwear companies are extending their product offerings to cater to a wider customer base in a bid to leverage their manufacturing and distribution capabilities optimally.

For example, Rupa, in addition to its existing brand license for FCUK, entered into partnerships to sell innerwear products of foreign brands such as ‘Fruit of the Loom Inc’ and ‘Bumchums’ in India. The company created a niche for itself in new segments such as socks (through the ‘Footline’ brand), leggings (through the ‘Softline’ brand, by signing up with Bipasha Basu), and winter wear (through its ‘Thermacot’ brand)

Product diversification and foray into high-value product retailing is the ongoing trend across India’s innerwear industry, thereby enabling the branded businesses to boost their operating margins and asset turnover ratios, two of the biggest drivers of earnings growth.

Grabbing a larger share

Right business strategies in the right industry environment could fuel growth further since a large part of the industry is still dominated by unorganised players. The FY17 combined revenue of the five listed innerwear companies amounted to Rs 5,323 crore, which is roughly 18 percent of India’s total innerwear market size (approximately Rs 30,000 crore). Industry estimates suggest that domestic innerwear may grow to Rs 68,270 crore by the end of FY24.

The transition of business processes from unorganised entities to the organised ones is another noteworthy characteristic that India’s innerwear industry has been witnessing of late. As per a Wazir (one of the leading textile consultants in the country) report, this shift is likely to accelerate in due course, as seen in the exhibit below:-

What seems to be driving this change is increasing the presence of organised retail and e-commerce, product innovation, growing awareness about hygiene, and higher disposable income levels (particularly in the mass segments like middle class).

While these growth drivers work in favour of the outerwear industry as well, innerwear companies could continue to deliver healthy growth given the series of proactive measures taken by them and a few tailwinds that work in their favour. The biggest blessing for the innerwear industry is the consumer stickiness for certain brands and limited competition (due to an oligopolistic nature of the market and technological expertise needed to manufacture innerwear products), which prevents new players from entering this space easily.

For outerwear companies, there is virtually no entry barrier and new entrants flooding the market has become the order of the day. It is an industry running on discounts with very few takers for brands.

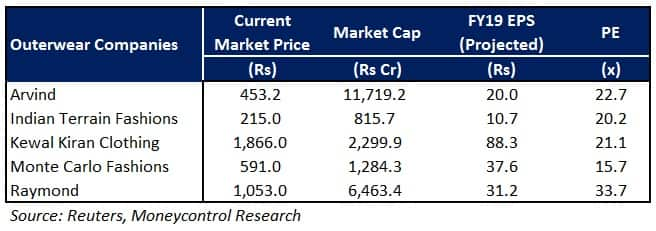

Unsurprisingly, the positives stated above are reflected in the higher valuation multiples for innerwear companies (compared to their outerwear counterparts), as seen in the exhibits below:-

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!