By Anindya Banerjee, Head Commodity and Currency Research at Kotak Securities

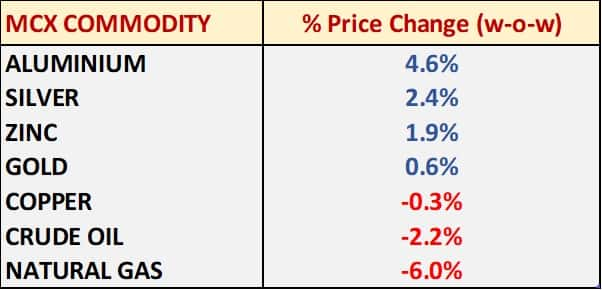

This week (ending August 23), both bullion and industrial commodities on the MCX saw significant macroeconomic influences. Aluminium emerged as the standout performer, driven by a relentless decline in LME inventory and extremely bearish sentiment in the market, largely due to concerns over China. The pervasive bearish outlook was shared widely, even by retail investors.

The highlight of the week was Fed Chair Jerome Powell's speech at the Jackson Hole symposium. In addition, traders closely monitored the US Fed minutes and flash PMIs. US Treasury yields dipped following Powell's signal that a rate cut may commence in September. The market is currently pricing in approximately 33 basis points of cuts for the upcoming September 18 FOMC meeting, with a total of 100 basis points expected by year-end and an additional 125 basis points projected for next year. This outlook seems appropriate given the present economic conditions.

Leading up to the September 18 decision, key data points include the core PCE deflator on August 30, where the market anticipates a 0.2 percent month-on-month increase, based on CPI and PPI inputs. The more critical indicator will be the jobs report on 6 September, especially after Powell’s comment that “we don’t seek or welcome further cooling in labour market conditions.”

In Europe, August's flash PMIs exceeded expectations, providing a positive boost to market sentiment. The resulting risk-on mood, coupled with bearish sentiment in the US Dollar, propelled commodities higher. Silver outpaced gold, benefiting from bullish trends in base metals and a risk-on attitude in global equity markets. Silver, often seen as a bridge between gold and copper, tends to outperform gold when copper is performing well.

Crude oil rebounded from the Rs 6,000 mark (per barrel, with market volatility contracting in a pattern that has persisted since late last year. There is ample supply to cap geopolitical price spikes around Rs 7,000, but sufficient demand exists to prevent a sharp decline below Rs 6,000. Conversely, natural gas faces bearish sentiment.

The Energy Information Administration (EIA) reported a 35 billion cubic feet (Bcf) injection into natural gas storage for the week ending August 16, surpassing market expectations of a 26 Bcf build. This larger-than-expected increase, coupled with the upcoming shoulder season, has fuelled fears of a supply glut, leading to a significant drop in natural gas futures.

Looking ahead to next week, we expect bullish sentiment to persist in bullion, supported by a weak US Dollar and softer US yields. Base metals could also benefit from the positive market outlook. While crude oil may see further gains, natural gas is likely to remain under pressure.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.