Finance Minister Nirmala Sitharaman, in the Interim Budget presentation on February 1, showcased a promising macroeconomic picture for India. The spotlight on key indicators, including the fiscal deficit returning to a positive trajectory, an emphasis on capital expenditure (capex), and a significant uptick in corporate profits, signals a path for the nation's financial outlook.

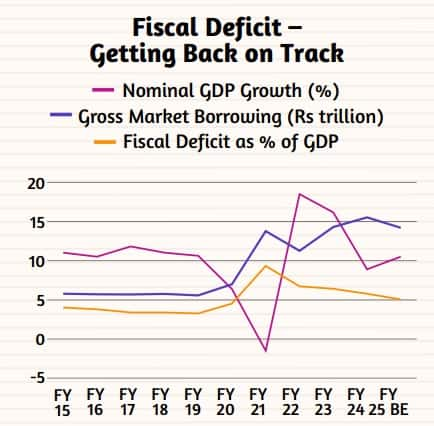

Fiscal deficit in recovery mode

The quantum of fiscal deficit and government borrowing remains notably elevated compared to pre-Covid levels, despite a declining fiscal deficit as a percentage of GDP. This decline in fiscal deficit is attributed to robust economic growth. Sustaining this growth momentum becomes crucial for maintaining fiscal balance in the future. The fiscal deficit target for FY25 was set at 5.1 percent of GDP, a reduction from 5.8 percent in FY24. The government aims to reduce fiscal deficit to below 4.5% by FY26. The government's gross borrowing for FY25 was capped at Rs 14.13 lakh crore, a decrease from Rs 15.43 lakh crore in FY24. While the net market borrowing was pegged at Rs 11.75 lakh crore vs 11.80 lakh crore in FY24, showcasing a disciplined approach to financial management. In percentage terms, the Centre's gross borrowing is 8.4 percent lower than the FY24 figure, while for net borrowing the reduction is a much lower 0.4 percent compared to the current fiscal's figure.

Moneycontrol's Quick Guide to Budget & Markets

Capex takes care of growth

A driving force behind the positive macro picture is the government's emphasis on capital expenditure (capex) as a catalyst for growth. The budget allocates substantial resources to bolster capex, signaling a strategic move to invest in infrastructure, development, and essential sectors. Finance Minister Nirmala Sitharaman proposed a substantial increase in capital expenditure to Rs 11.11 lakh crore for FY25, marking an 11.1 percent YoY growth. The capital expenditure, representing a percentage of GDP, has witnessed substantial growth, increasing from 1.7% in 2014 to 3.4% in 2023-24. This move is aimed at creating a robust foundation for sustained growth.

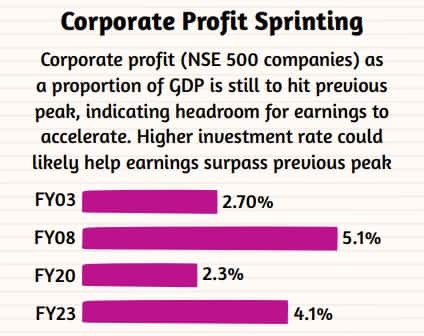

Corporate profits on the rise

There is an uptick in corporate profits. While the corporate profit (NSE 500 companies) as a proportion of GDP has not yet reached its previous peak of 5.1% in FY08, there is significant potential for earnings acceleration. The current levels, at 4.1% in FY23, show headroom for further growth.

Moneycontrol brings you a guide to Budget and Markets, in under two minutes

The Interim Budget doesn't compromise on spending on creation of capital assets that has been a major driver of economic growth. The government's reduced borrowings in the next fiscal year will make more capital available for the private sector as it prepares to ramp up capex, thereby aiding the overall growth process.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.