In a departure from the normal, the finance ministry released a report titled 'The Indian Economy: A Review' just a few days before the Union Budget for 2024-25 is presented in Parliament on February 1.

The report, authored by officials from the office of the Chief Economic Adviser V Anantha Nageswaran, seemingly replaces the Economic Survey that is usually presented ahead of the full Budget. However, writing in the preface of the report released on January 29, Nageswaran asserted that "this is not the Economic Survey of India".

Also Read: No Econ Survey, but Fin Min report says FY25 growth may be near 7%

"That will come before the full budget after the general elections," the government's top economist added.

While the government does not present an Economic Survey prior to an interim Budget, Moneycontrol had reported in November 2023 that the finance ministry would publish a 'concise' document detailing the state of the Indian economy before February 1.

Here, Moneycontrol takes a close look at five key charts from what is likely to be the final statement from the finance ministry before the presentation of the Budget.

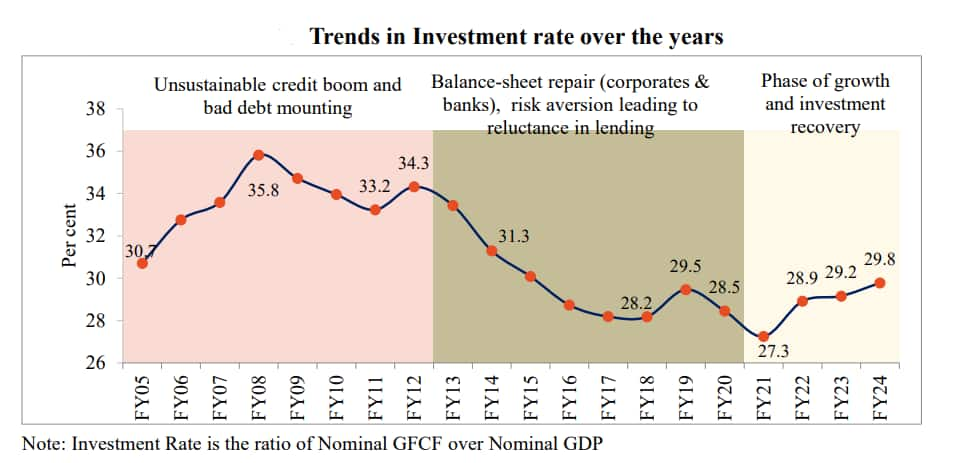

Investments on the riseRaising investments, particularly of the private sector, has been a key focus area for the government. And according to the ministry's report, stronger balance sheets of banks and companies means "growth in investments and credit are poised to increase in this decade".

Source: Ministry of FinanceHousing on the up

Source: Ministry of FinanceHousing on the upThe housing sector is crucial to the growth of the economy given its numerous backward and forward linkages - if the sector does well, so do others such as cement and steel. And according to the finance ministry, housing prices began to recover after the coronavirus pandemic, with the average annual growth in real estate prices increasing from 2.3 percent in 2021-22 to 4.3 percent in the first half of the current financial year.

Source: Ministry of Finance

Source: Ministry of FinanceA reduction in housing inventory, as shown in the above chart, "despite an appreciation in real-estate prices and higher interest rates attests to the strength of the recovery of incomes and optimism about the future", the ministry noted.

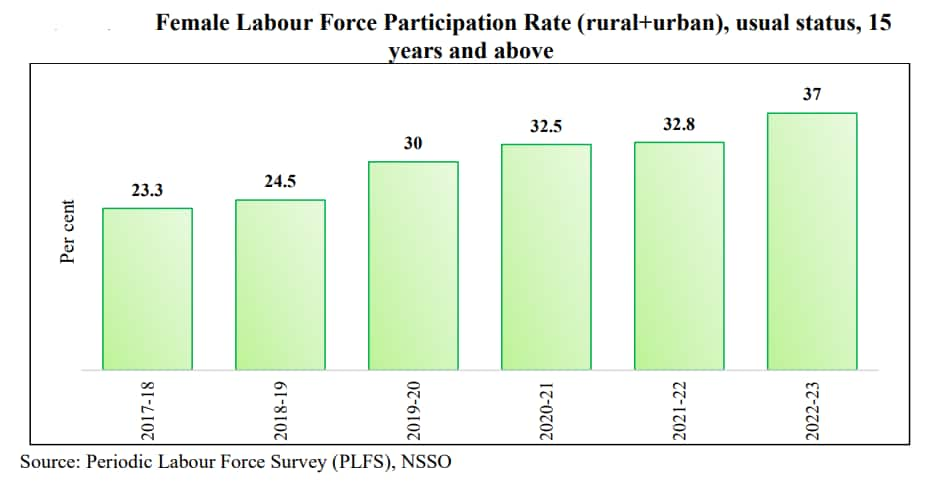

Women on the riseKey to India's future growth is going to be the inclusion of more and more women in the labour force. According to the World Bank, India's pursuit of sustained 8 percent growth to become a developed country by 2047 will not be possible at the current low level of female participation in the workforce.

Source: Ministry of Finance

Source: Ministry of FinanceAs per the finance ministry, the government's various initiatives are already taking effect, with the female labour force participation rate rising to 37 percent in 2022-23 from 23.3 percent in 2017-18, improvement in the sex ratio at birth, and falling maternal mortality rates.

"These underline the tectonic shift towards women-led development in India," the report said.

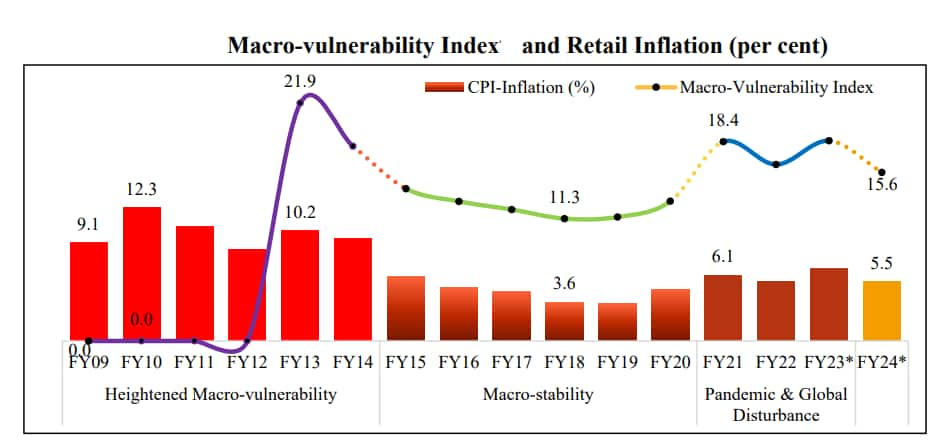

Macroeconomic vulnerabilityEven as reforms and changes on the ground take place, maintaining - and improving - the economy's overall resilience is crucial to ensure investors remain confident. And the finance ministry said the government is "committed to an institutional architecture that fosters macro stability".

Source: Ministry of Finance

Source: Ministry of FinanceConstructing a macro-vulnerability index using the fiscal deficit, current account deficit, and retail inflation numbers, the finance ministry said the economy had progressively become less vulnerable even as buffers were being created for future turbulence.

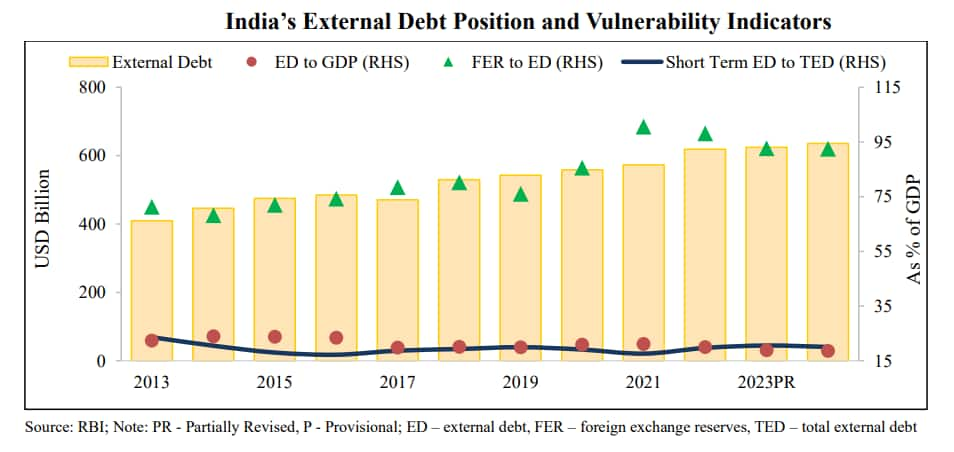

External strengthWhile India's public finances have often been cited as a weakness and inflation can be volatile, the external position is widely regarded as a key strength.

Ministry of Finance

Ministry of FinanceIn terms of external debt, while it has been on the rise in absolute terms, it remains easily serviceable.

"India's external debt...is considered comfortable and has been prudently managed over time," the finance ministry's report said, adding that a large portion of the short-term debt is in the form of short-term trade credits.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.