It’s been long since any significant changes have been made in the income tax rates (old regime) applicable to individual taxpayers, or to the deduction limits under various sections of the Income Tax Act, 1961. This, and more, are what taxpayers and experts expect from Budget 2023.

Moneycontrol spoke to three income tax experts to understand the most important personal taxation proposals that budget 2023 should pick :

Rationalising the income tax rate

In budget 2020, Finance Minister Nirmala Sitharaman had announced a new, optional tax regime with more tax slabs and lower tax rates. Even though she addressed the long-pending demand of lowering rates, the new tax regime has found few takers till date. The reason being that it disallows most of the income tax deductions that the old regime still allows, which makes it a more tax efficient option than the new regime. Therefore, the demand to bring down the tax rate applicable to individual taxpayers still persists. More so, because of the big difference between corporate and individual tax rates.

Also read | What can the finance minister do to make the new income tax regime more attractive?

“Consequent to the reduction of corporate tax rates (from FY 2019-2020), the differential between personal and corporate tax has widened. The highest marginal rate for individuals has now gone up to 42.74 percent, against the corporate tax rate of 25.17 percent,” says Vivek Jalan, Partner, Tax Connect Advisory, a tax consultancy.

Jalan added that India’s highest personal tax rate is exceptionally compared to other countries. For example, the maximum personal income tax rate in Hongkong is 15 percent, Sri Lanka – 18 percent, Bangladesh – 25 percent, and Singapore – 22 percent. Also, the huge gap in tax rates between individual and corporate tax rates is leading to several changes in favour of the corporate model (for example, proprietorship businesses becoming private limited companies).

Therefore, according to Jalan, it has become an urgent necessity to reduce the personal tax rates for individuals so that there is a degree of equity and fairness, as also competition, with other countries. This, says Jalan, can be done by increasing the income tax slabs.

Basic exemption limit and deduction should be raised

For individuals up to the age of 60 years, income up to Rs 2.5 lakh is exempt from tax. For taxpayers between the age of 60-80, and for those above 80, the exemption limit is Rs 3 lakh and Rs 5 lakh, respectively. Many tax experts think this needs to be raised.

Archit Gupta, Founder and CEO of tax and investing platform Clear, points out that it had been nearly a decade since the exemption limit was modified. Instead, the government increased the tax rebate u/s 87A that taxpayers could claim on income below Rs 5 lakhs. A new tax regime was also introduced but was not well received by taxpayers due to its complex structure and limited deductions.

Gupta believes that taxpayers expect relief either in the form of a hike in the basic exemption limit from Rs 2.5 lakh to Rs 5 lakh, or a reduction in tax rates. Taxpayers also expect deductions under Sections 80C and 80D to be enhanced. Certain tweaks are anticipated in the new tax regime allowing taxpayers to enjoy deductions and exemptions on their investments.

More cities for higher HRA exemptions

Last month, BJP MP Tejasvi Surya requested Sitharaman to classify more cities as metros under the income tax rules so that salaried employees from those cities could also claim higher house rent allowance (HRA).

Gupta echoes the demand for increasing the number of cities which qualify for higher HRA exemption. “Taxpayers are eligible for HRA exemption of up to 50 percent of their salary in Delhi, Mumbai, Chennai, and Kolkata. However, this deduction is reduced to 40 percent for other major metropolitan cities such as Bangalore, Ahmedabad, Gurgaon, and Hyderabad. Given the rising rental costs in these cities, it is imperative that HRA exemption be increased to 50 percent for these cities as well,” explained Gupta.

Streamlining capital gains tax

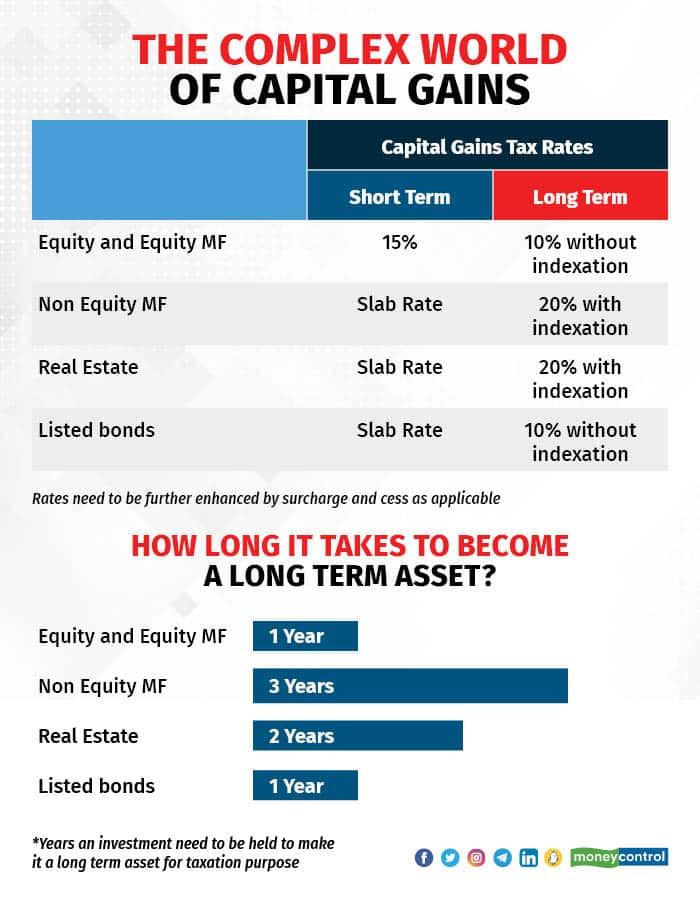

Capital gain tax is another issue that needs rationalisation, as per experts. At present tax rates on capital gains differ depending on the type of capital asset. There is a difference even in the holding periods applicable for short-term and long-term capital gains.

Also read | What the mutual fund industry wants from Budget 2023

Aarti Raote, Partner, Deloitte India, said that an area that warranted attention was ‘capital gains provisions,’ which are complex. “The gains are taxed based on the holding period of assets. However, at present, there are different holding periods for different classes of assets. For example, gains from the sale of equity shares of a listed company are considered long-term if held for more than 12 months, but unlisted shares are required to be held for 24 months in order to qualify for long-term gains,” she said.

Tax rates on capital gains differ depending on the type of capital asset. There is a difference even in the holding periods applicable for short-term and long-term capital gains.

Tax rates on capital gains differ depending on the type of capital asset. There is a difference even in the holding periods applicable for short-term and long-term capital gains.

Similarly, real estate assets are considered long-term if held for more than 24 months, while gold needs to be held for three years to qualify for the same.

“It would help if capital assets were classified simply as equity and non-equity, and the disparity in the holding period and tax rates was reduced,” added Raote.

Simplify the reporting of incomeMany experts believe that in the last few years, income tax return (ITR) forms and processes have become more complex and the same needs to be simplified, especially where income from other countries or foreign assets are concerned. Kuldip Kumar, Personal Tax Expert and Former National Leader, Global Mobility Practice, PwC India, said that, “while reporting foreign income and assets in the ITR form, one needs to report the same in multiple schedules and for different reference periods. This creates confusion and adds to the compliance burden on taxpayers.”

Kumar illustrates the complication with an example. An individual needs to report a particular foreign asset under the Foreign Asset schedule (with details of income accrued during the ``calendar year,’’ i.e., January 1 to December 31), under Assets and Liabilities (with cost of such foreign asset held as on 31 March), and under applicable income schedules like House property, Other Sources, etc., (with details of income computed as per the “financial year”, i.e., April 1 to March 31 of the subsequent year).

Kumar says that suitable changes are needed for streamlining the foreign assets and income reporting in the ITR form, whereby foreign assets are reported only in one particular schedule. Further, a common reference period (such as the accounting year) may also be proposed for reporting such foreign assets, as well as offering foreign income to tax. Legislative changes may be brought in the budget where foreign income is taxed on a calendar year basis rather than on a financial year basis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.