Though the new tax regime, introduced in the 2020 Budget, was promoted as a simpler, user-friendly system, it has not found many takers.

In fact, many, including even influential voices from within the system, are calling for tweaks to the structure. Former revenue secretary Tarun Bajaj recently called for tweaks to the minimal exemptions regime to make it more appealing to taxpayers.

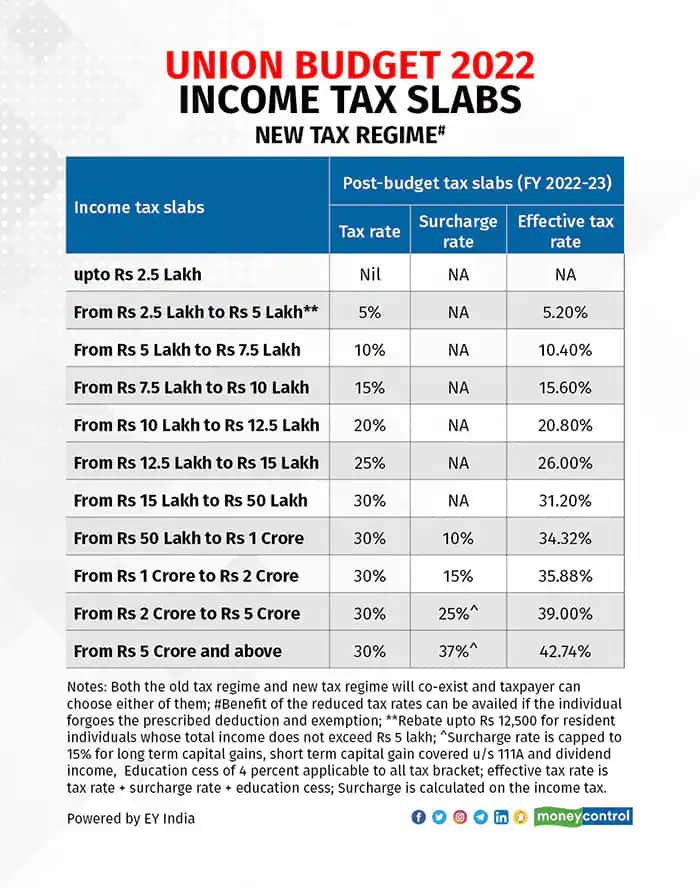

The new regime rationalised tax slabs but there were fewer tax exemptions. It offered lower tax rates but removed nearly 70 exemptions.

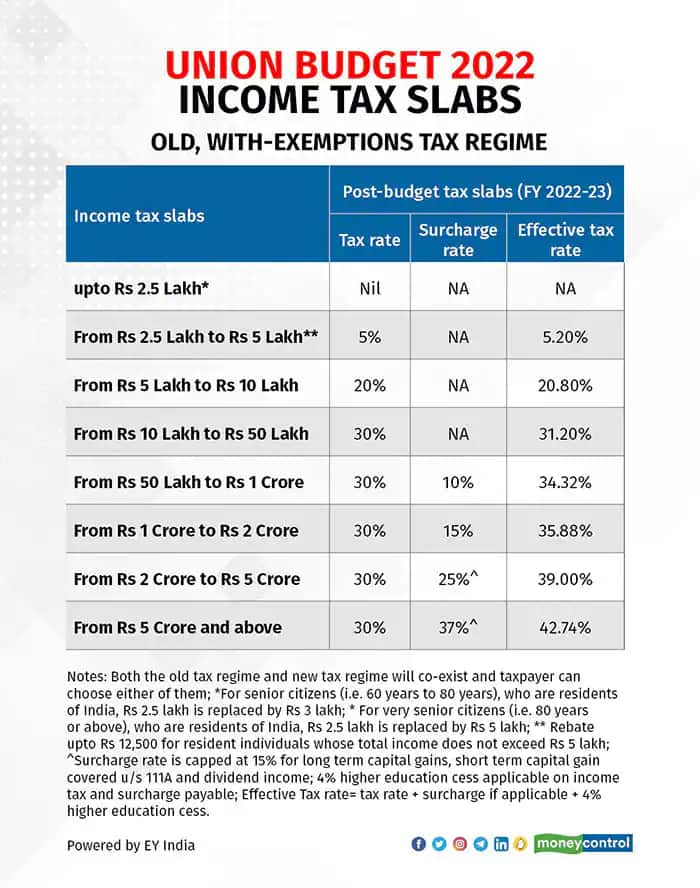

The older tax regime, which offers tax-saver benefits under Section 80C, 80D, 24 and so on, continues to be in force alongside, with taxpayers being allowed the flexibility to choose between the two.

The salaried class has an advantage as they can make a choice every year while filing income-tax returns.

Tax consultants believe that the government ought to consider at least the deductions that are related to routine, necessary expenses under the new regime.

Also read | Changing the rules to an exemption-free income tax regime would be a bad policy: Montek Singh Ahluwalia

Increase the basic exemption limit to Rs 5 lakh

The basic exemption limit – income up to which no tax is payable – is Rs 2.5 lakh under both regimes for taxpayers below 60 years of age. However, the government offers a rebate under Section 87A of the Income-Tax Act, 1961, to individuals whose income is below Rs 5 lakh. That means, effectively, they do not have to pay any tax.

“Further, individuals opting for the old tax regime have the option to claim exemptions or deductions up to Rs 1.5 lakh per annum under Section 80C. Hence, effectively the gross income on which no tax is payable is much higher under the old tax regime,” points out Parizad Sirwalla, Partner and Head, Global Mobility Services, KPMG India.

Therefore, there is no incentive for those who are claiming tax benefits of at least Rs 2.5 lakh to move to the new regime.

“The basic exemption limit of Rs 2.5 lakh could be enhanced to Rs 5 lakh in order to make the new tax regime preferable to the old tax regime,” says Sudhakar Sethuraman, Partner, Deloitte India.

Also read | Why the new income tax regime has few takers

Lower tax rates, relax tax slabs further

The maximum tax rate of 30 percent should also be reduced to 25 percent to sweeten the deal, say experts.

“Fixing the maximum tax rate at 25 percent will position India in line with some of the neighbouring countries. For example, Hong Kong has a 17 percent tax rate for individuals while Singapore has 22 percent. This will also make it easier to attract global talents into India,” says Sethuraman.

Tax slabs, too, can be rejigged to make it taxpayer-friendly. “Currently, individual(s) having a total income of more than Rs 15 lakh are liable to be taxed at the rate of 30 percent. The slabs under the new regime could be stretched to Rs 20 lakh to make it more beneficial,” says Sandeep Sehgal, Partner, Tax, AKM Global, a tax and consulting firm.

HRA and housing loan deductions

A house is a coveted asset for most Indians. The existing regime offers tax relief on home loan principal repaid (up to Rs 1.5 lakh) and interest paid (up to Rs 2 lakh) under Sections 80C and 24, respectively.

Also, taxpayers who live in rented accommodation can claim exemption on house rent allowance (HRA) that they receive from their employers.

However, the new regime offers no such concessions. “The government could consider allowing HRA exemption and Section 80C deduction in the new tax regime. Rental payment and contributions to various investment options that are eligible for Section 80C deduction are invariably incurred by numerous individual taxpayers,” says Sethuraman.

Deduction on housing loan interest is another benefit that can be considered, say tax experts. “Many individuals have opted for purchase of house property and those who have taken housing loans are incurring interest costs on their newly-owned properties. Thus, if the new tax regime also allows individuals to set off such interest losses against salary income, they will be incentivised to opt for the new regime,” says Suresh Surana, Founder, RSM India.

Also read | Income-tax deductions on home loans made easy

Deductions on health insurance premiums paid

The existing with-exemptions regime offers a host of tax breaks to those who buy health insurance policies. If you are below 60, you can claim deductions of up to Rs 25,000 under Section 80D on health insurance premiums paid.

In addition, if you pay premiums for your senior citizen parents’ policies or are a senior citizen yourself, you are eligible for a tax deduction of up to Rs 50,000.

However, the new regime does not offer this benefit. “Given the priority to health in the wake of COVID-19 and even otherwise, individuals continue to avail insurance for themselves and their families by paying medical insurance premium. Also, there is an absence of a universal affordable healthcare facility across the country. Hence, the government may consider allowing the deduction for medical insurance policy for self and family even under the new, optional tax regime,” says Sirwalla.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!