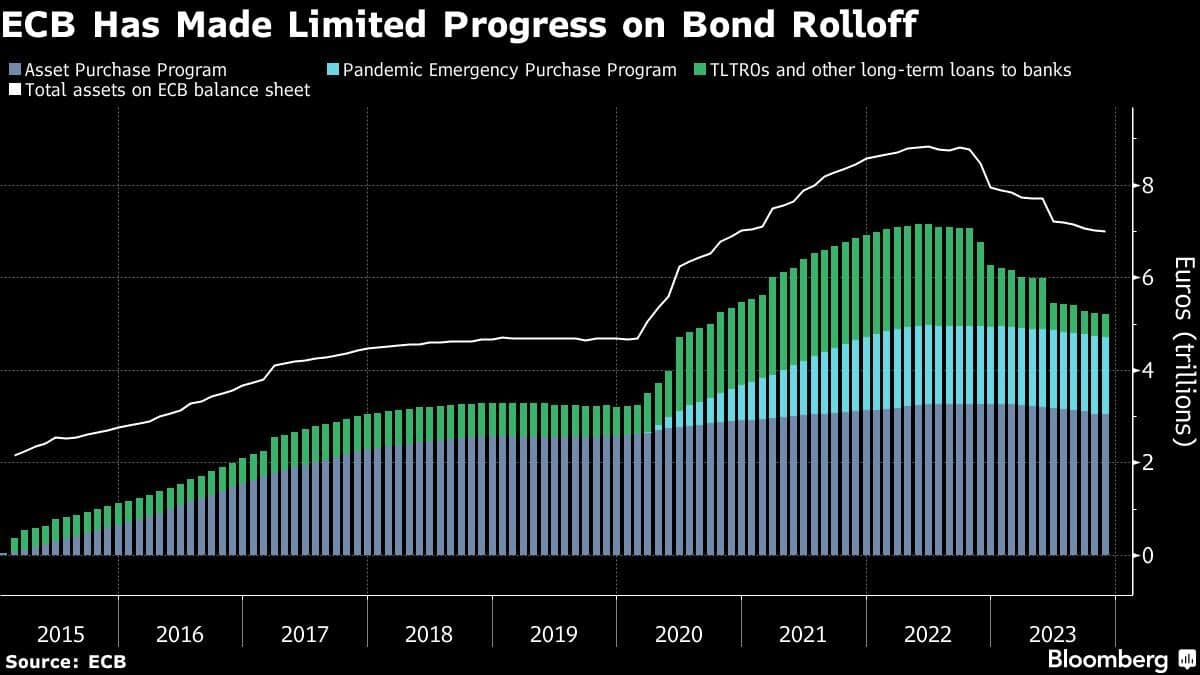

The European Central Bank kept interest rates on hold for a second meeting with inflation tumbling, but said it will step up its exit from €1.7 trillion ($1.8 trillion) of pandemic-era stimulus.

The deposit rate was left at a record 4% — as predicted by all 59 economists in a Bloomberg survey — with the ECB reiterating that this level will make a “substantial contribution” to returning consumer-price growth to its 2% goal.

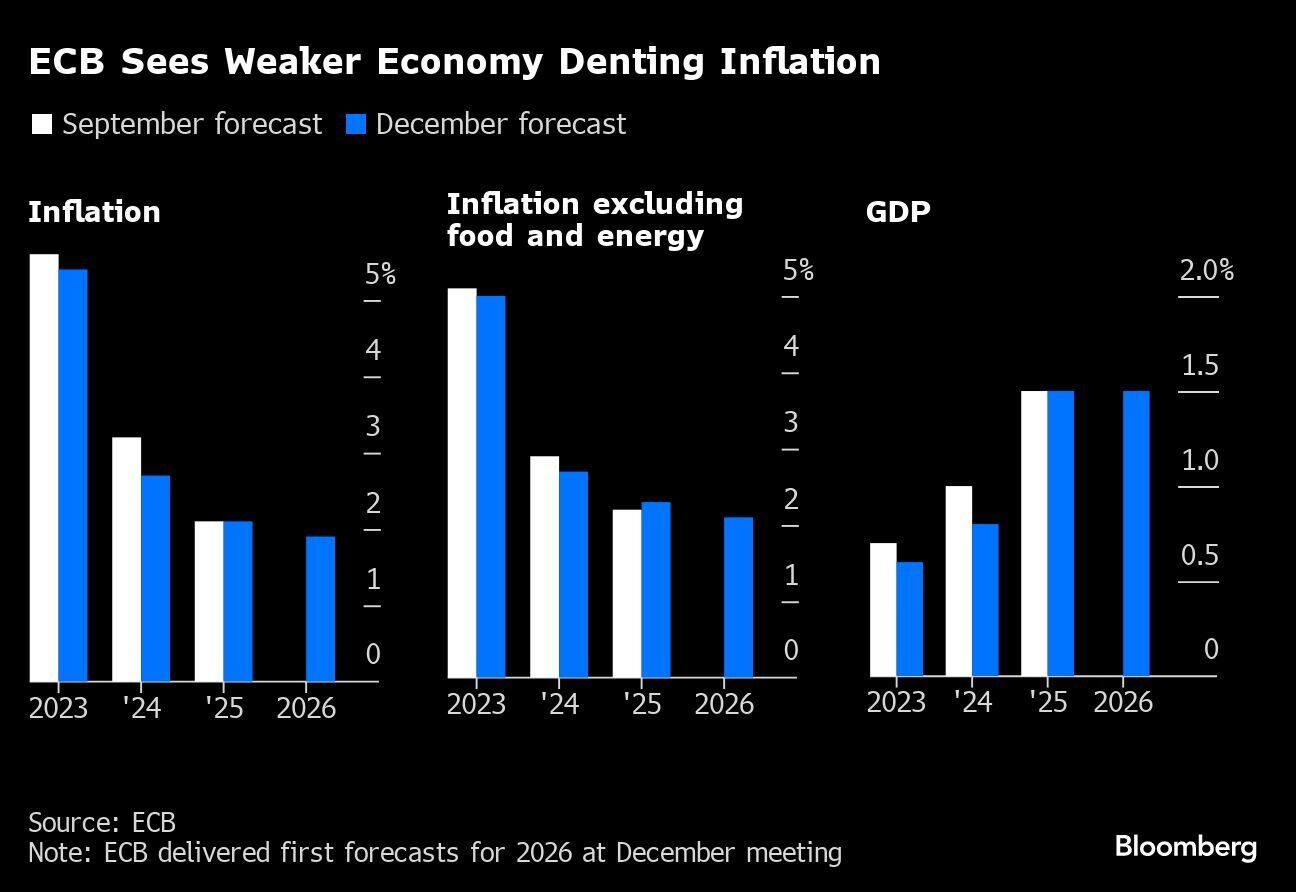

Officials, meanwhile, said they’d accelerate the end of reinvestments under the PEPP bond-buying program. That will put all policy tools into tightening mode, even as fresh projections showed a weaker economy softening the inflation outlook.

“The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary.,” the ECB said Thursday in a statement. It “will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.”

ECB sees weaker economy denting inflation

ECB sees weaker economy denting inflation

Leaving borrowing costs unchanged mirrors decisions during the past day by the Federal Reserve and the Bank of England. But while Fed Chair Jerome Powell supercharged global wagers on rate reductions by saying discussions on the topic have begun, ECB President Christine Lagarde is expected to join the BOE in pushing back against such expectations.

Markets are betting on an ECB cut as soon as March. Lagarde — who’ll address reporters at 2:45 p.m. in Frankfurt — has said no move should be expected “in the next couple of quarters.”

Behind the enthusiasm for wagers on easing is a steeper-than-expected plunge in inflation, to 2.4% in November. The ECB’s latest quarterly forecasts offered further grounds for optimism, showing price gains at 2.7% next year and 2.1% in 2025. In 2026, they’re seen at 1.9%.

ECB has made limited progress on bond rolloff

ECB has made limited progress on bond rolloff

Progress on inflation may also have influenced the announcement on PEPP. Several officials had expressed a preference for an earlier phase-out, before rates are lowered, to avoid sending conflicting messages to markets down the line.

The step means, however, that the ECB loses an instrument to tackle friction on European bond markets, as reinvestments can be deployed flexibly across jurisdictions.

The ECB said:

Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion a month on average

It intends to discontinue reinvestments under PEPP at the end of 2024

A lot will depend on the broader economy, which analysts reckon is suffering its first recession since Covid struck — albeit a far milder downturn. The ECB now sees gross domestic product only advancing by 0.6% this year and 0.8% next.

With the economy not crashing, though, wages and their capacity to reignite inflation will be a greater focus for the ECB. Negotiated pay in the euro area increased by 4.7% in the third quarter — the fastest pace in decades. Important bargaining rounds will only happen next year, meaning uncertainty over the path for prices is set to persist.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!