Technology stocks in India and the US have taken a beating, making investors wonder whether the epic bull run leading to unheard of valuations, massive deals for unprofitable companies and a party fueled by rock bottom interest rates may be ending.

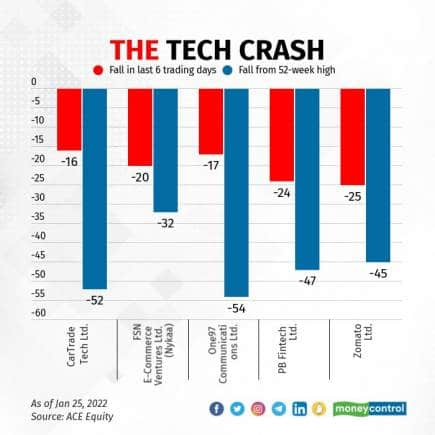

Newly listed internet companies including the torchbearer Zomato, along with Policybazaar, Nykaa, CarTrade and Paytm have fallen between 10-30 percent in the last five days, data indicates. From their listing highs, they have fallen as much as 50 percent, with billions in market cap evaporating and shifting investor sentiment. Paytm, whose shares have anyway been falling since it listed, is now valued at $8 billion, half its last private round at $16 billion.

Zomato’s shares falling 30 percent even prompted founder and CEO Deepinder Goyal to send a note to employees internally to reassure them of its financial position, adding that he has been waiting for a bear market. He certainly isn’t the only one, even as investors poured record money into private and public technology companies despite being wary of their valuations. Last year’s internet IPOs underpinned the excitement of retail investors being able to invest in new companies whose products they consume routinely, a coming-of-age 15 years in the making.

"I think some rationality in the market was needed anyway. It was getting overheated. Companies going public now will have to relook their valuation assumptions,” said Punit Shah, partner at Alteria Capital, a venture debt fund.

Indian technology stocks have followed their US peers, where shares of companies such as Robinhood, Lyft and Peloton have fallen sharply. Peloton, whose fitness bikes and treadmills became a pandemic favourite, has fallen over 80 percent.

The falling shares have led investors to ponder the real worth of these companies, as well as whether other private tech companies are overvalued, given that their aggressive valuations also stemmed from a blistering stock market.

Companies listed at valuations significantly higher than private valuations (bar Paytm) only because they saw record demand, and took advantage of investor appetite “I think expectations were poorly managed by the tech companies in their IPOs. Retail investors let their imagination run wild while setting expectations, bothering only about valuation expansion. But,these companies continue to remain extremely hungry for capital and any adverse market sentiment will put their capital raising to grave risk,” said Shyam Sekhar, founder of ithought, a financial advisory firm.

He said that large institutional investors realised that these companies will always need money, giving them an opportunity to dump shares now and buy them later if they want to, even as retail investors bought shares at deflated prices.

Due to low interest rates in the US and other countries, investors increased their allocation to riskier sectors such as technology, eyeing better returns than traditional asset classes. Now, as inflation rises, central banks may hike interest rates again, reducing the money available for tech companies, and leading to a selloff.

"With interest rates rising, valuation multiples have to cool off. Companies with lower cash flows will see their multiples fall more. Tech companies are typically growth focused, so with less cash flow, they may be hit,” said Sandeep Jethwani, co-founder of wealth management startup Dezerv.

"Companies going for an IPO will have to recalibrate and benchmark to other companies globally. Last year there were also a lot of narrative stocks, fuelled by Reddit etc, which will return to normalcy,” he added.

Investors are yet unable to conclude whether a bear market is truly setting in, or the recent correction is only an aberration.

“This is probably just markets looking for reasons to correct. This is what markets are, super volatile. It is too early to say if this is sudden sanity or just a liquidation or a fire sale. We should wait a few months,” said Deepak Shenoy, founder of Capital Mind, an advisory firm.

“We are not seeing signs of deals in India slowing down right now, but typically there is a lag of 2-3 months till the chill of public markets is felt on private markets,” said Alteria’s Shah.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.